The Japan 225 has been facing strong bearish pressure due to August profit-taking. As a result, price action in the market has dipped below a key technical level. Since price action has moved past the 40,000 threshold, it seems the market may fall lower.

Key Levels

Resistance: 44,500, 45,500, 46,000

Support: 42,000, 40,500, 39,000

NIKKEI Heads Toward the 42,000 Baseline

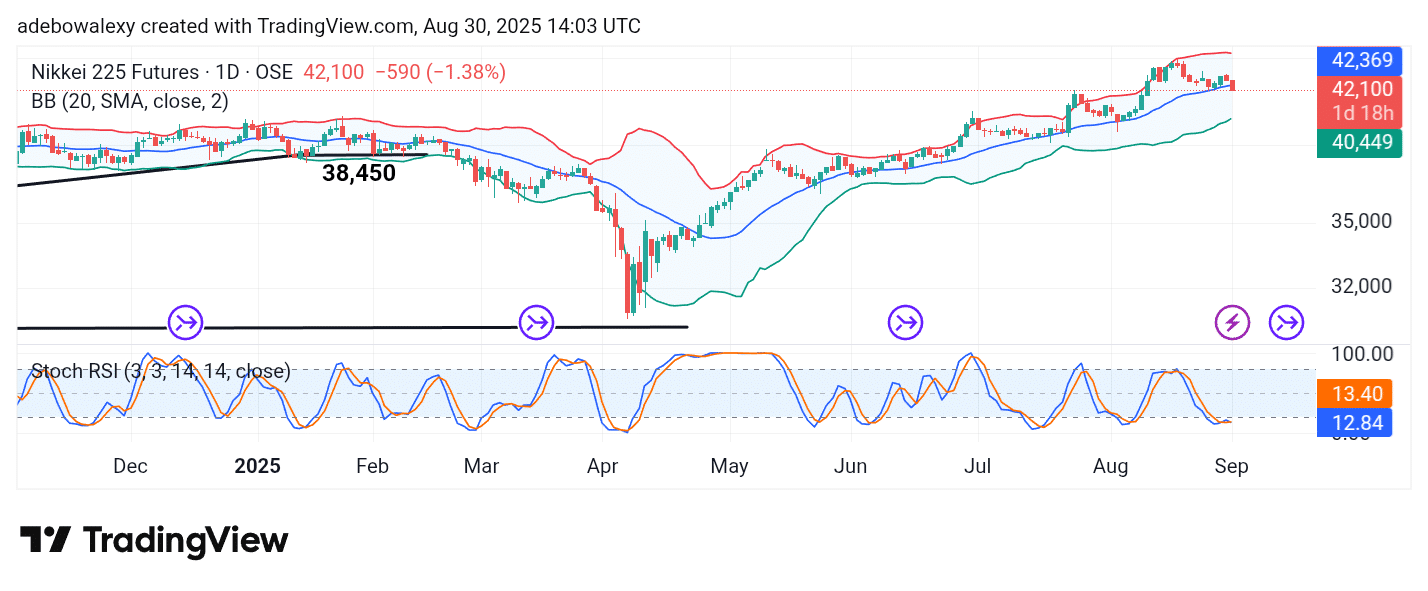

Price activity in the Japan 225 market seems to have cleared a bearish test. The last price candle on the chart has fallen below the middle band of the Bollinger Bands (BB) indicator. Be that as it may, the indicator retains an upward trajectory even with price action breaching the support as mentioned.

The Stochastic Relative Strength Index (SRSI) indicator lines are deep in the oversold region. Also, following price action’s plunge below the mid-band of the BB indicator, the SRSI lines have converged and are now proceeding sideways as of the time of writing. Therefore, this market may edge lower in the new week.

Bears in the Japan 225 Market Keep Clawing Down Profits

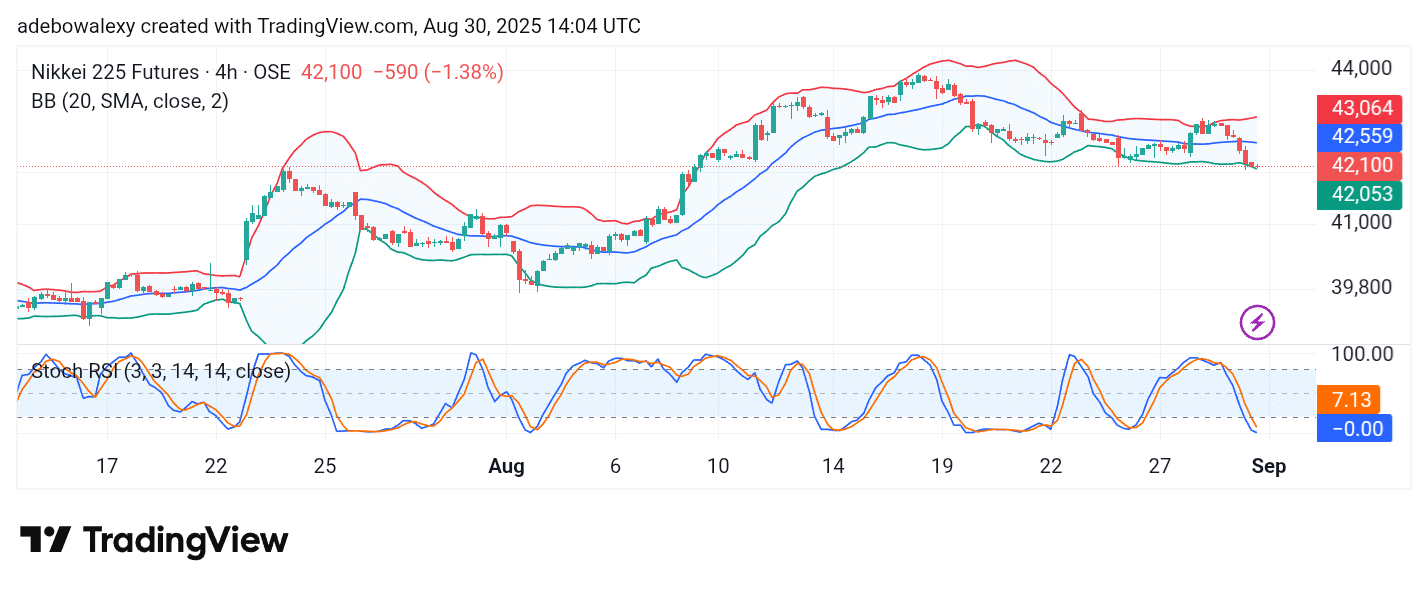

Looking at the NIKKEI 225 market on the 4-hour price chart, it can be seen that price action keeps pushing at the lowest band of the BB indicator. At the same time, the SRSI indicator lines have also descended deep into the oversold region.

The lead line of the indicator is already at the -0.00 price level while the lagging line follows closely. Technically, it appears that price activity in this market may head lower, with profit-taking possibly extending toward the 41,000 and 40,000 price levels.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.