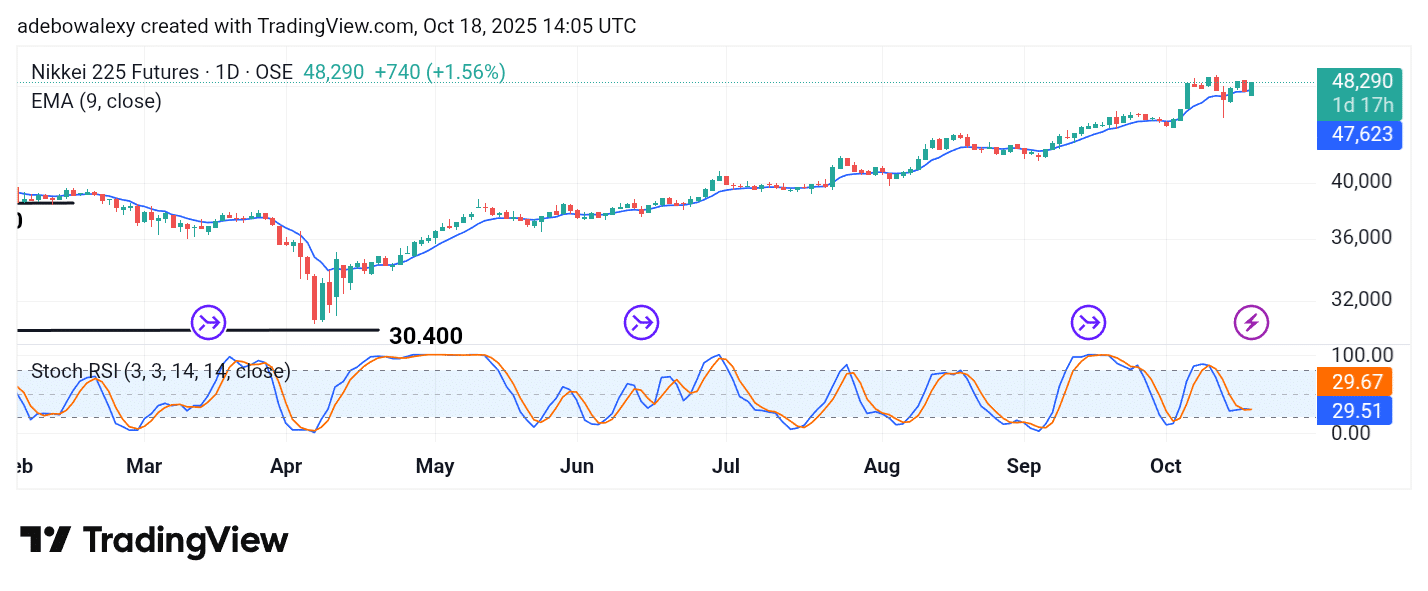

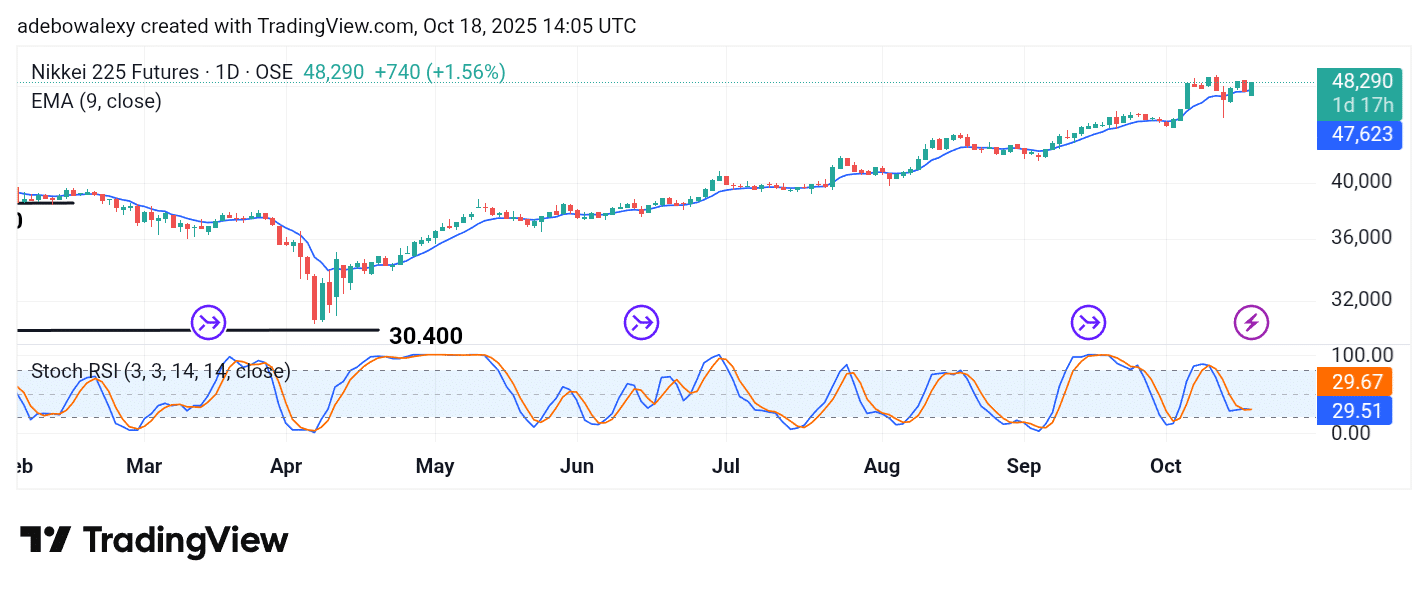

Over the past few weeks, the NIKKEI market has remained afloat and moved steadily upward above key technical levels. The market eventually closed in the green, maintaining its position above important support zones. This indicates the possibility of further upward movement in the coming week.

Key Levels

Resistance: 48,500, 49,000, 49,500

Support: 48,000, 47,000, 46,000

NIKKEI Stays Largely Above the 9-Day EMA

The Japan 225 market has rebounded off the 9-day Exponential Moving Average (EMA) line for most of the concluded week. Friday’s session, in particular, was quite profitable, pushing the market to a solid position above the EMA line.

The Stochastic Relative Strength Index (SRSI) indicator lines can be seen merging for an upward crossover. However, the lines did not rise noticeably afterward, instead moving sideways. Nevertheless, the position of the last price candle on the chart suggests that price action may continue upward.

Japan 225 Levitates Upward

Even on the 4-hour chart, price action appears to be gradually rising above the 9-day EMA curve. The SRSI indicator lines show an upward trajectory, with the lead line positioned well ahead of the lagging line, indicating a volatile market condition. Although the lead line shows a slight deflection, the overall upward momentum remains visible.

Considering that price activity continues to hold above the 9-day EMA curve, there is a strong likelihood that price action may advance further toward the 48,500 level and potentially the 49,000 mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.