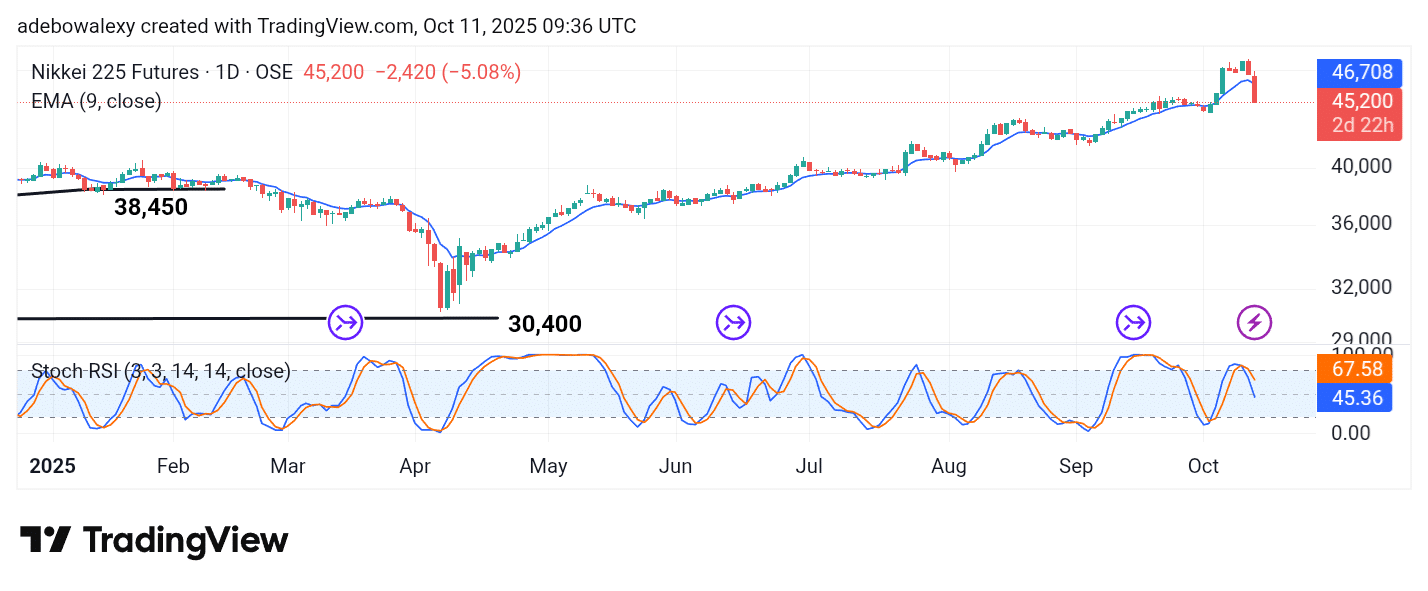

The Japan 225 market has plummeted sharply following reports that the U.S. president threatened to impose a 100% tariff on Chinese goods. Several other markets have also felt the impact of this development as prices tumble across the board. In a more detailed manner, let’s take a closer look at the price behavior below.

Key Levels

Resistance: 46,000, 47,500, 48,000

Support: 45,000, 44,000, 43,000

NIKKEI Bears Have a Cracker

The Japan 225 market edged strongly downward toward the close of the week, as reflected by the last price candle on the chart. At this point, the price of the futures contract lies a notable distance below the 9-day Exponential Moving Average (EMA) line.

Similarly, the Stochastic Relative Strength Index (SRSI) indicator lines are diving toward the oversold region, suggesting that bearish momentum remains dominant. Technically, this indicates that further dips may still be on the way in this market.

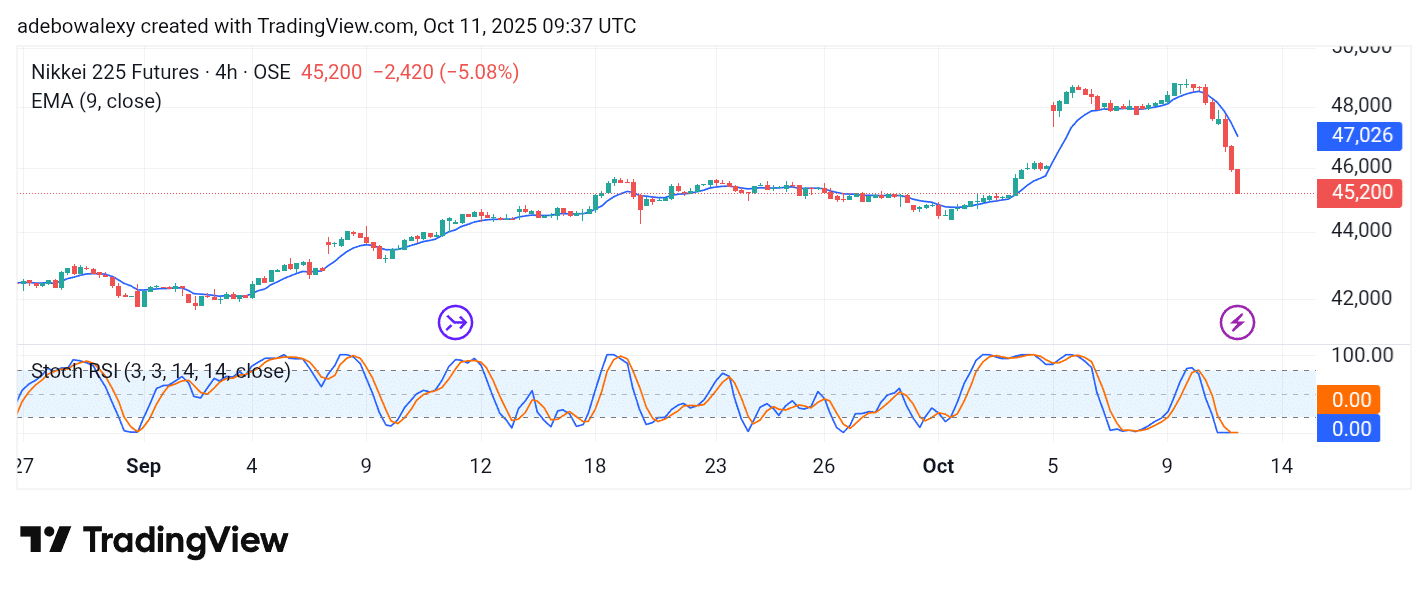

Japan 225 Bearish Sentiment Continues to Prevail

The NIKKEI 225 has remained predominantly bearish for eight consecutive sessions, pushing prices even further below the 9-day EMA curve. Meanwhile, the SRSI indicator lines continue to move sideways in the oversold region, reflecting sustained downward pressure.

The last two price candles on the chart appear bald, a sign of continued selling activity and minimal bullish presence—indicating a market in free fall. Unless a reversal pattern emerges soon, the market may continue its decline toward the 44,500 price level.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.