While most stocks traded in the green during the previous week, downward forces struck profits and nearly wiped out all the gains in the Japan 225 market. However, the index managed to close in positive territory and continues to hold an upside advantage, suggesting the potential for further upward movement.

Key Levels

Resistance: 45,500, 46,000, 46,500

Support: 45,000, 44,500, 44,000

NIKKEI Sustains Above the 45,000 Mark

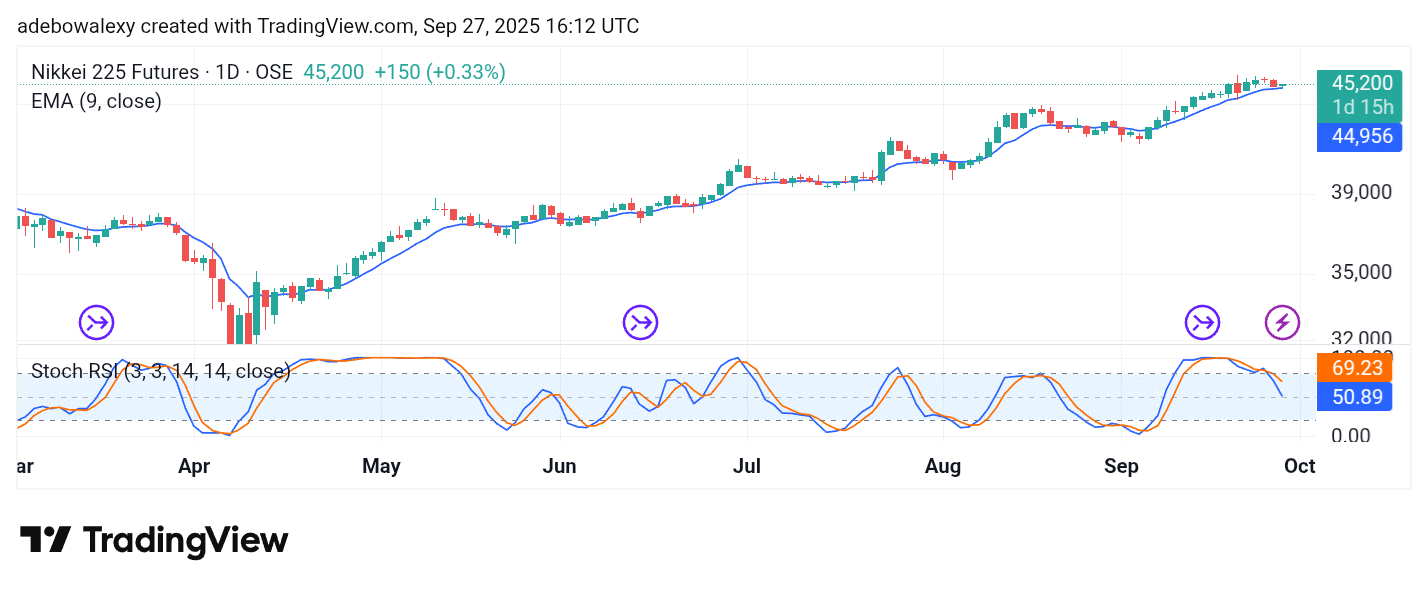

As noted earlier, price action has rebounded from a key technical level that may support bullish sentiment. The latest daily candle on the Japan 225 chart is green, appearing immediately after a red candle, indicating that buyers are attempting to reclaim control of price movements.

Meanwhile, the Stochastic Relative Strength Index (SRSI) lines are descending more steeply, with the lead line testing the 50 mark, despite only a moderate downward movement in prices. This suggests that bearish momentum is weak and may soon be overcome.

Japan 225 Price Action Keeps Pushing Limits

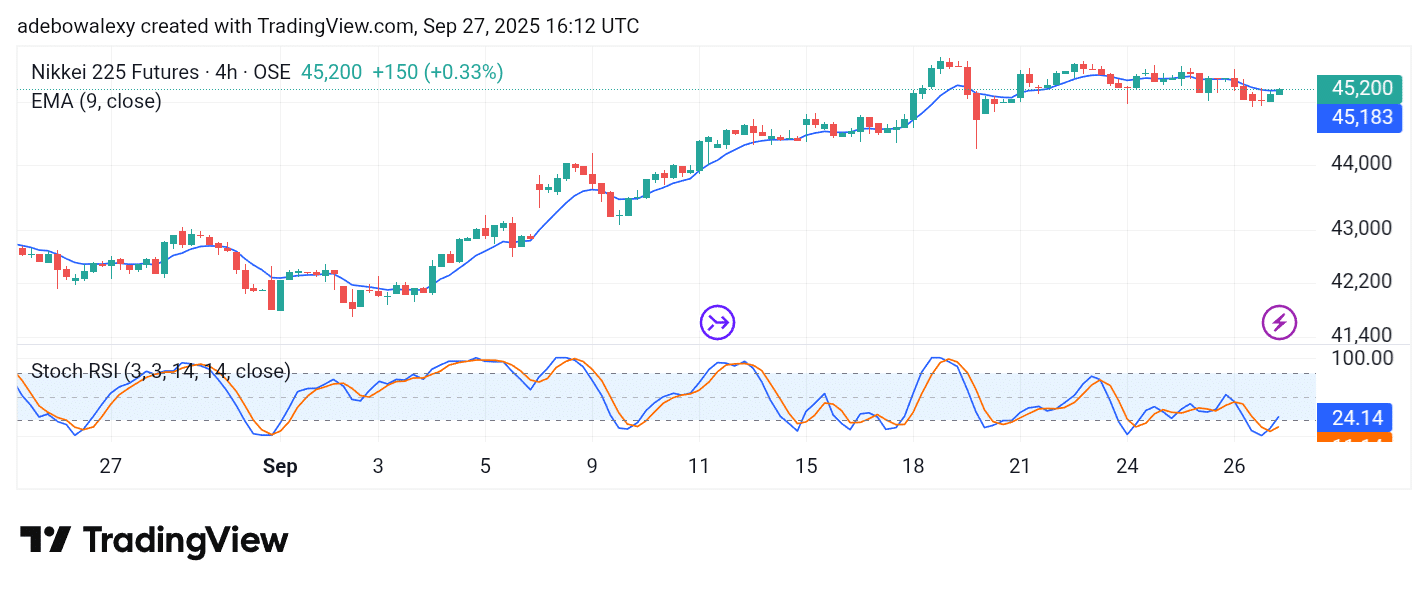

On the 4-hour chart, the NIKKEI has already risen above the 9-day EMA line. The latest candle can be seen breaking through resistance at the EMA curve while remaining green.

At the same time, the SRSI indicator has delivered a bullish crossover in the oversold region, with the lines rising upward and the lead line piercing the 20 threshold. Taken together with the recent upward trajectory of price action, this indicates that the market has the potential to move toward 45,500 and possibly even 46,000.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.