The Japan 225 market has joined the group of stocks that managed to end the week’s trading activity in positive territory. This performance was largely driven by the Fed’s rate cut announced during the week. As a result, this market may register additional gains in the coming week.

Key Levels

Resistance: 46,000, 47,000, 48,000

Support: 44,500, 43,500, 42,500

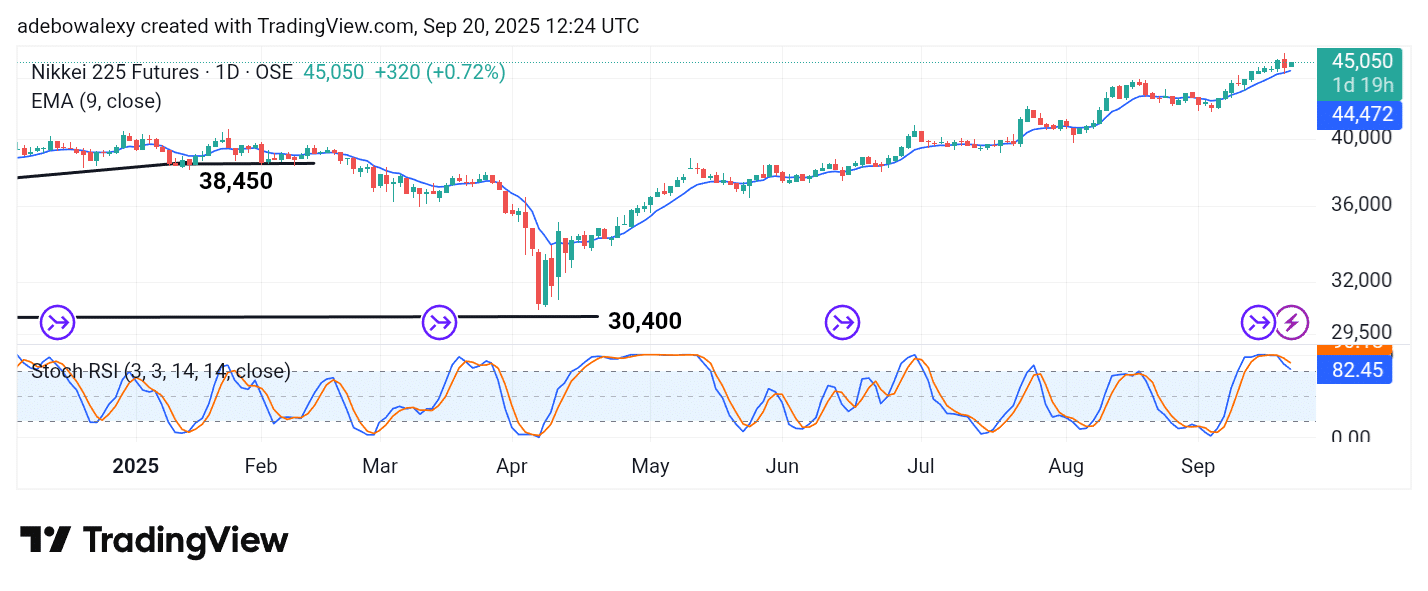

NIKKEI Breaches the 45,000 Threshold

The Japan 225 market has successfully breached a medium-term resistance level at the 45,000 mark. The most recent session on the futures daily chart closed in green and above the 9-day Exponential Moving Average (EMA).

However, price movement has been relatively limited, judging by the small size of the candlesticks. Meanwhile, the lines of the Stochastic Relative Strength Index (SRSI) are positioned above the 80 threshold but show a downward trajectory. This contradicts, to some extent, the bullish bias suggested by price action holding above the 9-day EMA.

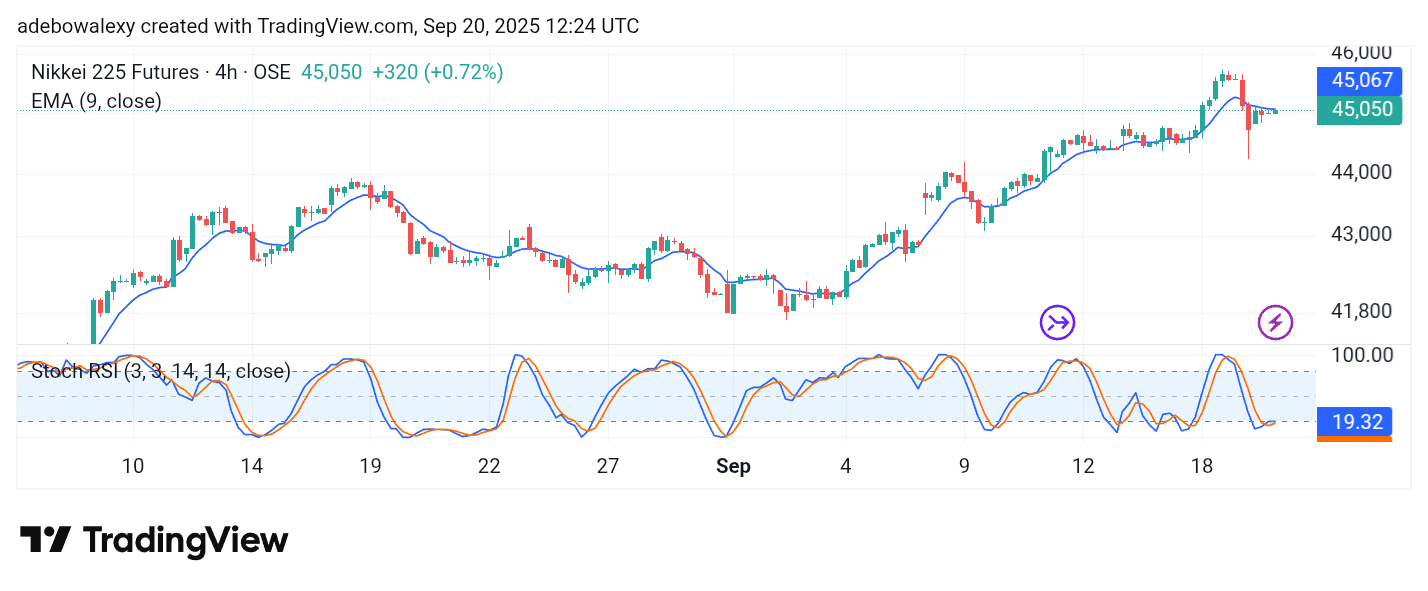

Japan 225 Hugs Key Levels

Examining this NIKKEI market on the 4-hour chart reveals that price action has been hovering around technical levels that could potentially give rise to further price increases. The most recent candlestick lies below the 9-day EMA curve but closed pressing against it from underneath.

Additionally, the SRSI indicator lines are in the oversold region but display a slight upward movement. Should more favorable fundamentals emerge, this may support price action in climbing above the 9-day EMA, with the potential to reach higher levels toward the 46,000 mark.

Make money without lifting your fingers: Start trading smarter today

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.