Fundamentally, market participants are on edge to see how the recent halving event would impact the price of BTC. Although Bitcoin’s hash rate hasn’t witnessed any drawdown yet, many expect a massive decline to happen soon as smaller miners will become disenfranchised due to the reduced block reward.

Popular blockchain analysis firm, Glassnode, released positive data on Bitcoin which shows that the benchmark cryptocurrency’s network health and liquidity saw a decent boost this week. They noted that Bitcoin’s network growth has now gotten to its highest point since 2017. They added that Bitcoin’s liquidity has also been on the rise every week for the past five weeks now. All these are positive data and are indicative of heightened investor activity.

However, Glassnode mentioned that although the data paints a positive picture for Bitcoin, overall investor sentiment is on a sharp decline and this could have adverse effects on the health of the Bitcoin network.

Bitcoin (BTC) Value Forecast — May 13

BTC/USD Major Bias: Sideways

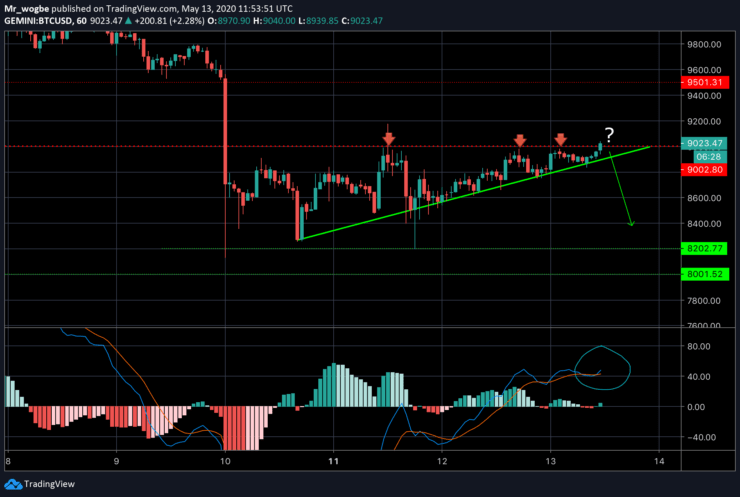

Supply Levels: $9,000, $9,500, and $10,000

Demand Levels: $8,200, $8,000, and $7,500

Bitcoin remains consolidated between the $8,500 -$9,000 and has failed to successfully break the $9,000 resistance line after several attempts.

Although BTC remains above an upward-facing trendline and the hourly MACD shows fresh buildup in bullishness, prolonged inactivity at this level could cause it to lose bullish steam and decline rapidly to the lower-$8,000 level and possibly lower.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.