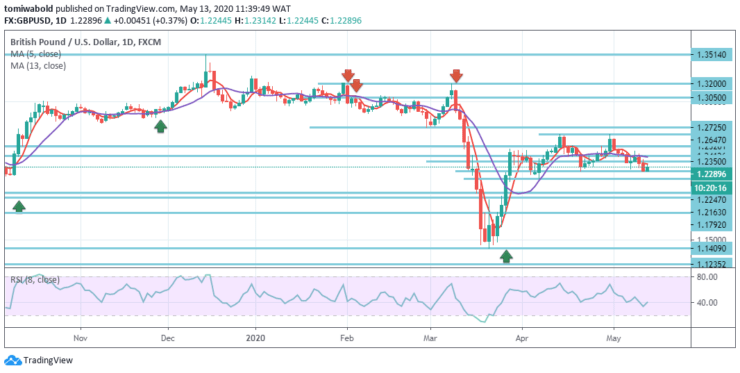

GBPUSD Price Analysis – May 13

The GBPUSD pair retained on to its fairly positive tone around session highs, across the area of 1.2275-1.2301, but had a very restrained impact to the economic releases in the UK. The updated GDP report revealed that, during the first quarter of 2020, the UK economy shrunk worse than expected by 2 percent.

Key Levels

Resistance Levels: 1.3514, 1.3050, 1.2647

Support Levels: 1.2247, 1.1792, 1.1409

GBPUSD Long term Trend: Ranging

Taking a look at the 24-hour outlook, GBP bounced back to level 1.2301, prior to actually trending down to reach a new low at level 1.2244. Downward momentum may have lifted, but just by less. After this, there’s still close support at a level of 1.2163 and although GBP declines below that level, the next support is at a level of 1.1792 and its probably out of scope.

All in all, to suggest that the current downward pressure has eased, GBP has to rise back beyond 1.2350 (minor resistance is at 1.2300 level). At this level, the potential of this kind of shift isn’t that strong, but it might continue to increase as long as GBP over the next session does not slip under 1.2163 level.

GBPUSD Short term Trend: Bearish

On Wednesday, the pair managed to secure some support close-mid-1.2200s level and staged a minimal intraday growth from three-week lows, pulling two consecutive days of unbeaten run losing. With today’s downturn, the attention of GBPUSD is back on support level 1.2247. There a split may finish a level of the double top at (1.2647).

It may mean a corrective recovery from 1.1409 levels is ended. Intraday bias may be switched back to downside to re-test the low level at1.2247. On the contrary, after the recovery from 1.1409 to 1.3200, the next resistance break of 1.2647 level may immediately start.

Note: learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.