The volatility has increased dramatically over these last few weeks. Though this up-and-down nature has been common over the last 18 months, it has now increased.

3

Payment methods

Trading platforms

Regulated by

Support

Min.Deposit

Leverage max

Currency Pairs

Classification

Mobile App

Min.Deposit

$100

Spread min.

Variables pips

Leverage max

100

Currency Pairs

40

Trading platforms

Funding Methods

Regulated by

FCA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

0.3

EUR/CHF

0.2

GBP/USD

0.0

GBP/JPY

0.1

GBP/CHF

0.3

USD/JPY

0.0

USD/CHF

0.2

CHF/JPY

0.3

Additional Fee

Continuous rate

Variables

Conversión

Variables pips

Regulation

Yes

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$100

Spread min.

- pips

Leverage max

400

Currency Pairs

50

Trading platforms

Funding Methods

Regulated by

CYSECASICCBFSAIBVIFSCFSCAFSAFFAJADGMFRSA

What you can trade

Forex

Indices

Actions

Cryptocurrencies

Raw Materials

Etfs

Average spread

EUR/GBP

1

EUR/USD

0.9

EUR/JPY

1

EUR/CHF

1

GBP/USD

1

GBP/JPY

1

GBP/CHF

1

USD/JPY

1

USD/CHF

1

CHF/JPY

1

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

Yes

CYSEC

Yes

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

Yes

CBFSAI

Yes

BVIFSC

Yes

FSCA

Yes

FSA

Yes

FFAJ

Yes

ADGM

Yes

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

Min.Deposit

$50

Spread min.

- pips

Leverage max

500

Currency Pairs

40

Trading platforms

Funding Methods

What you can trade

Forex

Indices

Actions

Raw Materials

Average spread

EUR/GBP

-

EUR/USD

-

EUR/JPY

-

EUR/CHF

-

GBP/USD

-

GBP/JPY

-

GBP/CHF

-

USD/JPY

-

USD/CHF

-

CHF/JPY

-

Additional Fee

Continuous rate

-

Conversión

- pips

Regulation

No

FCA

No

CYSEC

No

ASIC

No

CFTC

No

NFA

No

BAFIN

No

CMA

No

SCB

No

DFSA

No

CBFSAI

No

BVIFSC

No

FSCA

No

FSA

No

FFAJ

No

ADGM

No

FRSA

71% of retail investor accounts lose money when trading CFDs with this provider.

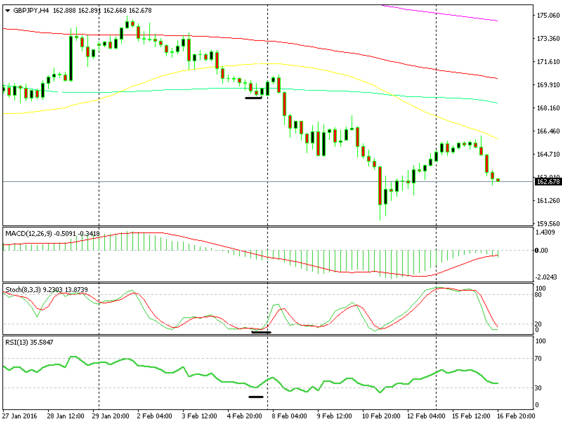

We have seen huge moves of many hundred pips; USD/JPY declined by 1,000 pips in just eight trading days while GBP/JPY lost 1,500 pips during the same time period.

It is dangerous trading in such volatile forex markets and some traders might even retract, but there are also some good possibilities to make a big profit. After all, we are forex traders and profit is what we are here for! We should also take into account that there is always risk involved in this business. High volatility shouldn´t put us off trading forex strategically. That said, we must have a trading plan. During the last 2-3 weeks, we’ve had to change our trading rules in order to be successful during such times.

It´s hard to trade in a volatile market, but with the right forex strategy you can be profitable

Don´t try to catch a falling knife

This rule applies to everyday forex trading strategies and particularly to volatility trading; if the price is falling hard, don’t panic and rush to fix everything. You can´t affect the price action and change the market direction. If you try to catch a knife in real life, you´ll probably cut your hand. In forex trading, if you try to catch a falling market during high volatility you are likely to slice your winnings in half.

So, don´t be a hero trying to pick tops or bottoms. You never know where the market will bottom out. If you think a 5 cent decline in a few days is enough and the fall is overdone, hold on a moment and think again. Take a look at the GBP/JPY chart below.

After a 600 pip decline during the first week of extreme volatility, you´d think that the decline is over. The price is at the 100 MA, the stochastic has been oversold for a few sessions and the RSI indicator just touched the oversold line. Well, the following week was even crazier and the price continued to slide for another 900 pips. Does anyone have pockets that deep?! So the first rule in volatility trading is: don´t try to pick tops and bottoms under extreme volatility.

Get rid of the noise

I keep several moving averages and other technical indicators on my charts when I conduct my daily trades. They are very helpful during normal times, showing when the market is overbought/oversold etc. But when the market panics these indicators count for nothing. You might have three trend lines, four moving averages, RSI and stochastic indicators in the hourly or H4 chart – all showing that a forex pair is oversold – but under these conditions, you cannot trust them.

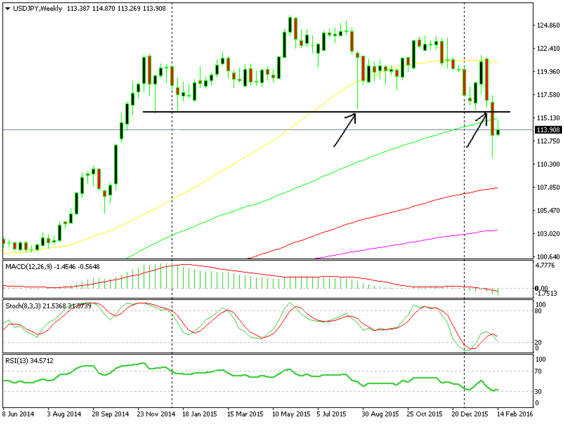

When the market is extremely volatile, you should look at the big levels and get rid of the noise. The 116 level has been an important resistance level in USD/JPY and it has held several times. When the Chinese mini stock market crash happened in August 2015, it was at this level where the price stalled. It´s only logical to disregard small intraday levels and concentrate on the big ones. Two weeks ago, when we witnessed another such forex market crash I only focused on this level. When it finally broke, I stopped thinking about buying into more as the positions had shifted and the bears had taken control. This takes us to the next volatility trading strategy: go with the break.

Go with the break

Big technical levels are important in forex. Many traders rely on them and open positions when the price gets near enough, with stops just on the other side. But when a big level gets broken, such as the 116 level in USD/JPY, then all trust is lost and a lot of buy positions are closed (apart from the triggered stop losses).

Now, imagine that happening when the forex market is already in a panic. The panic multiplies and the volatility becomes extreme. Let´s take a look at the USD/JPY chart once more; the 116 level held several times over a time period of 14-15 months. However, a little more than a week ago during the extreme volatility, that resistance level finally let go and there was a 500 pip decline. So in volatility trading, when a big level is breached during volatile times you just go with the break. It´s very easy to panic during such times and that pushes the price further down.

Think big and milk the trade

When volatility is extreme, It´s not the time to scalp or trade the small timeframes. Levels of 20 or up to 60 stop losses are easily reachable when the daily range is 300 pips. How many times have we seen the price move 50 pips in a matter of minutes? Therefore, it is only sensible to widen your targets during such occasions.

At Learn 2 Trade one of our volatility trading strategies is to increase the number of long-term forex signals when the volatility picks up and cut down on short-term forex signals. You have to think big when the price moves 500-700 pips a week. As we said above, the best volatility trading strategy is to pick the big resistance/support levels and let the price and the volatility do the job – just remember to keep it simple. You don´t even have to be extremely patient because it doesn’t take that long for the price to move from one big level to another.

If we look again at the USD/JPY example above, after breaking the 116 support level, it only took about two and a half trading days for the price to reach 111. So when trading volatility, keep the position open to milk the trade to its maximum. Usually, when the price moves several hundred pips in a few days it doesn´t reverse that quickly. There are a few days of consolidation and a few signals, so there is time to judge and decide whether to close the trade.

AvaTrade - Established Broker With Commission-Free Trades

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Awarded Best Global MT4 Forex Broker

- Pay 0% on all CFD instruments

- Thousands of CFD assets to trade

- Leverage facilities available

- Instantly deposit funds with a debit/credit card

As you can see, there are profit opportunities during extreme volatility. It´s true that it is dangerous to trade during these periods, but this is the nature of forex. Yet, there are methods to minimize the risk as we explained in this article. The trading strategy during these times is to think big, look at the big levels and the larger timeframes and just go with the flow.