More than $2 trillion worth of oil is used annually, so it makes sense that this asset class is one of the most traded commodities globally.

Our Forex Signals

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

3 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Most popular

Most popular

6 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

Lifetime

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratioSeparate Swing Trading Group

Up to 3 signals weekly

Up to 3 signals weekly 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiomonth

1 - month

Subscription

Up to 15 signals daily

Up to 15 signals daily 76% success rate

76% success rate Entry, take profit & stop loss

Entry, take profit & stop loss Amount to risk per trade

Amount to risk per trade Risk reward ratio

Risk reward ratiotime

Curious to learn how to trade oil from the luxury of home? If so, you have landed in the right spot.

We run through the inner workings of trading oil online, covering strategies, trading orders, possible fees, and more. We have also included a comprehensive review of the best 5 brokers to trade oil with.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts

Part 1: Understand the Basics of Trading Oil

Before you will be able to effectively learn how to trade oil, there are a few things to think about. As such, it’s important to begin with the foundations of trading this valuable fuel source.

What Does an Oil Trade Entail?

An oil trade entails trying to correctly predict the rise or fall of its value – and then placing an order with your broker. This must be carried out in time to catch a profitable opportunity.

To elaborate further, if you have a strong feeling that oil is undervalued and so you think its price will increase – place a buy order with your broker. If you are correct, and oil skyrockets, or sees even a small price rise – you make a profit on this trade.

For those unaware, oil will almost always be quoted to you in US dollars. In some cases, you might see oil priced in euros or British pounds for instance, but this is rarely seen. The most commonly adopted strategy is to trade oil in the short-term via CFDs. We talk about oil CFDs shortly.

If you are looking to keep your oil trade open for several weeks or months – futures might be the preferred option. With that said, if you want to gain exposure to oil in the long-term, you might consider stocks that are involved in this space – such as BP or Royal Dutch Shell.

How Are Oil Prices Determined?

Understanding how the price of this asset is determined is crucial when you learn how to trade oil. One of the number one catalysts of fluctuations in the price of oil is supply and demand in the markets.

Supply and demand are altered by various events such as:

- Any change to the value of the US dollar

- Hedgers purchasing oil to protect themselves against volatility

- Speculators bidding on oil futures on the basis of predicted price shifts

- Tension in the Middle East

- Overproduction or consumption of oil

- Natural disasters and extreme weather

- World crisis such as war and political unrest

- OPEC restricting oil supplies

- Changes in transportation costs

As you can see, many things can alter the price of oil. To give you an example, during the Gulf War, OPEC cut world oil supplies by over a million barrels per day. This did, of course, result in the price of oil skyrocketing.

There are many trading tools available at your fingertips to help you keep abreast with the latest news. We talk about fundamental and technical analysis shortly – both of which are highly insightful forms of research.

How to Trade Oil: Short-Term or Long-Term

When looking at how to trade oil, you should think about whether you fancy yourself as a short-term, or long-term trader.

Take a look below at the options available to you.

Oil Futures

A popular option for short-medium-term traders is oil futures. This is a financial instrument, tasked with tracking the real-world price of oil, according to global benchmarks. This contract between your and your online broker enables you to speculate and make money from the price fluctuations of an asset later down the line.

Oil CFDs

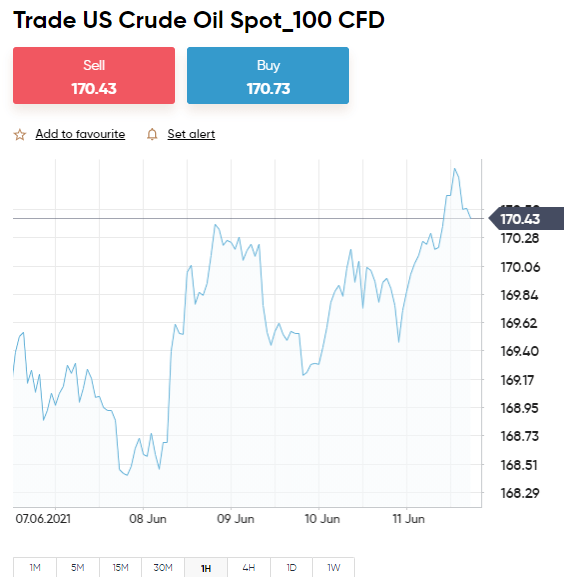

CFDs (Contracts for Difference) are another sought-after way to trade oil – for new and experienced traders alike. As is the case with the aforementioned futures, CFDs cut out the concern of having to take ownership of the underlying asset in question – barrels of oil.

In other words, if you want to trade oil but don’t have anywhere to store gigantic heavy tanks – you should think about trading it via CFDs! Oil CFDs observe and mirror real-world prices of the two biggest benchmarks in the world. These are the West Texas Intermediate (from North America) and Brent Crude Oil (from the North Sea).

One of the biggest benefits, apart from not having to own the asset – is that CFDs allow you to profit even if oil loses value (as long as you elected to short-sell).

See below a basic example of how CFDs work:

- WTI Crude Benchmark prices oil at $61.30

- Ergo, the oil CFD is also priced at $61.30

- If oil increases or decreases by any amount – whether it’s 0.2% or 20% – the oil CFD will mirror this valuation

When electing to learn how to trade oil via CFDs, all you have to do is try and predict whether the commodity will see an increase or decrease in price. You will likely reach this decision based on analysis, which we talk about shortly.

Many traders opt to add leverage to oil CFD trades. For those unaware, this can boost your oil position via an online broker- we talk about this after orders.

Oil ETFs

Oil ETFs are most suited to long-term oil traders, utilizing a ‘buy and hold’ strategy. Oil Exchange-Traded Funds give you the opportunity to invest in a basket of different assets in a singular trade.

ETFs, much like the aforementioned CFDs, allow you to invest and trade without owning the asset. ETFs always mirror the market sentiment of oil. At trading platform eToro, you can access the SPDR S&P Oil & Gas Exploration & Production ETF (which replicates benchmark S&P Oil &Gas as closely as possible) and heaps more.

Unlike in the case of CFDs, you will not be charged a daily fee when investing in oil ETFs. The respective fund will be backed by the commodity in question – or stocks that are involved in this industry.

Part 2: Learn Oil Orders

When you try to learn how to trade oil from home, you won’t get very far without first having a good understanding of the various trading orders.

The sections below will discuss the most important orders that you’ll need to consider when trading oil online.

Buy Orders and Sell Orders

In order to access your chosen market – you must first decide between a buy or a sell order.

See an example below:

- If you think oil is going to see a price rise – choose a buy order

- If you think oil is going to see a price drop – choose a sell order

Furthermore:

- If you enter your position with a buy order – you need to exit with a sell order

- If you enter your position with a sell order – you need to exit with a buy order

You must choose one order or the other depending on your prediction.

Market Orders and Limit Orders

Whilst still on the subject of entering the market, there are two orders you can choose between – ‘market’ and ‘limit’.

Market Order

When it’s time to trade oil, you will likely find that the market order is set as the default option when placing an order. This quite simply tells the broker that you wish to proceed immediately, at the current market price.

You will see a slight inconsistency in price when placing market orders. The reason is that due to the nature of supply and demand, prices will shift in the seconds your order is executed. The small disparity will be nothing to worry about and is inescapable.

Limit Order

A limit order enables you to be price specific about how you enter the oil market.

See a simple example of how a limit order is used below:

- You are trading oil which is priced at $59.97

- You do not want to enter this trade until the commodity increases to $62.96 – based on your technical analysis

- As such, you create a ‘limit’ order at $62.96

- If or when oil rises to $62.96, the broker will execute your order

- Otherwise, this remains as it is until you cancel it

Stop-Loss Orders and Take-Profit Orders

This brings us smoothly onto how you can plan your exit from the market, which is a crucial part of how to trade oil effectively. Two great options for this purpose are ‘stop-loss’ and ‘take-profit’ orders.

Stop-Loss Orders

Put simply, a stop-loss order gives you the opportunity to stop your losses at a specific price point during your trade. This is an order we recommend using on each and every oil position from here on.

See below an example of how you might use a stop-loss order on your next trade:

- You think the price of oil will fall so want to go short – however, you can’t afford to lose more than 4% on the trade

- As such, you need to place a stop-loss order at 4% above the initial price

- Let’s say on the other hand you are looking to go long on oil

- The stop-loss order should be placed 4% below the initial price

For clarity:

- Oil is priced at $59.97 and you don’t want to lose more than 4%

- If you go short on oil – you should set your stop-loss at $62.36 ($59.97 + 4%)

- If you go long on oil – your stop-loss will be $57.57 ($59.97 – 4%)

The stop-loss order will be actioned automatically by the online broker – so there is no need to manually time the oil markets. Either way, you will not lose more than your desired percentage on a trade.

Take Profit-Orders

Take profit orders are comparable to stop-loss orders – except you are locking in gains, instead of capping your losses.

By now, you will have the following orders set up on your oil trade:

- Buy or sell – will the price of oil rise or fall?

- Market or limit – are you happy with the market price, or would you prefer to set your own?

- Stop-loss – how much are you prepared to lose on this trade?

Now you can incorporate a take profit order into your trade:

- You wish to make a profit of 6%

- As such, you set your take-profit order to 6% above or below your position value – depending on which way you think the price of oil will go

Again, this order will be actioned as soon as the take-profit price has been reached.

Part 3: Learn Oil Risk-Management

When you learn how to trade oil for the first time, you should think about adding risk management to your trading strategy. This is all about damage limitation and maintaining a level of control on your trading capital.

Percentage-Based Bankroll Management on Oil

Starting with one of the most commonly used strategies – percentage-based bankroll management.

Simpler than it sounds, this system prevents you from risking too much money on any one trade. As such, you might decide to never risk more than 1%, 2%, or even 3% on any one trade.

For instance, if you decide to adopt bankroll management based on 2% and you have $3,000 in your account – don’t stake more than $60 on any oil position. This can very easily be recalculated to suit your ever-changing trading account balance.

Trading Oil via a Risk and Reward Ratio

It doesn’t matter what walk of life you come from, or how many months or years you have been trading for – risk/rewards ratios are simple and effective.

- Let’s just say that for every $1 you put on the line, you wish to make $2 – this risk/reward ratio would be displayed as 1:2.

- Other common risk/reward ratios are 1:3, and 1:4.

Furthermore, you can aid yourself in achieving this goal by utilizing stop-loss and take profit orders.

Oil Leverage

In layman’s terms, leverage is something offered by online oil brokers. It allows you to trade your chosen commodity with more money than you have. This obviously means that if you speculate correctly – your profits are magnified.

This can be by as much as 10 times if you reside in Australia, the UK, or parts of Europe. Meaning, if you have $1,000 in your trading account – you can open an oil position worth up to $10,000. Other countries are not restricted by how much leverage they can access.

It’s important to not abuse leverage. If you are incorrect in your hypothesis on oil, your losses will also be magnified 10 fold.

Part 4: Learn How to Analyze Oil Prices

Fundamental and technical analysis are indispensable when it comes to understanding how to trade oil. In this section, we walk you through both. Having a grasp on how to access such information can greatly improve your chances of making a profit.

Fundamental Analysis in Oil

Fundamental analysis requires you to keep a close eye on world events that could affect the pricing of oil. As we said, many things can alter the price of oil from political turmoil or all-out war.

Many oil traders subscribe to commodity-specific trading services. This is where you receive regular and breaking news updates relevant to your asset of interest.

There are also heaps of websites packed with news, forecasts, real-time updates, and feeds – including economical events you should be aware of.

Technical Analysis in Oil

Technical analysis is sometimes described as more of a trading discipline. This type of analysis involves reading price charts of past and present, studying trends, and market data such as volume and price movement. Furthermore, you will be able to view a multitude of different timeframes and include adaptable indicators.

This includes:

- Moving Average

- Aroon Indicator

- Relative Strength Index

- Average Directional Index

- MACD Indicator

- Stochastics Oscillator

Oil Signals

Oil signals are comparable to trading tips and offer an easier way to trade for beginners. This is perfect if you want to learn how to trade oil, but are yet to understand the aforementioned analysis needed to time the markets.

The oil signal will usually include:

- Whether to buy or sell

- Limit order price

- Take-profit order price

- Stop-loss price

Whether or not you action this order is your call. Here at Learn 2 Trade, we offer our very own signals service, where we provide a plethora of commodity trading suggestions for your consideration.

Part 5: Learn How to Choose a Good Oil Broker

As we’ve said, before you can properly learn how to trade oil, you need a reputable online broker on your side.

When researching the best trading platforms out there, we always consider the following highly regarded metrics.

Regulation

Regulation offers us all a safety net against the many shady brokers in the online domain. As such, we will only ever select regulated oil providers.

Highly respected regulatory bodies to look out for include:

- ASIC -Australia

- FCA – United Kingdom

- CySEC – Cyprus

- FINRA – US

All regulated oil brokers must follow a range of rules such as fee transparency, KYC, thorough audits, and client fund segregation in a tier-1 bank account.

Fees and Commissions

It’s vital that your are eyes wide open when it comes to any potential fees and commissions at your chosen brokerage.

Whilst that sounds obvious, there are key differences between the way trading platforms charge clients. In many cases, you will pay a variable commission fee when you trade oil.

This works as follows:

- The online broker charges 0.4% for every trade – that includes entry and exit

- The oil trade is valued at $1,000

- As such, you must pay $4 ($1,000*0.4%)

- Upon exiting your position, it is valued at $1,600

- Again you must pay 0.4% which is $6.40

Had you chosen to trade oil via eToro you would have saved $10.40 on the above position – as the broker charges zero commission!

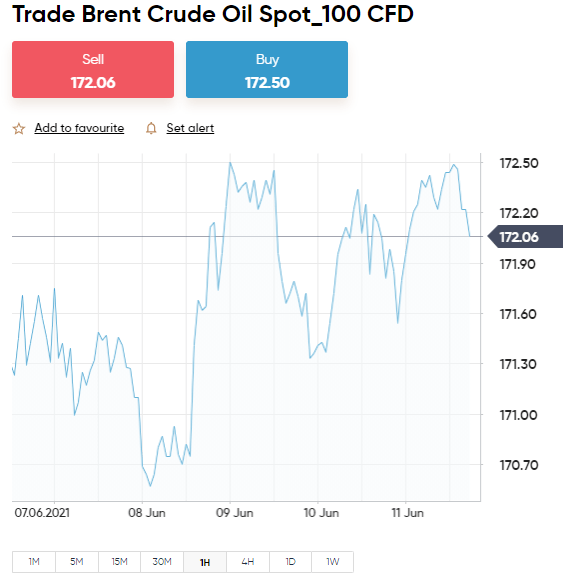

Spreads

The spread is an indirect fee charged by online brokers to ensure they turn a profit in all market conditions. As such, when you look to trade oil you will see that there is a ‘buy’ price and a ‘sell’ price (sometimes called ‘ask’ and ‘bid’).

The buy price refers to the price the market will purchase the asset for. Ergo, the sell price refers to the price the market is prepared to sell the asset for. It is the difference between these prices that makes the spread.

See below to clear things up:

- The buy price quoted is $59.99

- The sell price is $59.90

- The spread is 9 cents

In this example, your oil trade needs to rise in value by 9 cents for you to ‘break-even’ – so anything over 9 cents will count as profit.

Payments

No two oil brokers are the same, so you should definitely consider accepted payment types. Our Learn How to Trade Oil Guide found that many of the more traditional online brokers only allow bank transfer deposits. As you likely know, this can delay your oil trading venture by up to a week.

The best platforms are accepting of a multitude of fast and convenient payment methods, to fit in with the modern world. For instance, eToro is compatible with not only credit and debit cards – but also various e-wallets like PayPal, Skrill, Neteller, and more.

Best Brokers to Trade Oil Online

Having stuck with us so far, you are probably eager to put your newfound oil trading knowledge to good use. First, you need a trustworthy provider.

With that in mind, we have compiled and reviewed the 5 best brokers that allow you to trade oil in 2021.

1. AvaTrade – Oil CFDs and Impressive Techincal Analysis Tools

AvaTrade has been serving the oil trading community successfully for well over a decade. The online broker is held in high regard by traders, investors and authorities alike. In terms of available assets, AvaTrade offers a whole host of them. With regards to oil trading in particular - you can access WTI and Brent crude oil exchanges here. Furthermore, you can trade CFDs on a commission-free basis at this platform - with the accurate live market rates expected from these instruments.

Most of us are never far away from our mobile phones, so you might be interested in downloading the 'AvaTradeGO' app. The application works well on Android and iOS and enables you to buy, sell and deposit on the move. The AvaTrade proprietary platform also offers heaps of its own educational content, from risk management tools, charts, and indicators - to portfolio demos, simulations, and set-specific guides.

For those who are interested in third-party trading tool providers - AvaTrade is compatible with MT4/5. You can also link your account up to social trading platforms Zulutrade and DupliTrade. This enables you to share strategies on how to trade oil, and even copy other traders. When it comes to accepted payment methods, AvaTrade accepts wire transfers, and credit/debit cards. In some parts of the world, you will also be able to deposit funds into your account with e-wallets. This excludes Australia and the EU.

- Minimum deposit only $100 to trade commodities

- Regulated in heaps of regions such as the EU, Australia and South Africa

- Lots of tradable assets with 0% commission

- Admin fee pricey after 12 months inactivity

2. VantageFX –Ultra-Low Spreads

VantageFX VFSC under Section 4 of the Financial Dealers Licensing Act that offers heaps of financial instruments. All in the form of CFDs - this covers shares, indices, and commodities.

Open and trade on a Vantage RAW ECN account to get some of the lowest spreads in the business. Trade on institutional-grade liquidity that is obtained directly from some of the top institutions in the world without any markup being added at our end. No longer the exclusive province of hedge funds, everyone now has access to this liquidity and tight spreads for as little as $0.

Some of the lowest spreads in the market may be found if you decide to open and trade on a Vantage RAW ECN account. Trade using institutional-grade liquidity that is sourced directly from some of the top institutions in the world with zero markup added. This level of liquidity and availability of thin spreads down to zero are no longer the exclusive purview of hedge funds.

- The Lowest Trading Costs

- Minimum deposit $50

- Leverage up to 500:1

Part 6: Learn How to Trade Oil Today – Walkthrough

Having read parts 1-5, you are hopefully feeling much more confident about how to trade oil. Now all that’s left to do is sign up with a trading platform that can facilitate your desire to trade this valuable commodity.

For our walkthrough, we are using a broker, as the platform allows you to trade a variety of oil markets commission-free.

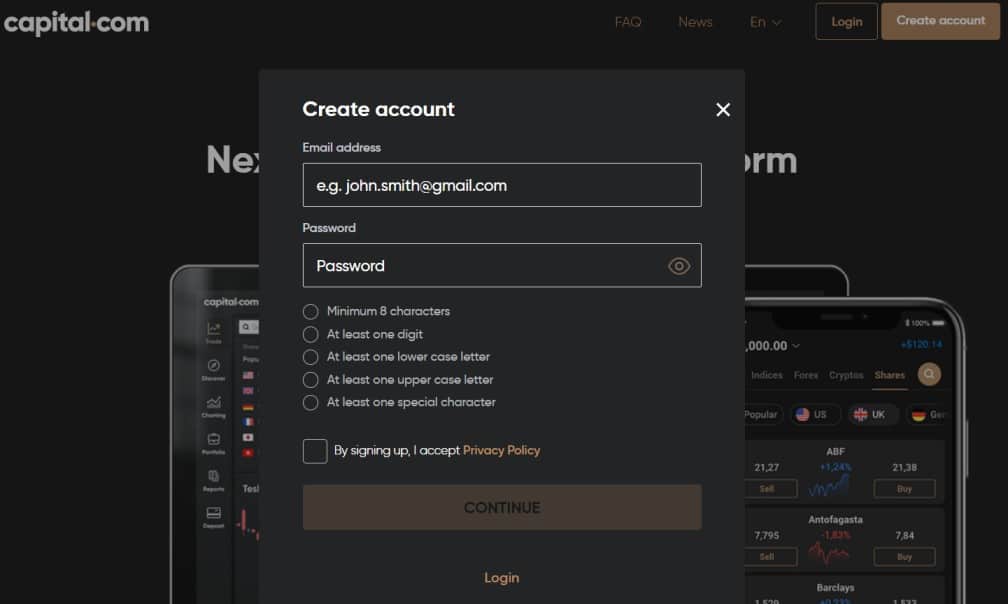

Step 1: Open an Account & Upload ID

Go to the broker’s website where you will see a ‘Create account’ button. After clicking this, you will see an order box appear in the middle of the screen – like the below.

Enter all of the information required and hit ‘Create Account’. All regulated oil brokers must follow strict KYC protocol. As such, you will also need to upload a copy of your photo ID. This must be government-issued such as your passport or driving license.

You will also have to upload a recent bank statement or utility bill as proof of address. You can leave the uploading of your ID for a later date. However, note this must be completed before you can deposit more than $2,225 or make a withdrawal.

Step 2: Deposit Some Trading Funds

Once your new account had been confirmed, you can deposit some trading funds.

Simply select your preferred payment type from the list of what’s available and enter the amount you wish to deposit.

Step 3: Search for Oil

Next, you can search for the market you wish to trade. Here we are looking to trade an oil CFD.

When you have found the asset you want, click it and hit ‘Trade’ on the next screen.

Step 4: Start Trading Oil

At this point, your order box will appear – see an example below.

- Buy or sell

- Stake

- Market or limit

- Stop-loss price

- Take-profit price

Once you have looked over your entries, you can click ‘Open Trade’. That’s it – you can now leave your commission-free order in the hands of the broker who will execute it accordingly.

Learn How to Trade Oil – The Verdict

Hopefully, this guide has helped you on your way when it comes to how to trade oil productively. Some of the most important take-aways to be conscious of when trading oil are that regulated brokers offer safety and fairness. Having a trading strategy in place is crucial before diving in with real cash stakes.

It’s worth doing your homework, and getting to grips with fundamental and technical analysis. Furthermore, it’s worth trying out a demo account, oil trading signals, or ‘Copy Trading’.

At Capital.com, you can trade or invest in oil on a commission-free basis under regulation from the FCA, CySEC, ASIC, and NBRB. Furthermore, the broker offers a free demo account and accepts an impressive amount of payment types. Remember to think about risk management and incorporate a stop-loss on every oil trade order.

Eightcap - Regulated Platform With Tight Spreads

- Minimum deposit of just 250 USD to get lifetime access to all the VIP channels

- Use our Secure and Encrypted Infrastructure

- Spreads from 0.0 pips on Raw Accounts

- Trade on the Award-Winning MT4 & MT5 Platforms

- Multi-jurisdictional Regulation

- No Commission Trading on Standard Accounts