Digital asset investment products have achieved their largest weekly crypto inflows on record, reaching $3.13 billion. At the same time, U.S.-spot Bitcoin ETFs experienced their first negative flow day after a strong winning streak this week.

Historic Week for Crypto Inflows into Crypto Investment Products

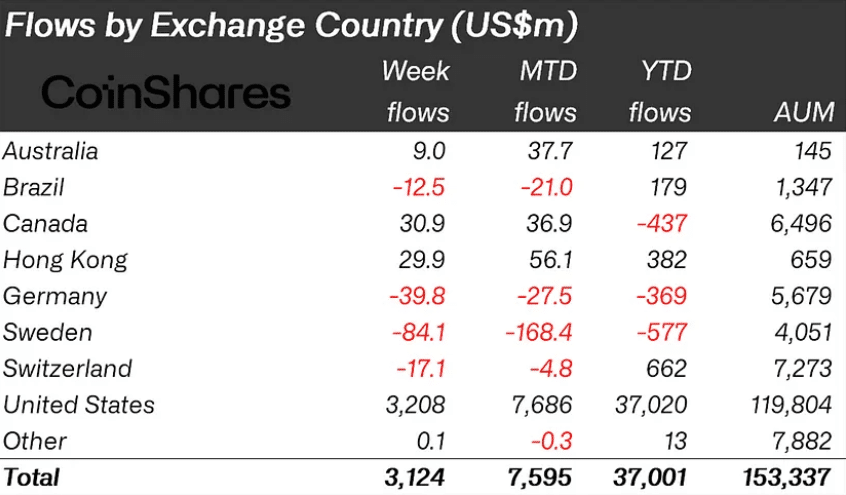

The latest CoinShares report reveals unprecedented activity in crypto investment products, with total inflows hitting $3.13 billion last week. This surge has pushed the year-to-date inflows to $37 billion, setting a new industry record.

Bitcoin products led the charge with $3 billion in inflows, though the rising prices also sparked interest in short-bitcoin positions that attracted $10 million.

Regional differences emerged across markets, with some European countries taking profits. Germany, Sweden, and Switzerland recorded outflows of $40 million, $84 million, and $17 million, respectively, while Australia, Canada, and Hong Kong showed continued buying interest with inflows of $9 million, $31 million, and $30 million.

Bitcoin ETFs Face First Setback

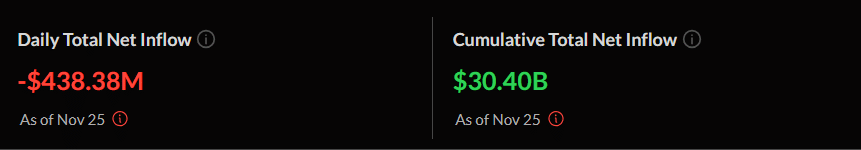

In a separate development, U.S. spot Bitcoin ETFs recorded their first negative flow day, with total outflows reaching $438.4 million. This marks the end of a five-day positive streak that had brought in $3.4 billion.

Bitwise’s BITB led the outflows with over $280 million, followed by Grayscale’s GBTC at $158.2 million. Only two funds bucked this trend: BlackRock’s IBIT gained $267.8 million in new investments, while Grayscale’s Mini Bitcoin Trust added a modest $420,460.

Despite this temporary setback, the cumulative total net inflow for Bitcoin ETFs remains strong at $30.4 billion, with total net assets reaching $102.2 billion.

These developments coincide with Bitcoin’s price movement below $95,000, retreating from its recent approach toward $100,000. Despite this price action, the overall crypto investment landscape continues to show strong institutional interest and growing market maturity.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.