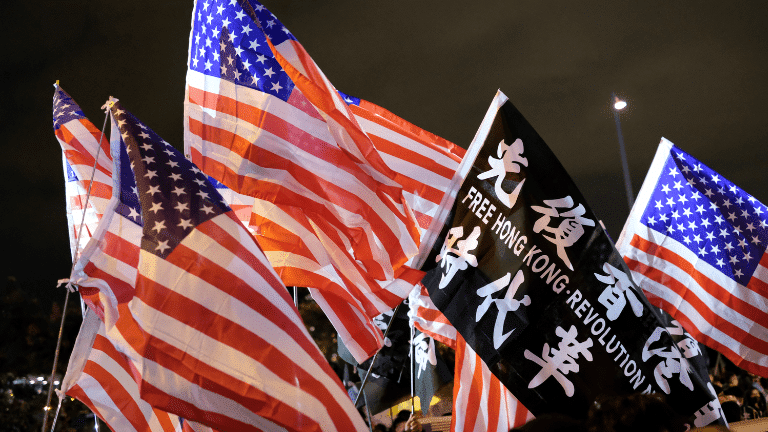

Hong Kong is emerging as a hub for financial crime, according to US lawmakers, who are urging a reassessment of America’s economic ties with the Asian financial center. They warn that Beijing’s tightening control over the city has enabled money laundering, sanctions evasion, and other illicit activities, raising alarms over Hong Kong’s financial sector global integrity.

In a letter to Treasury Secretary Janet Yellen, bipartisan leaders of the House Select Committee on China highlighted concerns about Hong Kong’s involvement in exporting restricted Western technology to Russia, managing ghost ships trading with North Korea, and facilitating oil purchases for Iran through front companies. They emphasized the city’s shift from a trusted financial hub to a key player in a network of authoritarian regimes, including China, Russia, Iran, and North Korea.

Hong Kong’s Financial Sector Faces Scrutiny

Since the implementation of the national security law in 2020, Hong Kong has faced mounting US sanctions targeting its businesses for circumventing restrictions, particularly in supplying dual-use goods to Russia. The city has also been criticized for refusing to comply with unilateral sanctions, such as allowing a yacht linked to a Russian oligarch to anchor in its harbor.

US lawmakers are pressing for detailed briefings on American banking ties with Hong Kong and strategies to mitigate risks tied to its shifting political and economic alignment. This call for action comes amid rising geopolitical tensions, with some advocating for further legislative measures to limit Hong Kong’s economic privileges.

Implications for U.S.

BusinessesExperts warn that Hong Kong’s diminishing autonomy from Beijing poses significant risks for US companies operating there. Anticipated policy shifts under future leadership could further intensify scrutiny on Hong Kong’s financial landscape, signaling challenging times ahead for global investors relying on the city as a business gateway to China.

Make money without lifting your fingers: Start using a world-class auto trading solution.

LonghornFX, your trusted Partner in CFDs, Cryptocurrencies and Stocks.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.