Market Analysis – February 12

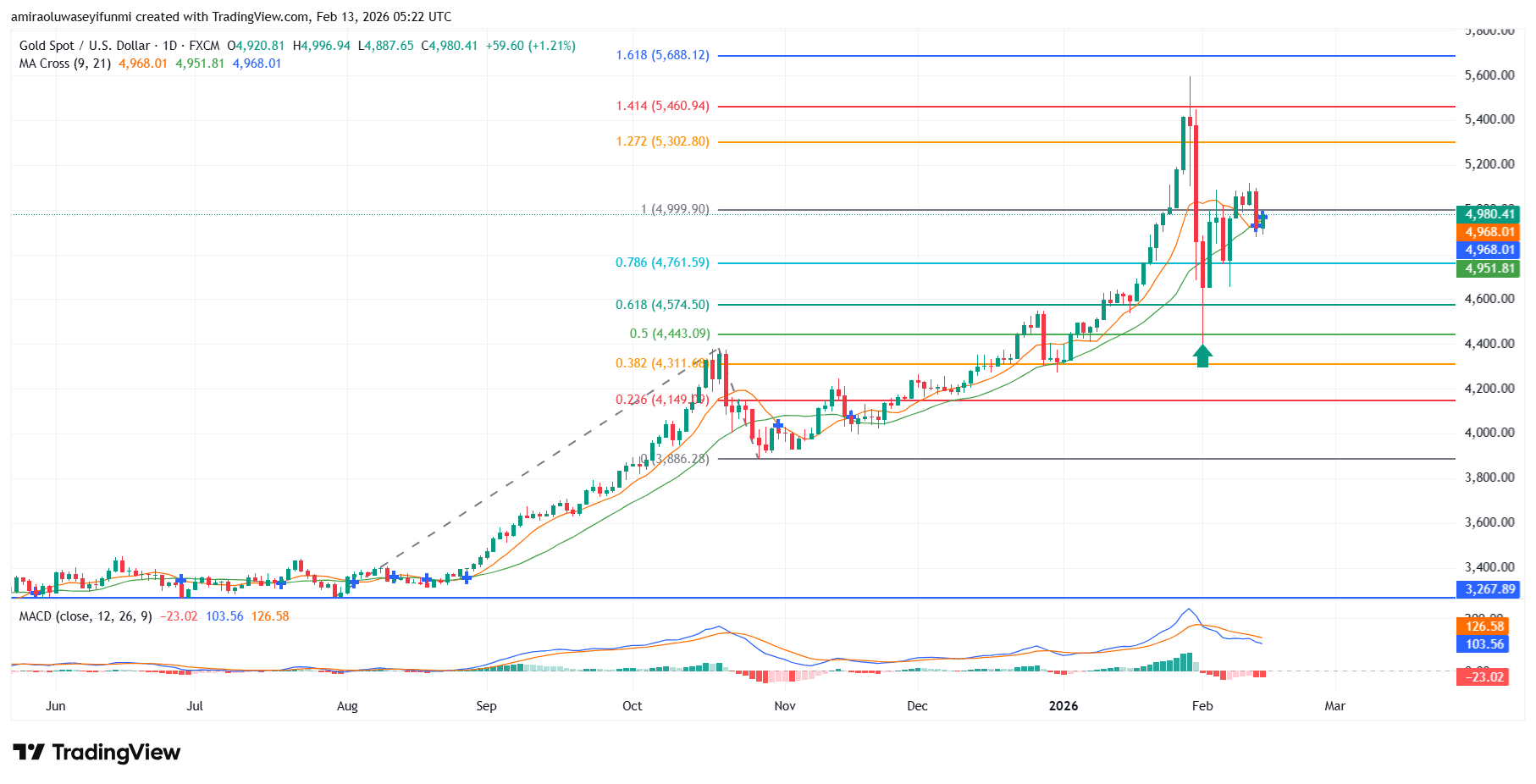

Gold (XAUUSD) sustains bullish momentum above key Fibonacci levels. XAUUSD Market continues to demonstrate a structurally bullish trajectory on the daily timeframe, supported by a consistent sequence of higher highs and higher lows. Price remains firmly positioned above the 9-period and 21-period moving averages, currently clustered around $4,970 and $4,950, reflecting sustained upside momentum. The broader advance from the $3,270 base toward the recent spike near $5,460 underscores strong institutional participation. Although MACD shows mild deceleration following the sharp expansion, it remains in positive territory, signaling that the dominant trend bias is still constructive.

Gold Key Levels

Resistance Levels: $5000, $5300, $5460

Support Levels: $4760, $4570, $4430

Gold Long-Term Trend: Bullish

Technically, price action has respected the $4,760 (0.786 Fibonacci) and $4,570 (0.618 Fibonacci) retracement zones as validated demand layers during prior pullbacks. The impulsive breakout above $5,000 accelerated toward $5,300 and briefly extended to approximately $5,460 before encountering supply-driven rejection. The subsequent retracement has been orderly rather than chaotic, with consolidation holding above the $4,950–$4,970 region, suggesting absorption of profit-taking flows. Importantly, the $4,760 level now functions as a critical structural floor, reinforcing the broader bullish framework.

Looking ahead, sustained acceptance above $5,000 positions XAUUSD Market for a renewed advance toward $5,300, followed by a potential retest of $5,460. A decisive breakout above $5,460 would likely expose the $5,690 extension objective as the next medium-term upside target. Downside risk remains contained provided price maintains structural support above $4,760; only a breakdown below $4,570 would materially weaken the prevailing bullish outlook. In the absence of such deterioration, the path of least resistance remains skewed toward incremental appreciation.

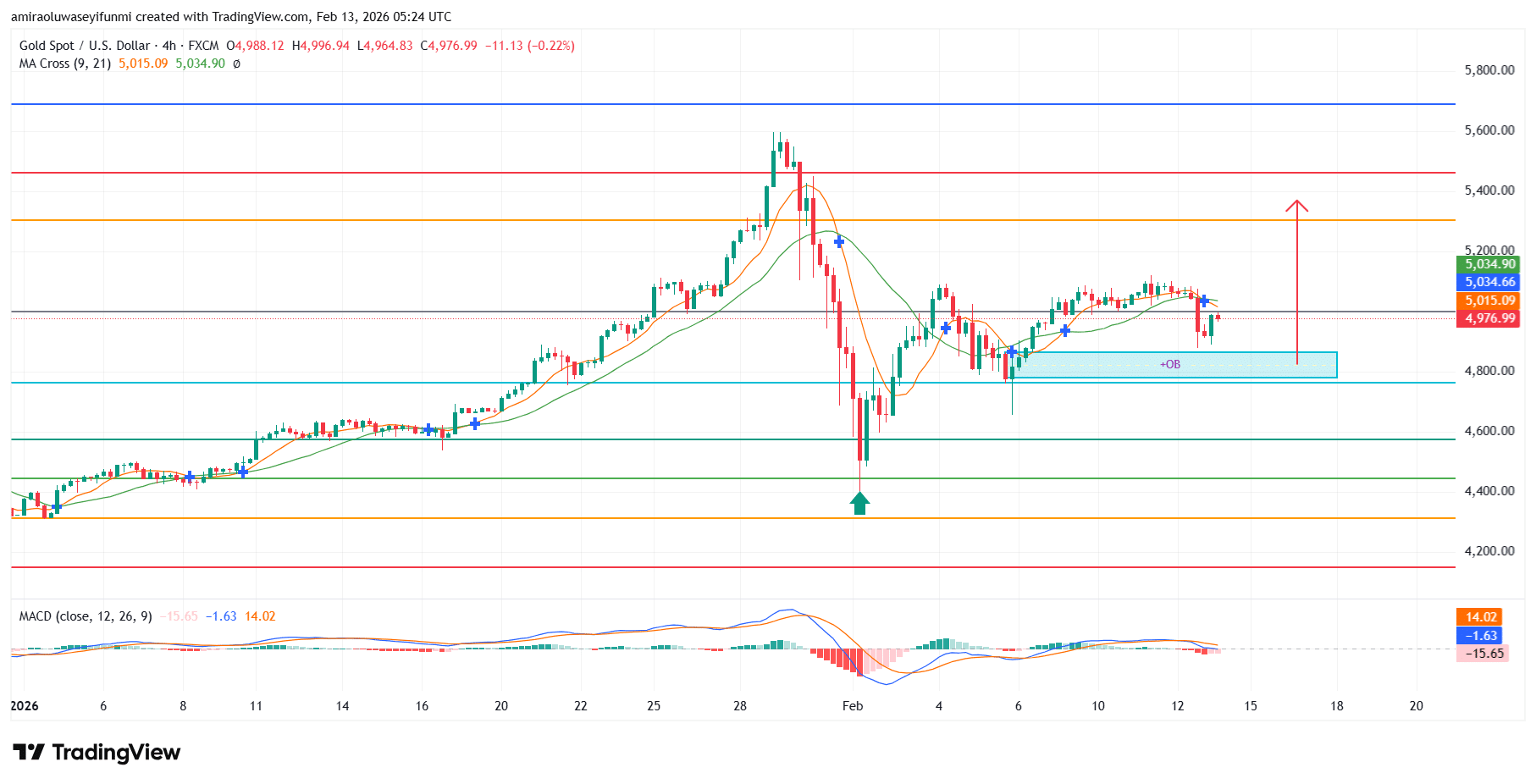

Gold Short-Term Trend: Bullish

Gold (XAUUSD) on the four-hour timeframe maintains a constructive bullish structure, with price holding above the $4,800 demand zone after a sharp corrective decline. The 9-period and 21-period moving averages are converging near $5,020–$5,040, indicating stabilization and a potential momentum shift back to the upside. Higher lows from the $4,450 swing base reinforce underlying buyer interest despite short-term consolidation below $5,100. A sustained push above $5,100 would likely open continuation toward $5,400, keeping the broader bullish bias intact and aligning with expectations often monitored through forex signals.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.