Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – September 7th

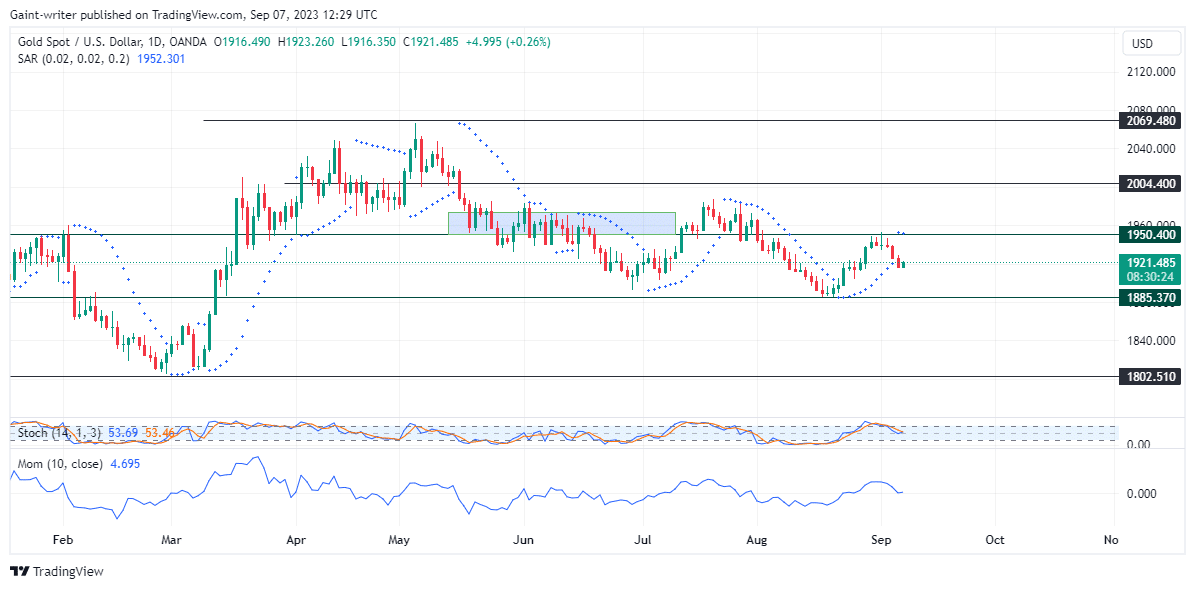

Gold (XAUUSD) struggles to regain bullish momentum. The loss of steam by the buyers has allowed sellers to penetrate the market. This potentially pushed the price down to the 1885.370 level. This decline in buyer momentum has significant implications for the market.

Gold (XAUUSD) Market Zones

Resistance Zones: 2069.480, 2004.400

Support Zones: 1950.400, 1885.370

Gold (XAUUSD) Long-Term Trend: Bullish

The key zone of 1950.400 has proven to be a challenge for

buyers, as their buying sentiment has been rejected in this area. The lack of liquidity and weakening buyers near this key level have opened the door for sellers to take control. This rejection of buy sentiment is primarily due to buyers losing steam early in the market.

I

The market has been pointing in a bearish direction recently, with sellers gaining more influence. If selling dominance continues to increase this week, we can expect the price to decline toward the 1885.370 market level. This is an important aspect to consider when analyzing the current state of the gold market.

I

The decline in buyer momentum is evident in the momentum indicator, which has been on a low trend since buyers were flushed out. Additionally, the Stochastic Oscillator has moved away from the overbought side. It does, however, suggest that sellers could become stronger in the near term. However, buy

traders still have the potential to rally and fight back at the key level of 1950.400. This is a crucial factor to watch for in the market.

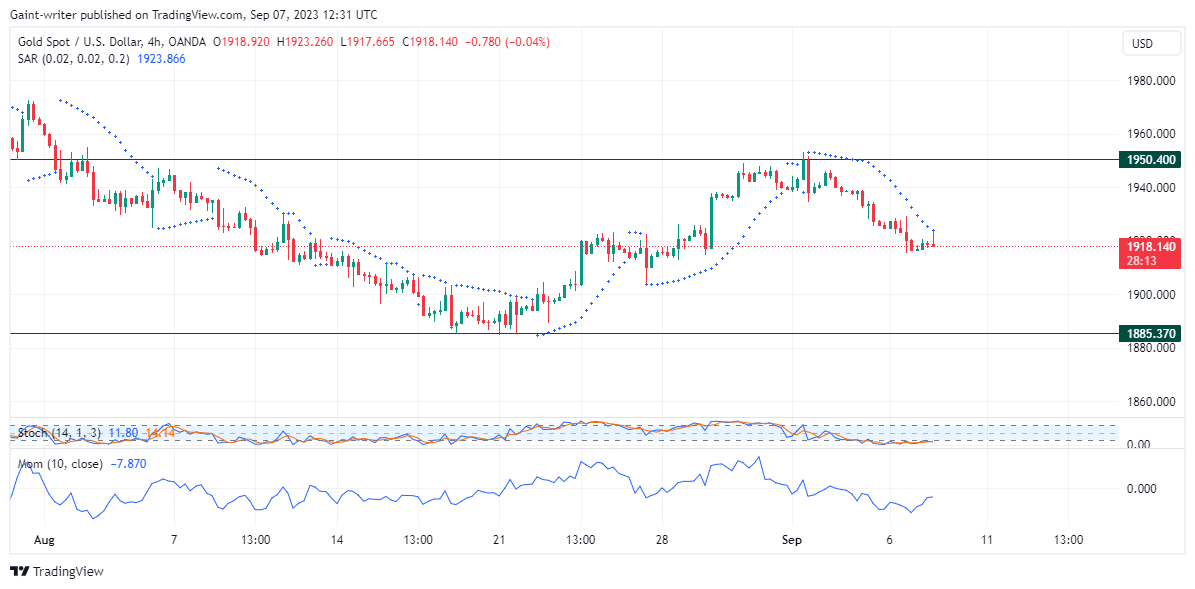

Gold (XAUUSD) Short-Term Trend: Bearish

On the 4-hour chart, we can observe a consistent

downward trend in the price of gold since the beginning of September. This further supports the bearish outlook for the market. The Parabolic SAR indicator, which helps identify potential reversal points, is also indicating bearish strength at the moment.

IYou can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here.

Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- The Lowest Trading Costs

- 50% Welcome Bonus

- Award-winning 24 Hour Support

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus