Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 minutes to learn more

Market Analysis – August 31

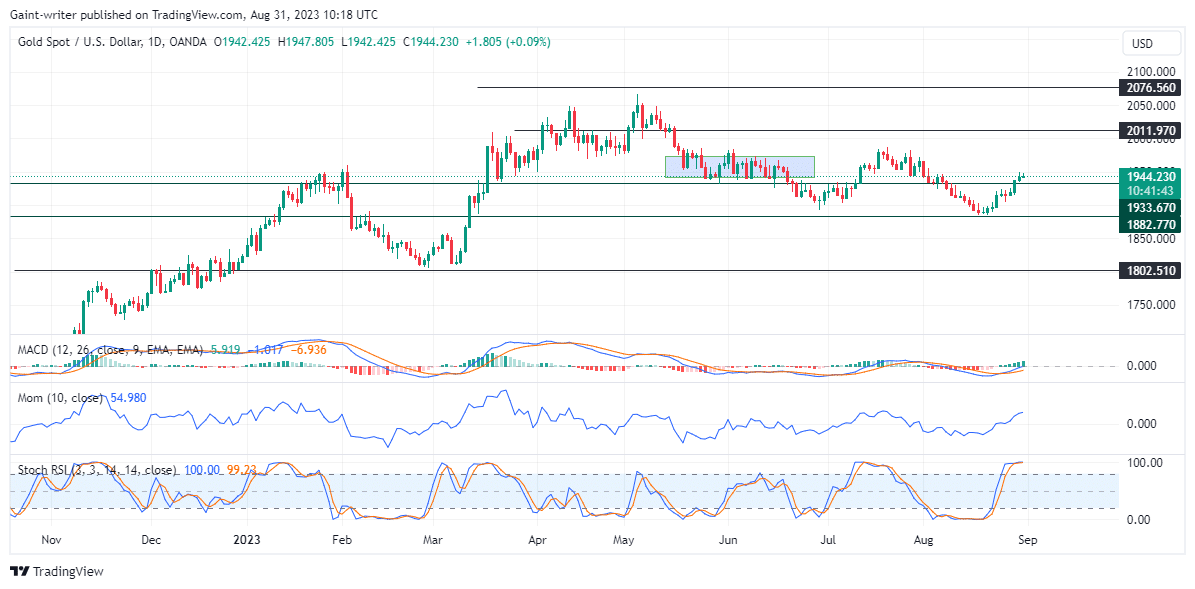

Gold (XAUUSD) bullish strength persists as key levels break. The market has seen continued strength from buyers as they refuse to relinquish their buying power. This has, however, resulted in a resilient bullish trend.

This week, the key level of 1933.670 was broken, reflecting a significant development for the precious metal.

Buyers have demonstrated their conviction by consistently pushing prices higher over the week. The ability to maintain this buying power indicates a positive sentiment.

Gold (XAUUSD) Key Levels

Resistance Levels: 2076.560, 2011.970

Support Levels: 1933.670, 1882.770

Gold XAUUSD Long-Term Trend: Bullish

Breaking key levels often signifies a shift in

market sentiment and can attract additional buyers to enter the market. This break indicates a potential increase in bullish momentum, raising the likelihood of further upward price movement. Traders should closely monitor any potential retests of this level to gauge its strength as a new support level. The imminent crossing of the MACD indicator over the 0.00 line adds credence to the bullish tendency.

This bullish crossover suggests that the buying pressure is likely to outweigh the selling pressure, potentially driving prices higher. Traders often view the MACD crossover as a significant buy signal. It further supports the notion of a continued bullish outlook for gold.

The increasing momentum indicator is a reflection of the growing buying surge in the

gold market. As more buyers enter the market and drive prices higher, the momentum indicator serves as confirmation of this upward momentum. Traders should be cautious of potential overbought conditions, but overall, the increasing momentum reinforces bullish sentiment. However, it further suggests that further price appreciation may be anticipated.

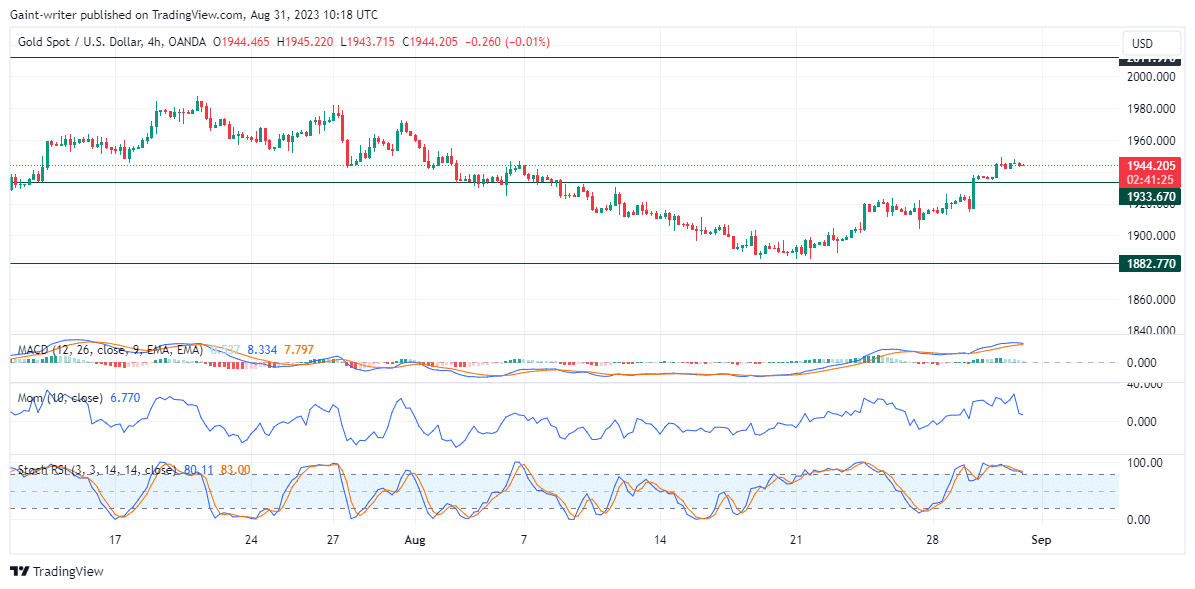

Gold (XAUUSD) Short-Term Trend: Bullish

Market traders may consider adopting a bullish stance in the gold market in the coming days. The continued buyer strength, key level break, MACD crossover, and increasing momentum all indicate a positive outlook for gold. Traders could potentially look for buying opportunities on pullbacks or consolidations before entering.

You can purchase Lucky Block – Guide, Tips & Insights | Learn 2 Trade here. Buy LBLOCK

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- The Lowest Trading Costs

- 50% Welcome Bonus

- Award-winning 24 Hour Support

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus