Market Analysis – August 14

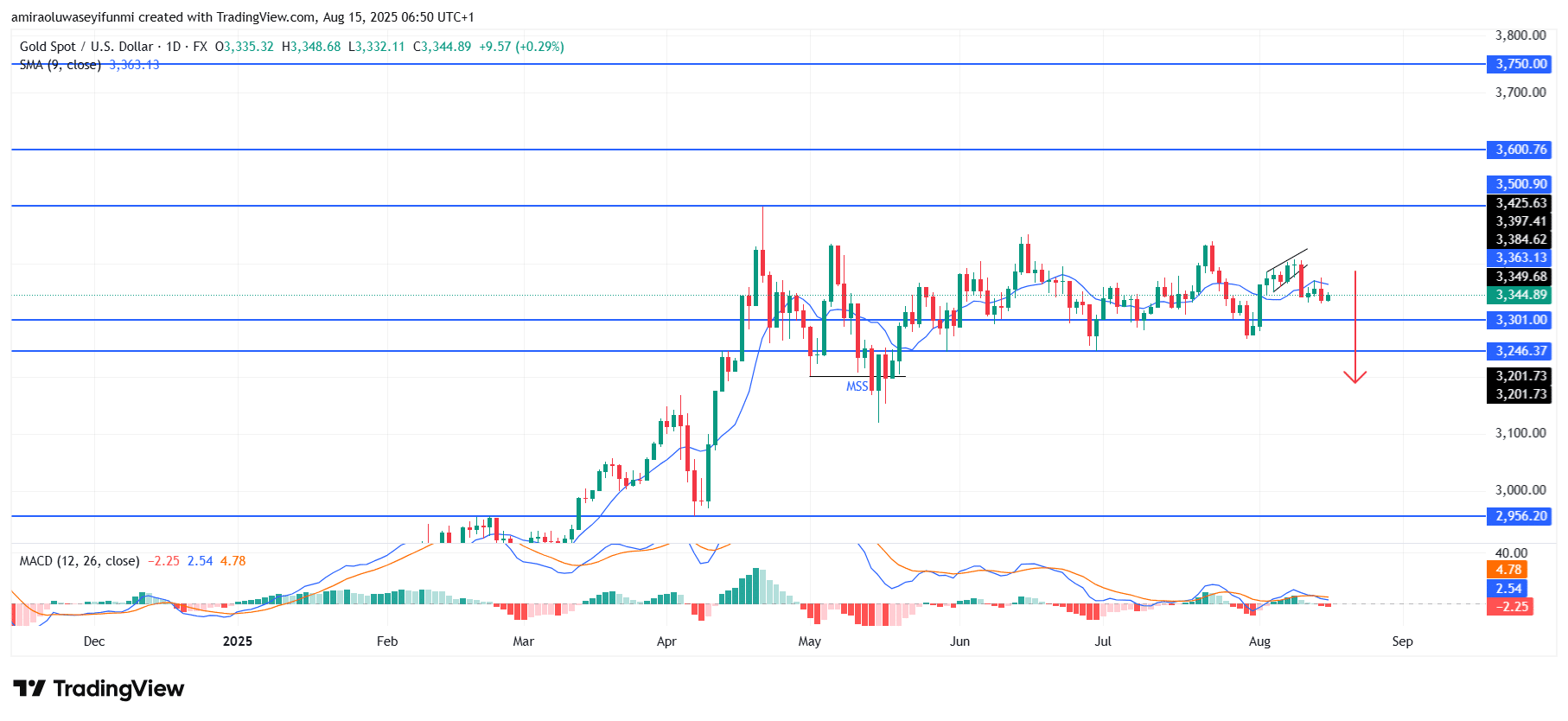

Gold (XAUUSD) is showing early signs of a bearish retracement as price hovers just above the $3,350 level while trading near the 9-day SMA at $3,360.

The MACD has crossed into negative territory, with the histogram posting red bars, signaling weakening bullish momentum. This decline in upward pressure follows an extended period of consolidation within a relatively tight range, indicating that buyers are gradually losing control.

Gold Key Levels

Resistance Levels: $3,500, $3,600, $3,750

Support Levels: $3,300, $3,250, $2,960

Gold Long-Term Trend: Bullish

The price recently failed to sustain a break above the $3,390 resistance zone, forming lower highs in the process. The chart also shows a breakdown from a short-term rising wedge pattern, a historically bearish structure that often precedes further declines. Immediate support is now focused at $3,300, with the next structural floor resting at $3,250 — a level that has previously acted as a springboard for bullish reversals.

Forecasts suggest that a decisive close below $3,300 could intensify selling pressure, paving the way toward $3,250 in the short term. If this support level fails, the retracement could extend further toward the $3,200 region, with an extreme downside target near $2,960 should macro sentiment and technical conditions align with bearish flows. Traders analyzing forex signals may closely watch these levels as they align with both technical and market-driven catalysts. Overall, the near-term trajectory remains skewed toward the downside until a strong bullish trigger emerges.

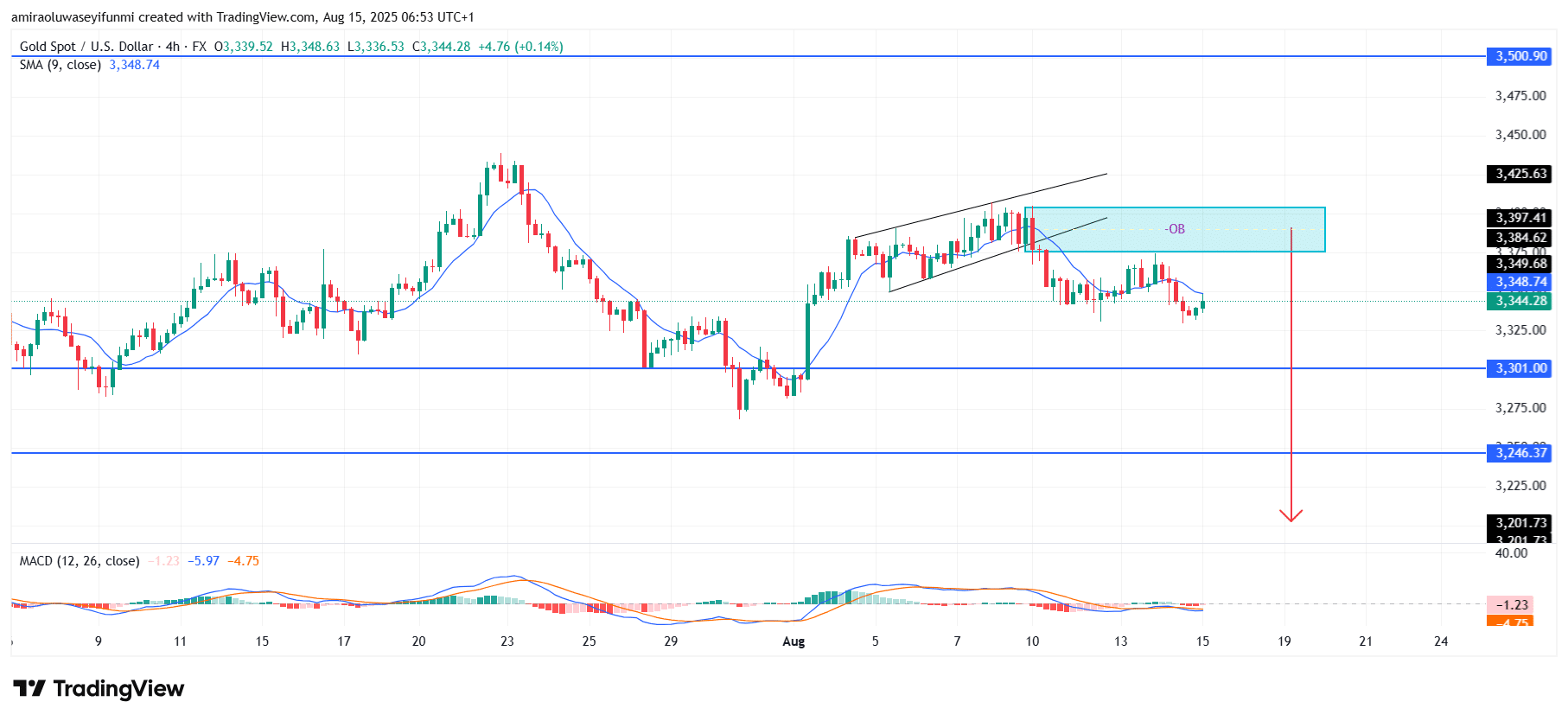

Gold Short-Term Trend: Bullish

Gold (XAUUSD) is trading below the 9-period SMA, reflecting sustained bearish momentum. Price recently rejected the order block zone near $3,380, confirming seller dominance.

MACD remains in negative territory, suggesting continued downside pressure. The next key support levels lie at $3,300 and $3,250, with a possible extension toward $3,200 if weakness persists.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.