Market Analysis – August 7

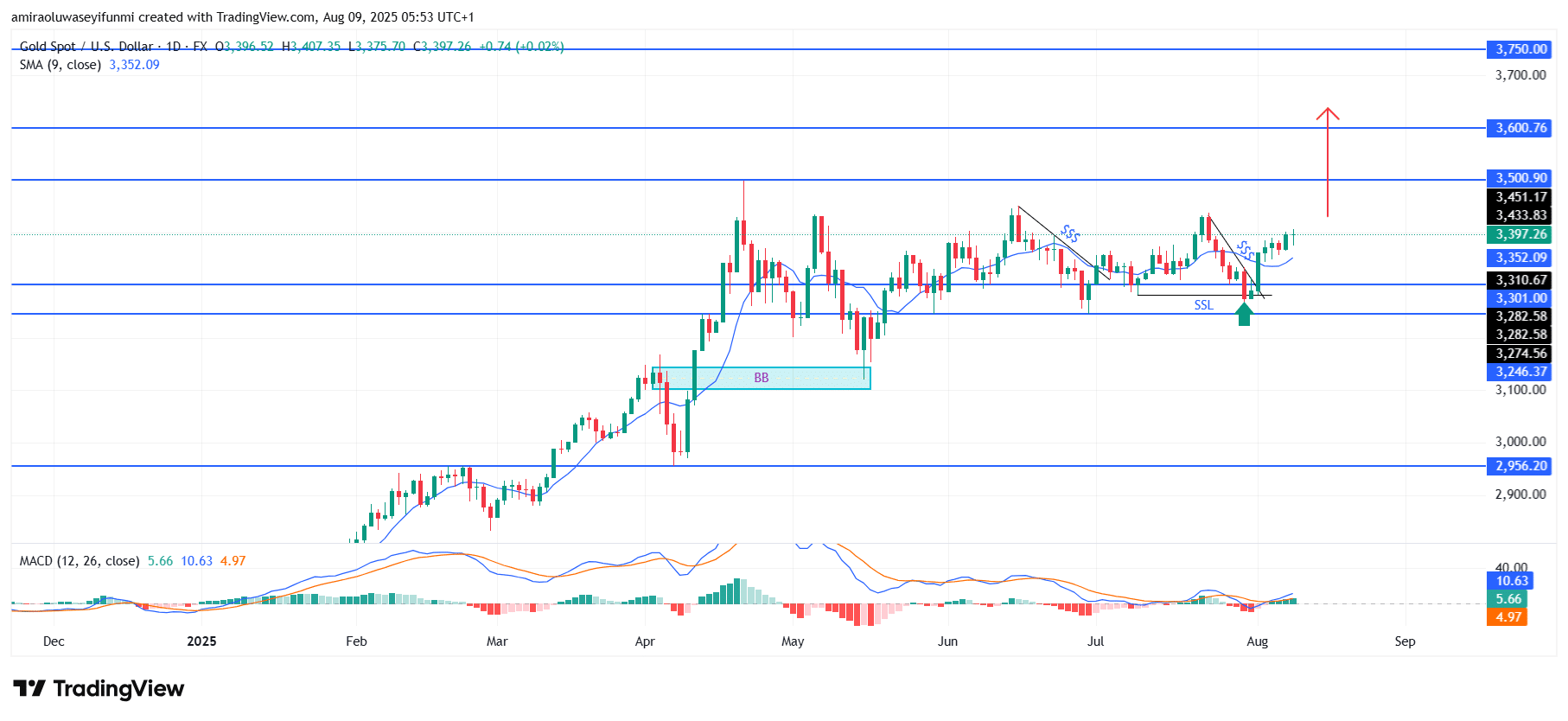

Gold (XAUUSD) continues to signal sustained upward momentum, with price trading above the 9-day SMA, confirming short-term bullish strength. MACD readings remain positive, with the MACD line positioned above the signal line, indicating growing buying pressure. On the daily chart, price action maintains a bullish bias, forming a sequence of higher lows since early August. This structure reinforces the ongoing uptrend and aligns with strong bullish sentiment reflected across key technical indicators.

Gold Key Levels

Resistance Levels: $3,500, $3,600, $3,750

Support Levels: $3,250, $3,100, $2,960

Gold Long-Term Trend: Bullish

Technically, the $3,300 demand zone has consistently attracted strong buying interest, with price repeatedly respecting this level. The most recent rebound aligns with previous swing lows and the lower boundary of the consolidation structure that has held since late May. The inability of sellers to extend losses beyond this support zone halted negative momentum, paving the way for a bullish reaction and an upward retracement.

In the near term, the market is likely to target the $3,450 zone, aligning with the moving average and prior mid-range resistance. A sustained break above this level could open the path for a medium-term rally toward $3,500. As long as $3,250 holds as a structural floor, the outlook favors a potential advance toward the $3,600 region in the coming weeks. Traders following forex signals may find these price zones important for identifying key trading opportunities.

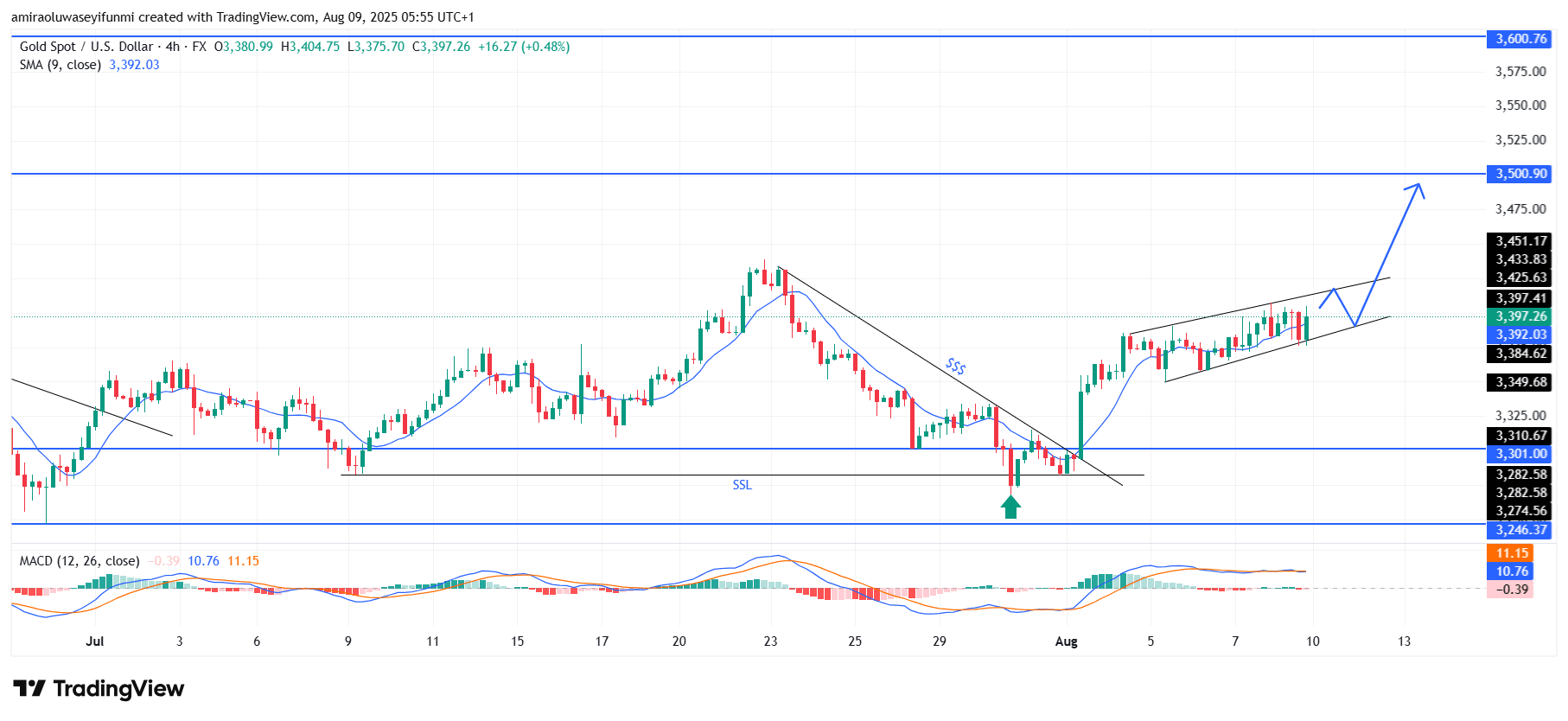

Gold Short-Term Trend: Bullish

In the short term, the 9-period SMA at $3,390 supports the market’s upward channel, confirming persistent bullish momentum. Price stability above the $3,380 support level signals that buyers are prepared to defend critical zones. While the MACD hovers near the zero line, it is positioned to rise if momentum accelerates. A breakout above $3,430 could trigger a move toward the $3,500 resistance in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.