Market Analysis – July 31

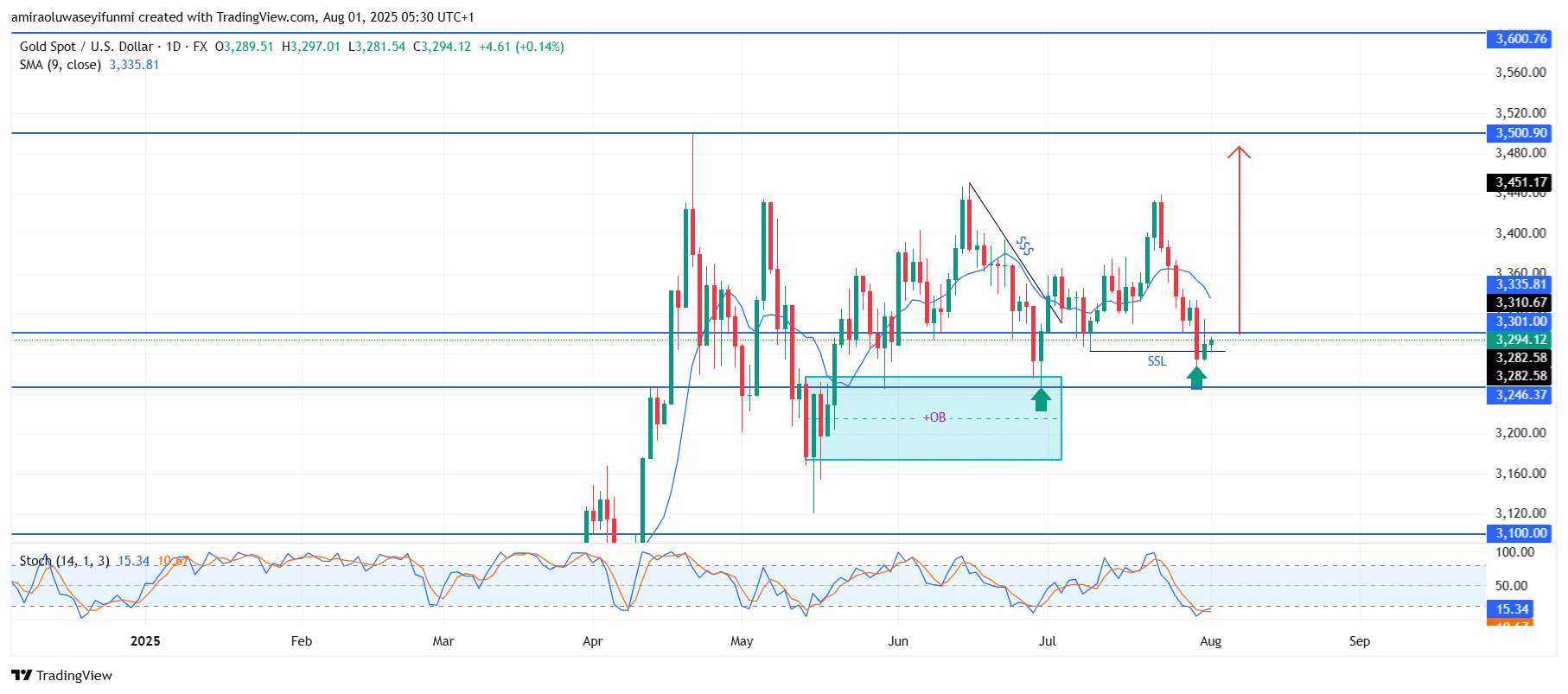

Gold (XAUUSD) is poised for a positive recovery from a key support level. After revisiting the $3,280 support, which has been reinforced by historical demand and an existing order block, gold has recently encountered resistance. The 9-day Simple Moving Average at $3,340 remains above the current price, indicating the potential for an upward reversal. Additionally, the daily stochastic oscillator has turned upward from oversold conditions at 15. With price momentum transitioning from a defensive to an expansionary phase, this confluence of technical factors suggests that market sentiment is shifting toward a renewed bullish trend.

Gold Key Levels

Resistance Levels: $3,450, $3,500, $3,600

Support Levels: $3,300, $3,250, $3,100

Gold Long-Term Trend: Bullish

From a technical perspective, price action has consistently respected the $3,300 demand zone, demonstrating robust buyer interest. The latest rejection from this area aligns with prior swing lows and coincides with the lower boundary of the consolidation structure that has developed since late May. The bullish reaction is further validated by a temporary halt in downward momentum, as sellers were unable to drive prices below previous support, creating favorable conditions for an upward retracement.

Looking ahead, the market is expected to aim for the $3,450 region as the initial target, which aligns with the moving average and previous mid-range resistance. A decisive break above this level would pave the way for a move toward $3,500 in the medium term. As long as the $3,250 support holds firm, the likelihood of XAUUSD advancing toward the $3,600 zone in the coming weeks remains strong, especially with forex signals favoring a bullish continuation.

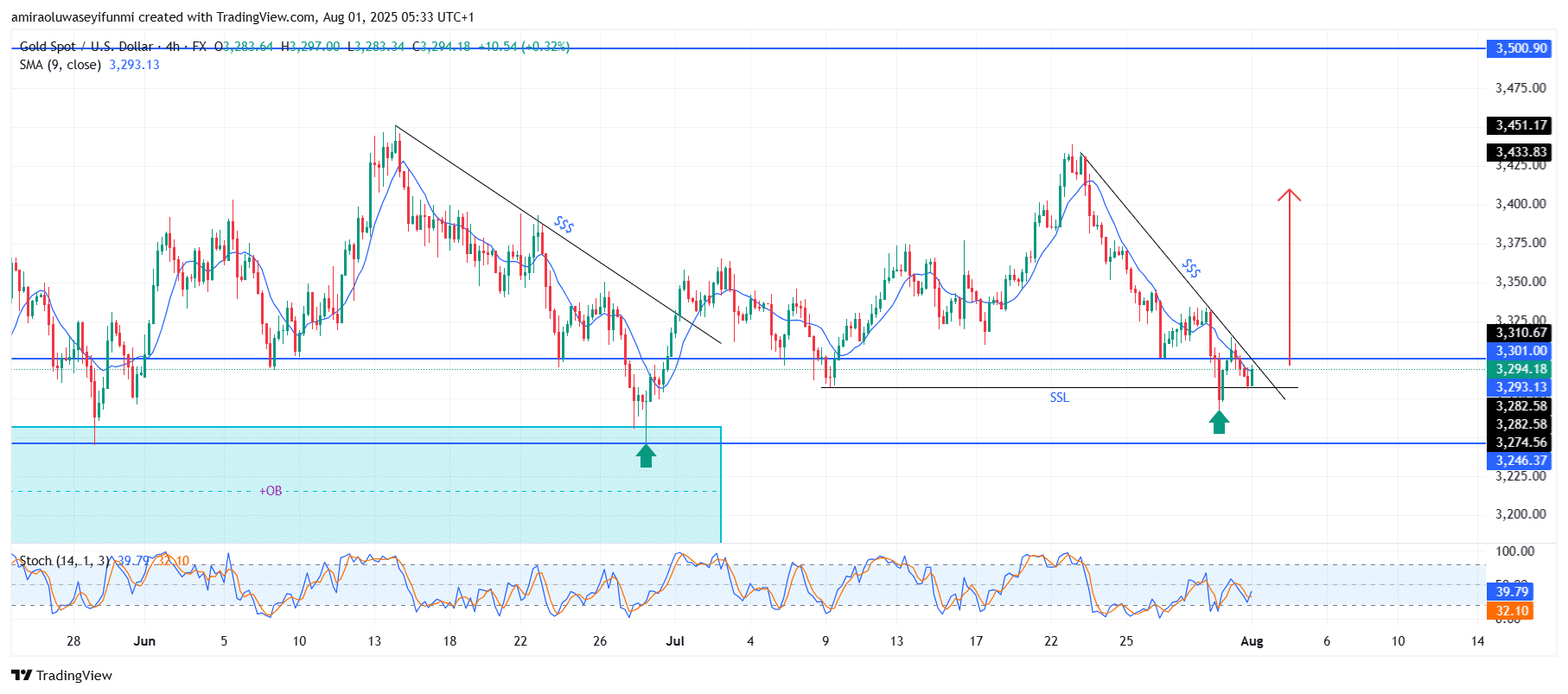

Gold Short-Term Trend: Bullish

Gold has rebounded from the $3,280 level, corresponding with the demand zone. Price has successfully broken above the short-term descending trendline, indicating a potential shift in momentum toward buyers.

The stochastic oscillator is rising from oversold levels, reinforcing the bullish outlook. A break above $3,310 could clear the way for a further push toward $3,450 in the near term.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.