Coinbase Global Inc. (NASDAQ: COIN) has undergone a significant strategic evolution in 2025, moving far beyond its traditional role as a cryptocurrency exchange.

The company is positioning itself as a comprehensive financial infrastructure provider, leveraging partnerships with major banks, stablecoin dominance, and blockchain network ownership to capture value across multiple revenue streams.

This strategic pivot comes at a critical time when institutional adoption of digital assets is accelerating under favorable regulatory conditions.

Recent developments show Coinbase building what analysts describe as an operating system for the next generation of internet-based financial services.

The Financial Foundation of Coinbase: USDC

The cornerstone of Coinbase’s financial strategy centers on USD Coin (USDC), a dollar-pegged stablecoin that has become a significant revenue generator.

Through its partnership with Circle, established in 2018, Coinbase has built a highly profitable business model around stablecoin services.

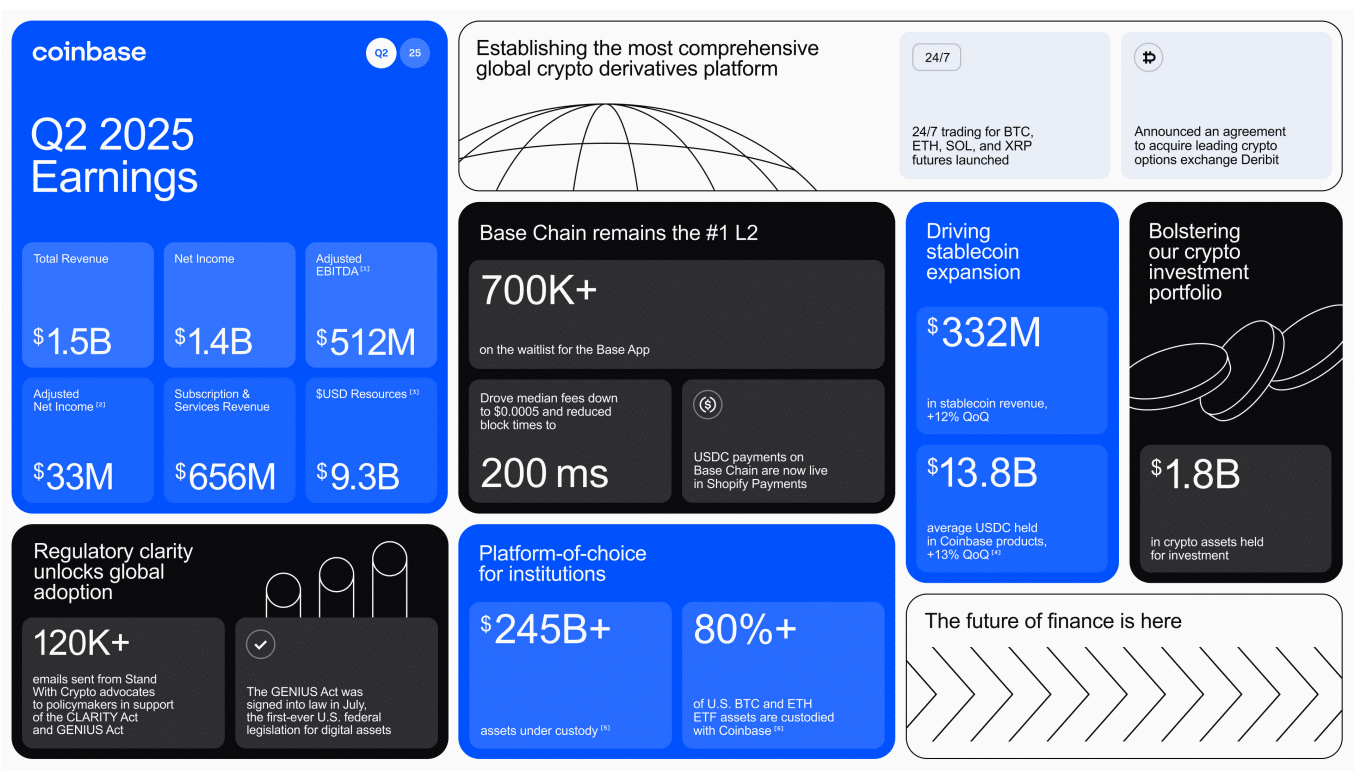

The company earned $332.5 million from stablecoins in Q2 2025, representing a 38% increase from the same period in 2024.

This revenue comes from multiple sources: Coinbase retains 100% of revenue generated on all USDC held on its platforms, plus approximately 50% of all other USDC revenue generated elsewhere.

The stablecoin market has experienced remarkable growth, with total stablecoin supply reaching $234 billion in March 2025, with USDC specifically hitting a new high of $60.1 billion.

This growth provides Coinbase with a steady revenue stream that operates independently of cryptocurrency price volatility, addressing one of the company’s historical challenges.

What makes this particularly compelling is the profit margin structure. The stablecoin business operates at margins significantly higher than traditional trading, as it requires minimal incremental infrastructure once established.

The JPMorgan Partnership

In July 2025, Coinbase announced a comprehensive partnership with JPMorgan Chase, the largest U.S. bank with over 80 million customers. This collaboration represents a fundamental shift in how traditional banking institutions approach cryptocurrency services.

The partnership includes three major components launching over the next two years. Starting in fall 2025, Chase credit cardholders will be able to fund their Coinbase accounts directly.

By 2026, customers can redeem Chase Ultimate Rewards points for USDC, marking the first time a major credit card rewards program enables point-to-cryptocurrency conversion.

The integration bypasses traditional account aggregators like Plaid, using JPMorgan’s internal APIs and authentication layers for direct funding transfers. This creates a more secure and streamlined user experience while reducing operational costs for both companies.

Beyond retail services, JPMorgan launched JPMD, a permissioned USD deposit token, on Coinbase’s Base blockchain in June 2025.

Unlike stablecoins, deposit tokens are digital representations of bank deposits managed through blockchain technology, designed specifically for institutional clients.

Coinbase’s Base Network: Infrastructure Ownership Strategy

The Base blockchain network, launched by Coinbase as an Ethereum Layer 2 solution, has become a critical component of the company’s long-term strategy.

By controlling the sequencer—the mechanism that processes all transactions on Base—Coinbase collects fees from every operation performed on the network.

Current sequencer revenue generates approximately $25-30 million monthly, translating to over $360 million annually. This revenue stream grows proportionally with network activity, creating a powerful network effect where increased adoption directly benefits Coinbase’s bottom line.

Base’s total value locked has grown substantially, indicating genuine adoption beyond speculative activity. The network processes payments in under one second for less than one cent, making it competitive with traditional payment rails for high-frequency transactions.

The value extends beyond direct fee collection. By owning the underlying infrastructure, Coinbase can offer integrated services that competitors cannot replicate, including seamless wallet functionality, instant settlement, and reduced operational complexity for businesses building on Base.

The Base App, launched in 2025 as a replacement for Coinbase Wallet, combines wallet functionality, trading capabilities, payment processing, social media features, and messaging.

The app operates entirely on the Base network using USDC for transactions, creating a closed-loop ecosystem where every transaction generates revenue for Coinbase.

Market Position and Future Outlook of Coinbase

Coinbase’s inclusion in the S&P 500 in May 2025 marked a significant milestone, with shares jumping 24% on the announcement. The company also announced plans to acquire Dubai-based Deribit for $2.9 billion, the largest deal in crypto industry history.

Wall Street analysts have responded positively to these developments, with some firms raising price targets to over $500 per share. These valuations reflect expectations that Coinbase can successfully execute its transition from trading-dependent revenue to diversified financial services.

The combination of stablecoin revenue, blockchain network ownership, traditional banking partnerships, and consumer application development creates multiple reinforcing revenue streams for Coinbase.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.