Market Analysis – May 22

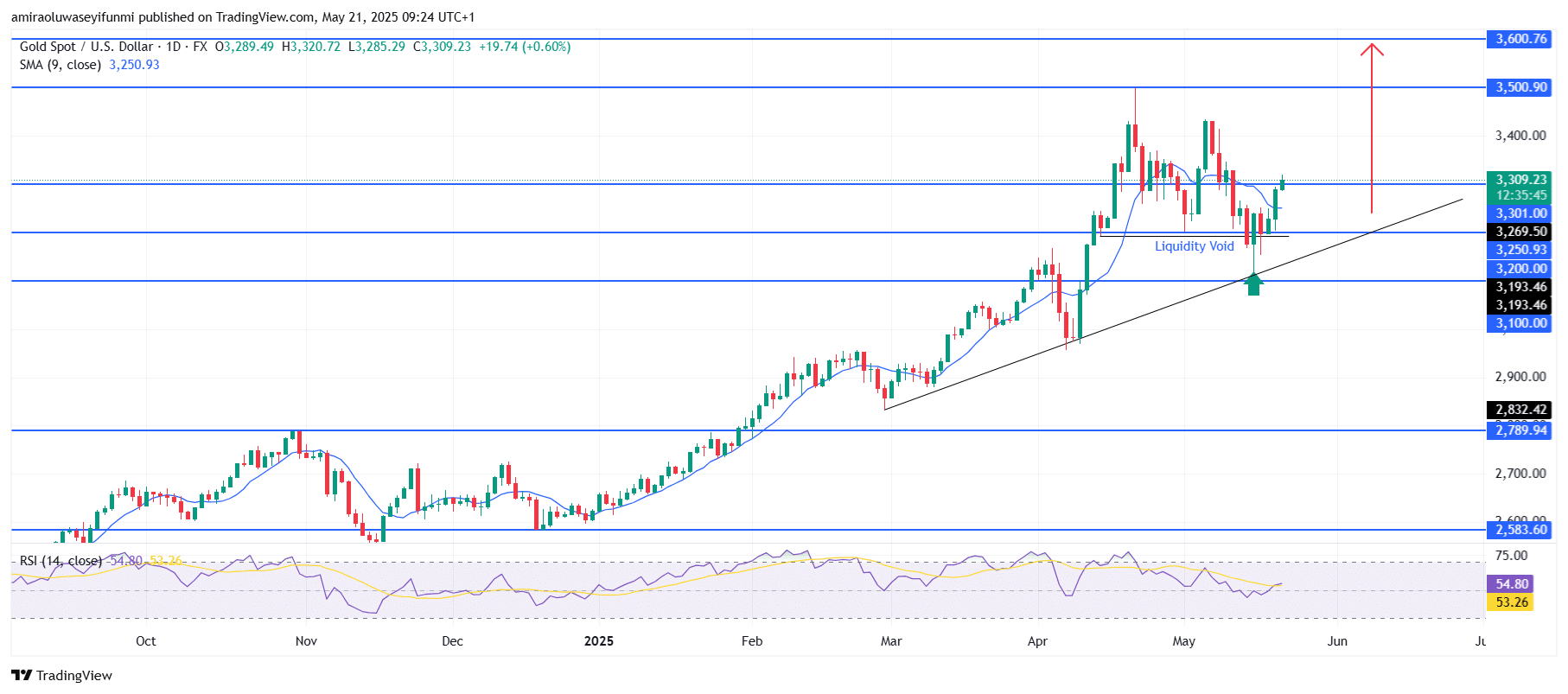

Gold (XAUUSD) continues to exhibit strong bullish momentum with the potential to break above the $3,300 resistance level. Technical indicators on the daily chart support a bullish outlook. The 9-day Simple Moving Average (SMA) is trending upward and acting as dynamic support. The price is currently trading around $3,310, above the SMA positioned near $3,250. The Relative Strength Index (RSI) is hovering around 55, indicating moderate bullish strength without entering overbought territory. This suggests room for further upward movement without immediate risk of a correction.

Gold Key Levels

Resistance Levels: $3,300, $3,500, $3,600

Support Levels: $3,200, $3,100, $2,790

Gold Long-Term Trend: Bullish

Gold (XAUUSD) has consistently respected an ascending trendline that aligns with the most recent higher low near the $3,200 level. Price action recently entered a marked liquidity void zone and rebounded sharply, signaling potential institutional accumulation. The former resistance around $3,200 has now become a support level, confirmed by the presence of a bullish engulfing candle near that zone. Continued consolidation above $3,300 and the rebound from the demand area highlight sustained buyer interest.

Given the current trajectory, XAUUSD is likely to retest the $3,500 resistance in the near future. A breakout above this key psychological level could pave the way toward the $3,600 target, as indicated by the upward projection. However, failure to hold above the $3,300 level could result in a retest of the ascending trendline, offering another potential entry point for long positions. The overall market structure remains bullish, provided price continues to form higher lows and remains above the $3,200 support level. Traders may also consider forex signals to enhance entry timing and risk management strategies.

Gold Short-Term Trend: Bullish

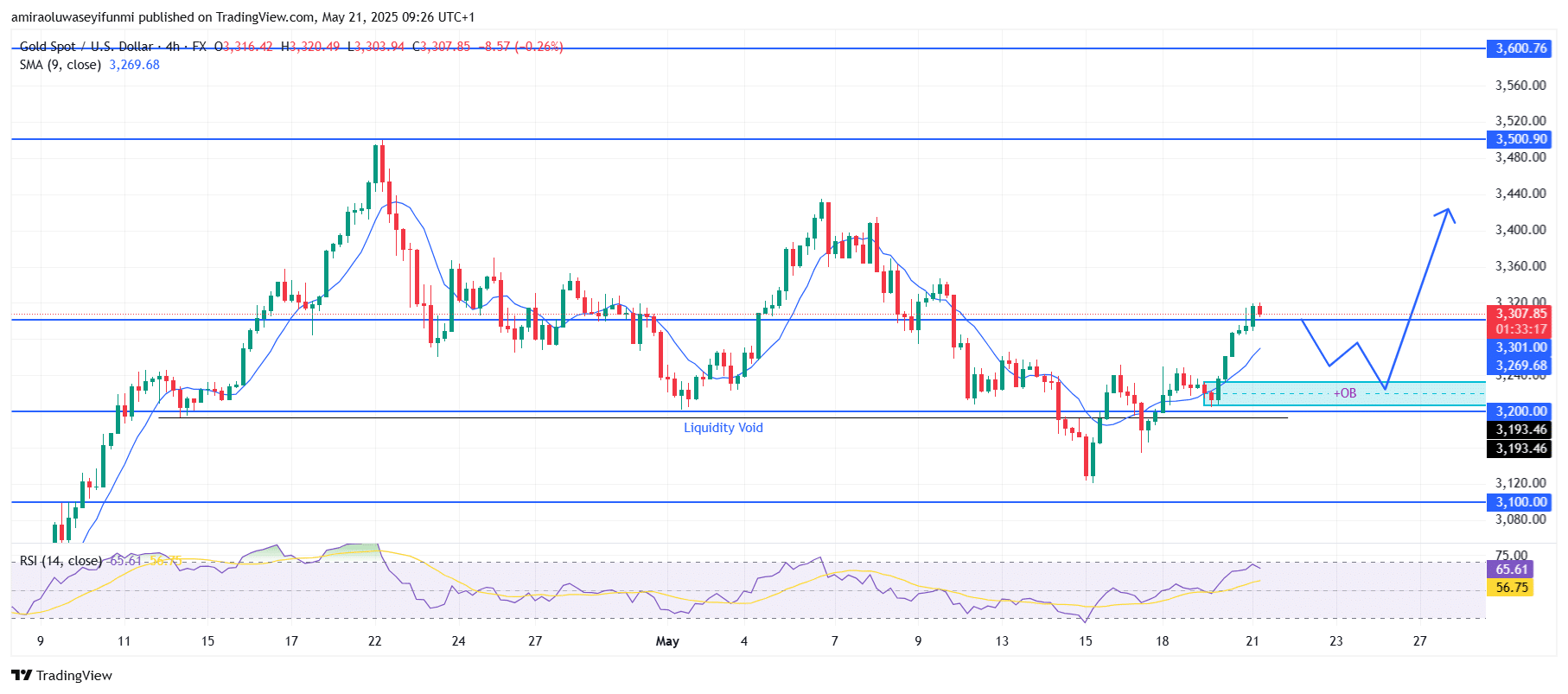

Gold (XAUUSD) maintains a bullish fractal structure on the 4-hour chart, characterized by a sequence of higher highs and higher lows above the $3,200 support zone. The recent breakout above the $3,300 resistance level is supported by the 9-period SMA, which is currently providing dynamic support around $3,270.

The RSI is now reading near 66, indicating strong bullish momentum with additional room for upward movement. A brief retracement toward the $3,270–$3,250 range may occur before a continuation of the bullish trend toward the $3,400 level.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.