The U.S. Senate just took a big step toward creating the first federal rules for stablecoins. In a 66-32 vote on May 21, 2025, senators broke through a filibuster to advance the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins).

This bill now heads to a full Senate vote, bringing America closer to having clear stablecoin regulations for the first time.

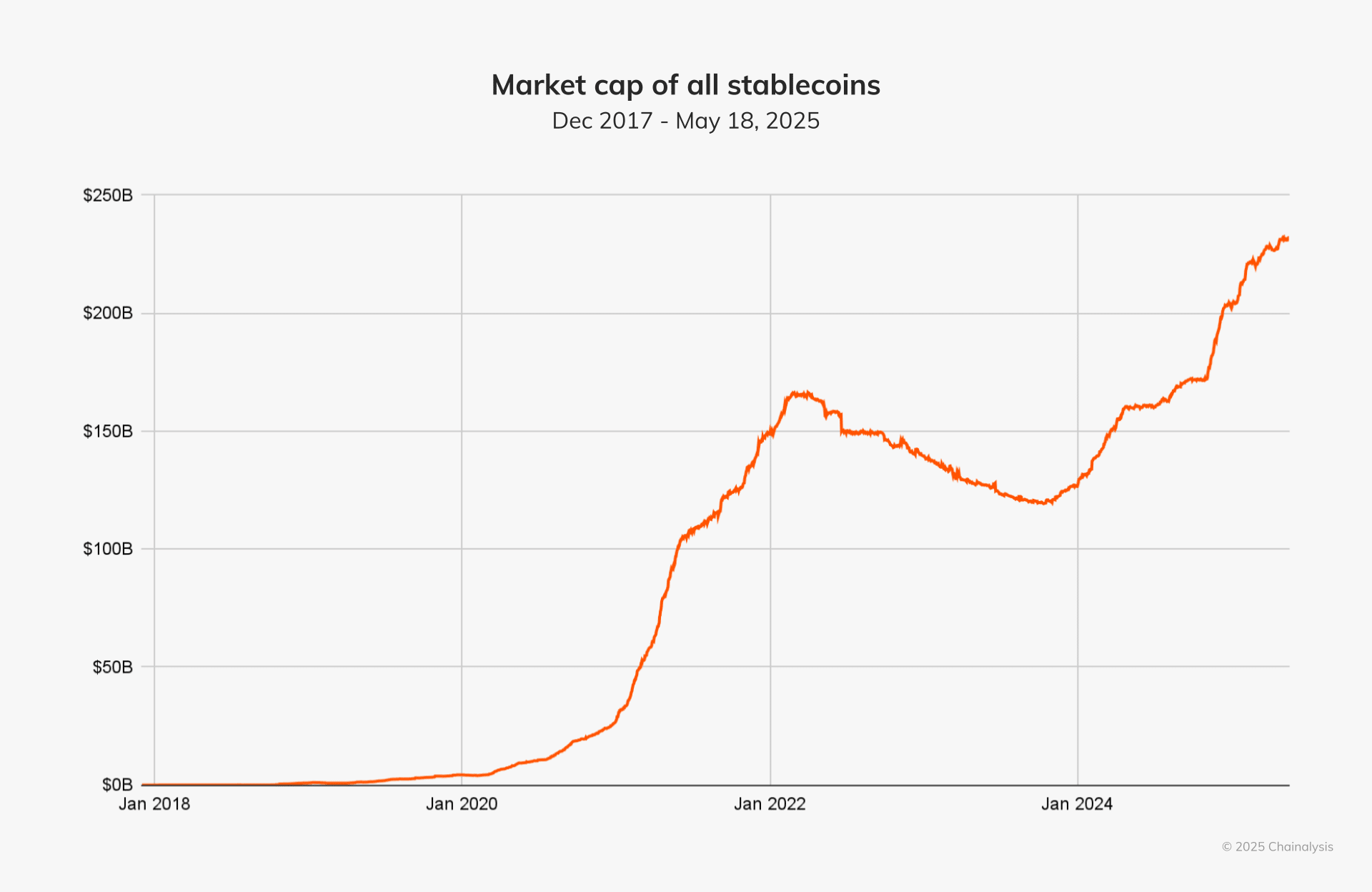

The timing couldn’t be better. Stablecoins now have a total market value of around $232 billion and handle most blockchain transactions.

These digital tokens are pegged to stable assets like the U.S. dollar, making them popular for trading, payments, and storing value without the wild price swings of regular cryptocurrencies.

What the GENIUS Act Actually Does

According to the latest Chainalysis report, the proposed law creates strict rules that stablecoin companies must follow. Every stablecoin must be backed by real U.S. dollars, short-term Treasury bonds, or other liquid assets.

Companies will need to publish monthly reports showing exactly what backs their tokens and get annual audits if they’re worth more than $50 billion.

The bill also bans companies from using misleading terms like “USG” or “legal tender” in their marketing.

More importantly, it requires stablecoin issuers to follow the same anti-money laundering rules as traditional banks. This means tracking transactions, reporting suspicious activity, and knowing who their customers are.

For enforcement, companies must build technology that can freeze or destroy tokens when authorities demand it. Foreign stablecoin makers who don’t follow these rules could be banned from U.S. markets entirely.

Why This Matters for the Crypto Market

Right now, American crypto companies face unclear rules that make it hard to operate safely. Many have moved operations overseas to avoid regulatory problems. The GENIUS Act would fix this by giving clear guidelines that let companies innovate while protecting consumers.

The bill has strong bipartisan support from senators like Kirsten Gillibrand and Bill Hagerty, who say it will keep crypto innovation in America while strengthening the U.S. dollar’s global position.

Other countries already have stablecoin rules. The European Union started enforcing its MiCA regulations in June 2024, while Singapore, Hong Kong, and Japan have their own frameworks. America risks falling behind without federal standards.

If both chambers of Congress approve the GENIUS Act, it goes to President Trump for his signature. This could happen later this year, finally giving the massive stablecoin industry the regulatory clarity it desperately needs.

Interested In Trading The Market With A Trustworthy Partner? Try Eightcap Today.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.