Market Analysis – May 15

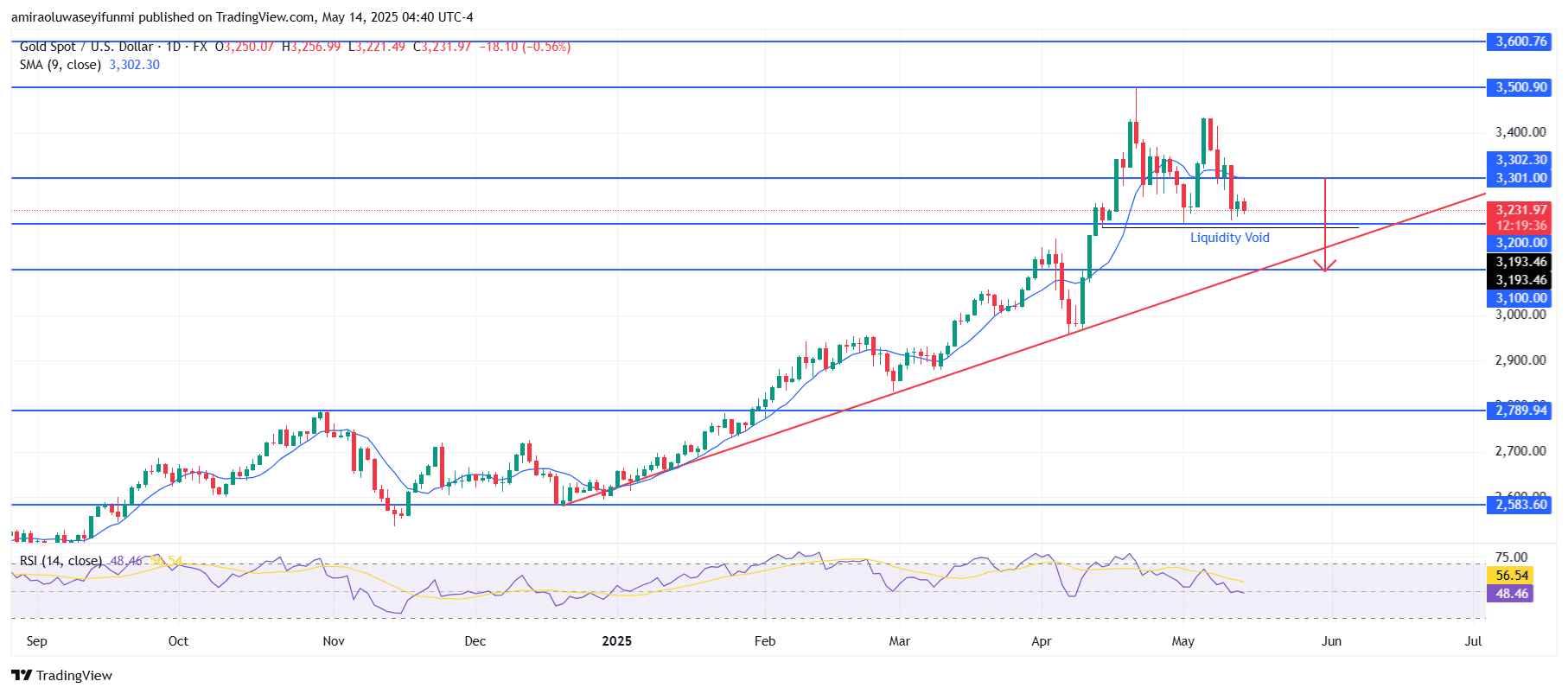

Gold (XAUUSD) is showing signs of weakness amid a key technical confluence. The 9-day Simple Moving Average (SMA), currently near $3,300, has been broken to the downside, signaling weakening short-term momentum. The Relative Strength Index (RSI) stands at 48.53, just below the neutral 50 level, suggesting a shift in control from buyers to sellers. Moreover, the downward slope of the RSI and a previously formed bearish divergence indicate a loss of bullish strength. The inability of the SMA to act as dynamic support further underscores the growing bearish pressure.

Gold Key Levels

Resistance Levels: $3,300, $3,500, $3,600

Support Levels: $3,200, $3,100, $2,790

Gold Long-Term Trend: Bearish

From a broader perspective, gold has repeatedly failed to break and sustain above the $3,350 zone, forming a double-top-like structure with lower highs. A clear rejection from the $3,300 resistance level has driven prices downward, now challenging the crucial horizontal support at $3,200. If the ascending trendline from December 2024 is broken and confirmed, it would represent a major shift in the market structure. A liquidity void between $3,230 and $3,200 may draw price action to fill the gap.

Should bearish momentum persist and the $3,200 level fail to hold, XAUUSD could decline further toward $3,100, potentially extending the drop to $2,790 in the weeks ahead. The breakdown of the bullish trendline signals the onset of a corrective phase, particularly if daily closes continue below $3,200. Buyers must regain control by pushing prices above $3,300 and ultimately breaking through $3,350 to invalidate this bearish scenario. At the moment, however, the path of least resistance appears tilted to the downside, as some traders may be looking to forex signals for guidance.

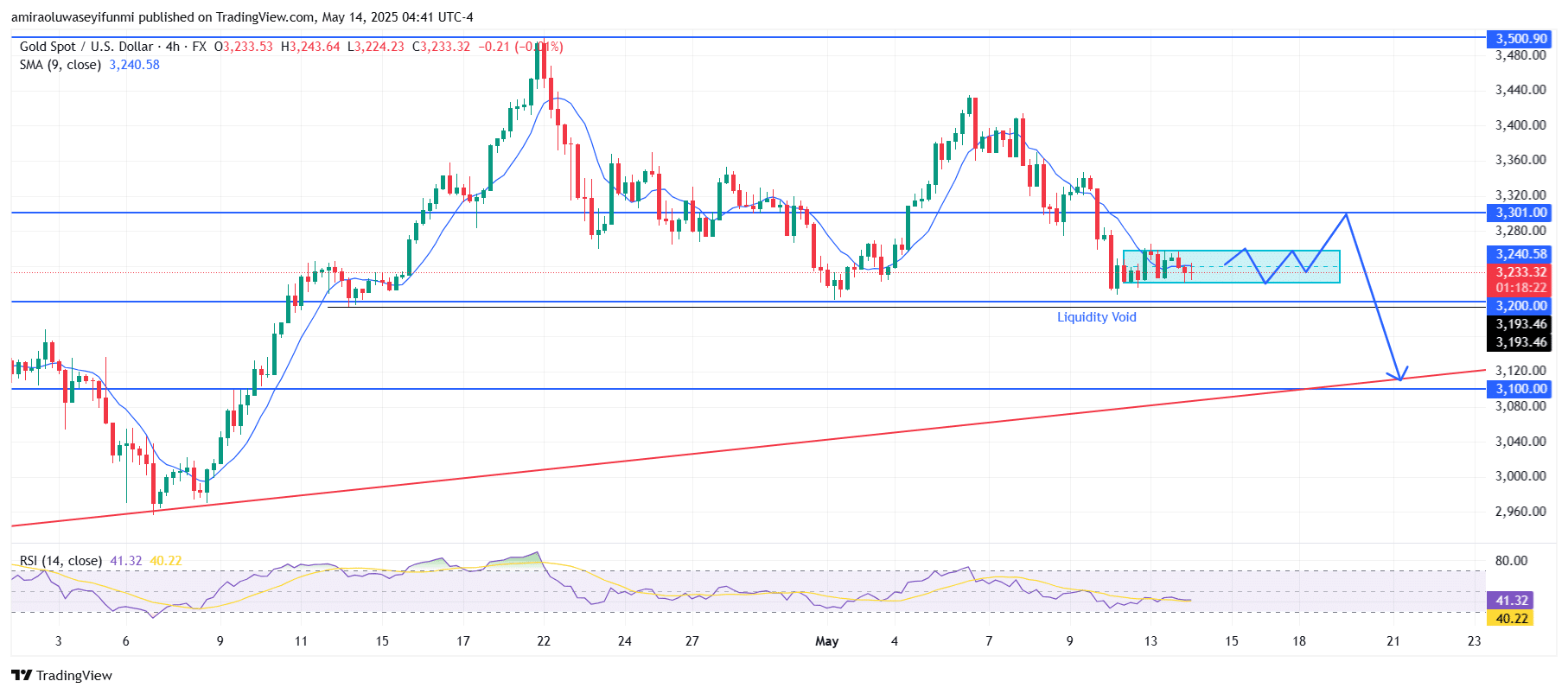

Gold Short-Term Trend: Bearish

XAUUSD is currently trading below the 9-period SMA, reinforcing the short-term bearish trend. The price is consolidating within a defined range, with resistance located at $3,240 and support at $3,200.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.