Market Analysis – September 18

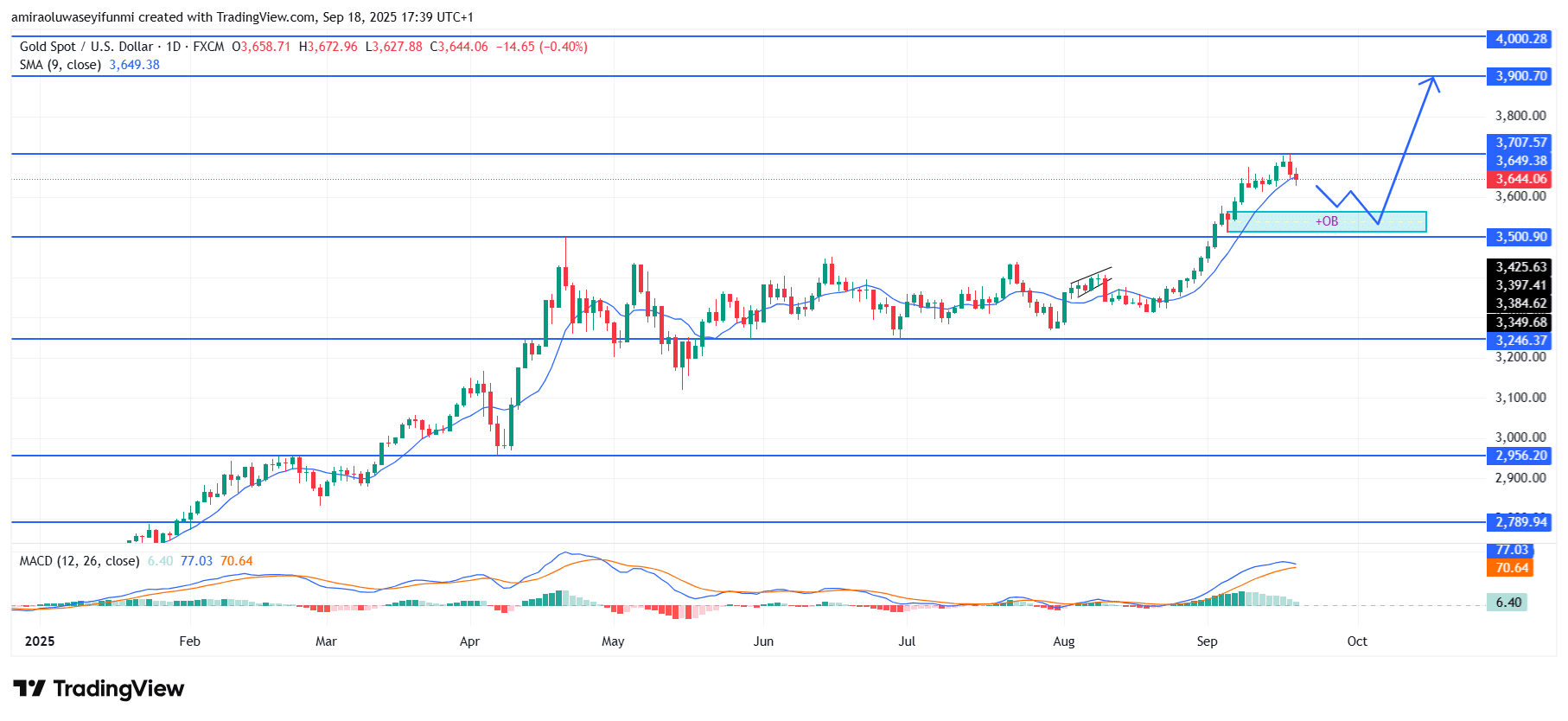

Gold (XAUUSD) shows a healthy correction before continuing its bullish trend. After reaching recent highs, XAUUSD has seen a moderate pullback, but the overall outlook remains positive. The price is currently trading near $3,640, just below the 9-day SMA at $3,650, which is acting as a pivot level. Although the MACD is narrowing, it still reflects positive momentum, suggesting that the retracement is likely temporary rather than a signal of a full reversal. This correction is consistent with normal market cycles, where consolidation creates a base for renewed movement.

Gold Key Levels

Resistance Levels: $3,710, $3,900, $4,000

Support Levels: $3,500, $3,250, $2,960

Gold Long-Term Trend: Bullish

Gold has maintained its demand zone around $3,500, identified as an order block where buying interest has been concentrated. The rejection at $3,710 triggered profit-taking and led to the current pullback, but the overall pattern of higher highs and higher lows remains intact. Holding above $3,500 supports the view that the bullish structure is still valid. If sellers increase pressure, the $3,500–$3,510 zone is likely to absorb liquidity, with immediate support aligning with the broader trendline.

Looking forward, XAUUSD is expected to resume its upward trajectory once the corrective phase ends. A strong rebound from the $3,500 level could spark another attempt to break $3,710, and a successful breakout would open the way toward $3,900. If bullish momentum strengthens, the extended target remains at $4,000, which is a key psychological level. As long as price action stays above $3,500, the bullish cycle is likely to persist, encouraging investors to accumulate positions at discounted levels in anticipation of higher prices.

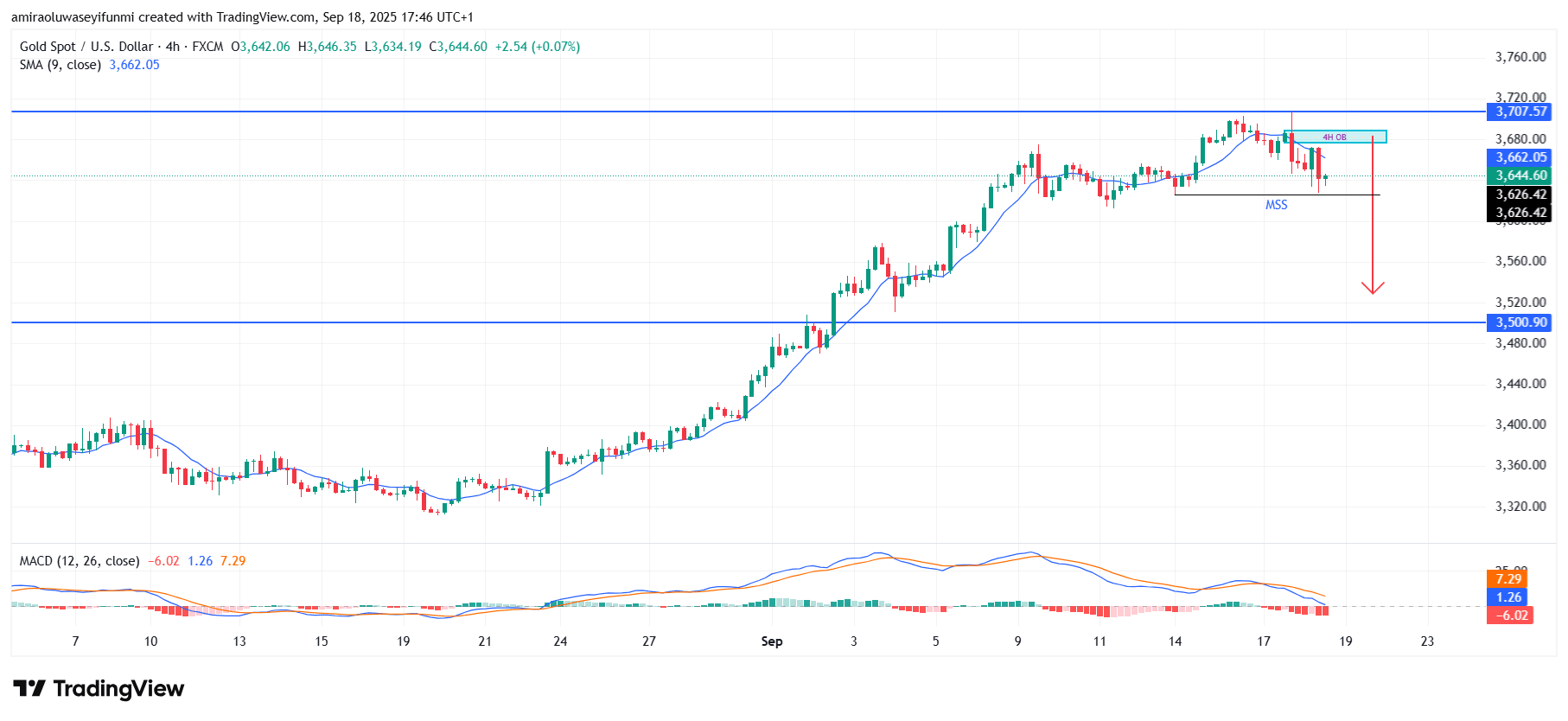

Gold Short-Term Trend: Bearish

Gold (XAUUSD) has broken market structure to the downside, indicating short-term bearish pressure on the four-hour chart. Price retested the 4H order block near $3,660, which is now acting as resistance.

The rejection from this zone suggests a continuation lower toward the $3,500 support region. MACD also signals weakening momentum, aligning with the short-term bearish outlook. Traders may monitor these key levels and use forex signals to anticipate potential reversal points and plan entry or exit strategies accordingly.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.