Market Analysis – September 11

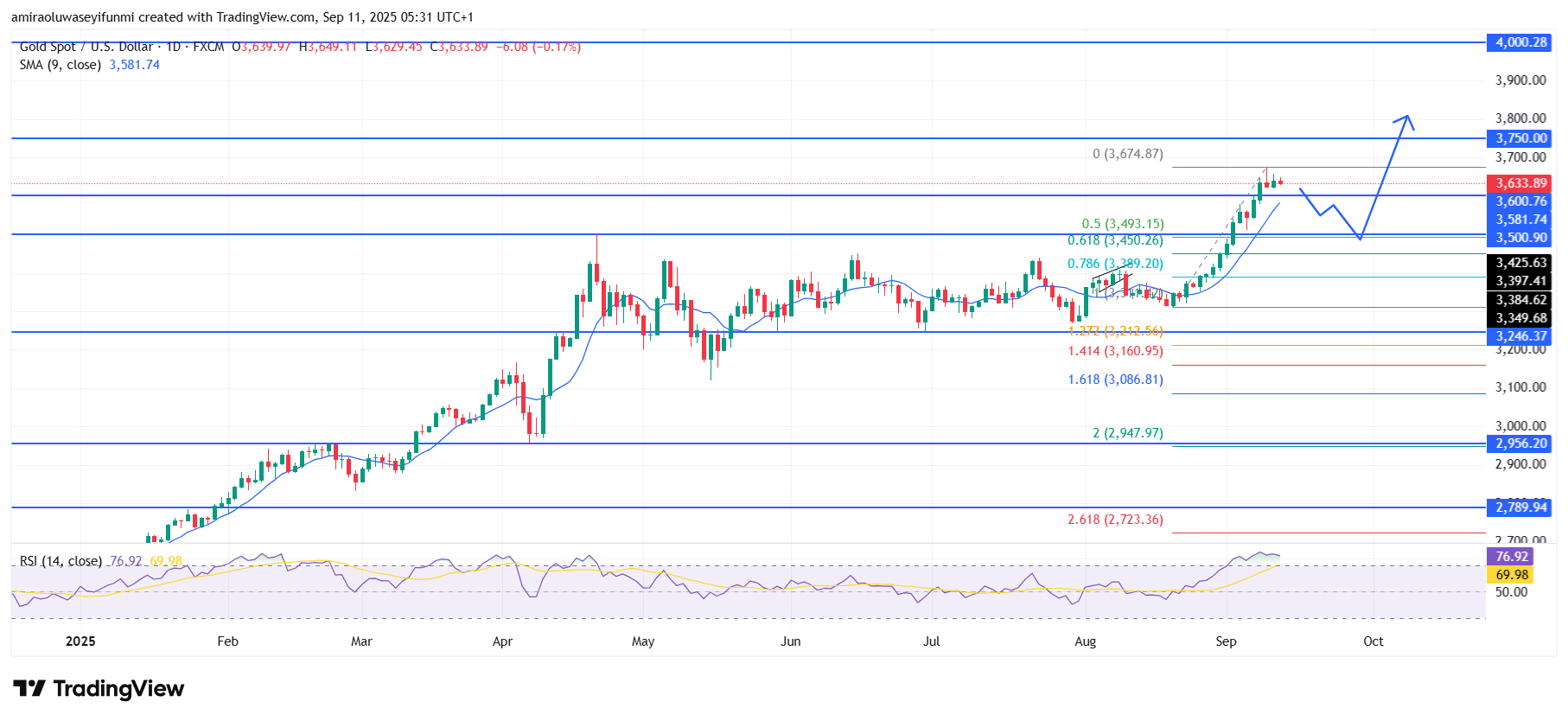

Gold (XAUUSD) bullish trajectory is being sustained by technical and momentum factors. Gold has maintained a strong upward movement, supported by momentum indicators and short-term moving averages. Price action has remained consistently above the 9-day Simple Moving Average around $3,580, reflecting persistent buying interest. The Relative Strength Index currently sits near 77, indicating overbought conditions but also confirming the prevailing bullish strength. Market sentiment remains optimistic as gold continues to post higher highs, reinforcing the broader bullish outlook.

Gold Key Levels

Resistance Levels: $3600, $3750, $4000

Support Levels: $3500, $3250, $2960

Gold Long-Term Trend: Bullish

From a technical perspective, gold has built strong support around $3,500 and $3,600, with the breakout above $3,490 confirming bullish continuation. Fibonacci retracement levels between $3,450 and $3,500 have provided a reliable base for further upside movement, while sellers have struggled to drive prices lower despite brief pullbacks. The rejection near $3,675 signals temporary resistance, but gold’s ability to hold above $3,600 shows that demand remains solid.

If gold sustains support above $3,600, the next upside target lies around $3,750, with potential extension toward the $3,800 psychological level. A continued bullish push could eventually challenge the $4,000 mark if momentum strengthens. On the other hand, any pullback is expected to find stability around $3,500 before buyers regain control. Overall, the outlook remains firmly bullish, with forex signals favoring a move toward fresh highs.

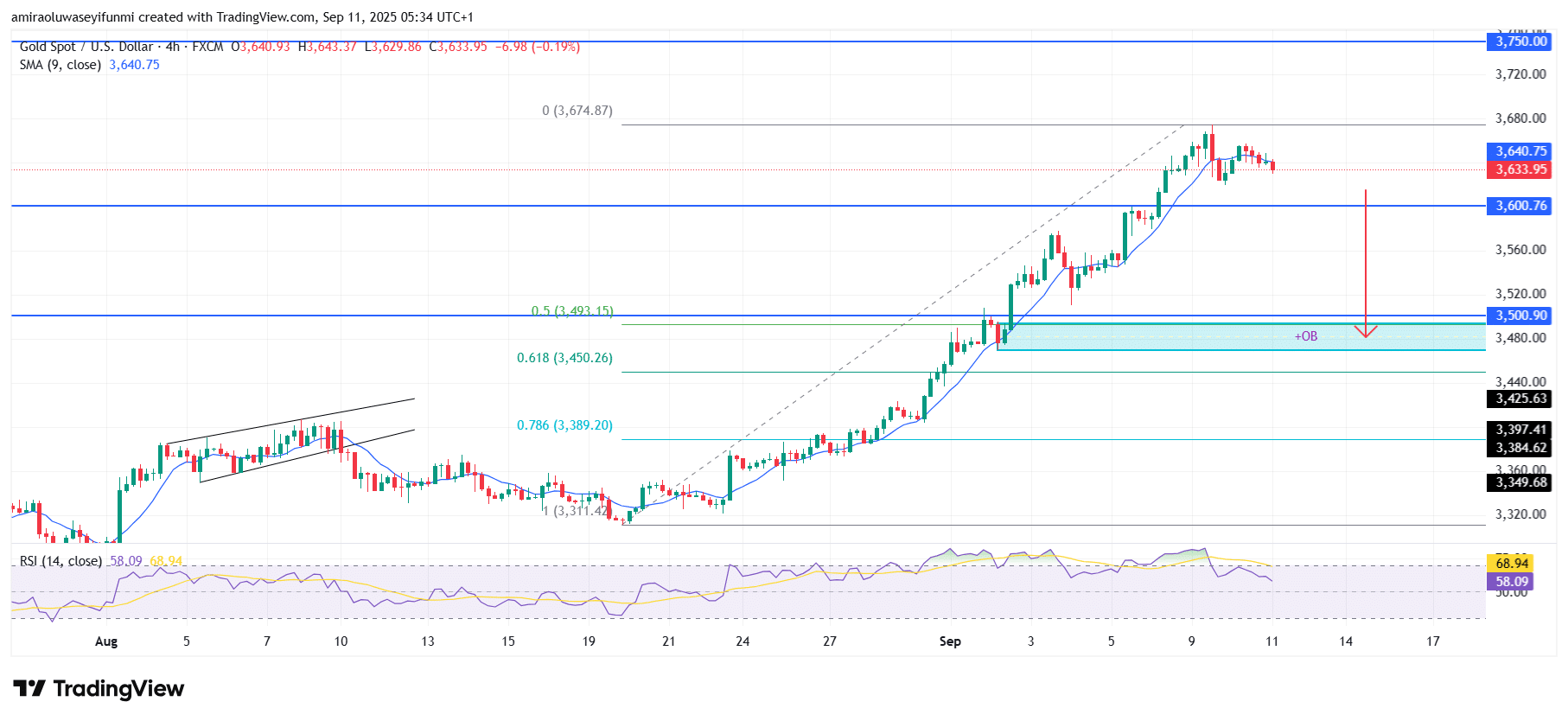

Gold Short-Term Trend: Bullish

Gold (XAUUSD) is showing initial signs of weakness as price struggles to hold above $3,640. The rejection from recent highs suggests that sellers may attempt to drive the market lower.

Immediate support is located near $3,600, with a deeper retracement potentially targeting the $3,500–$3,480 demand area. The RSI is gradually easing from overbought territory, which supports a short-term corrective bias before the broader uptrend resumes.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.