Market Analysis – September 4

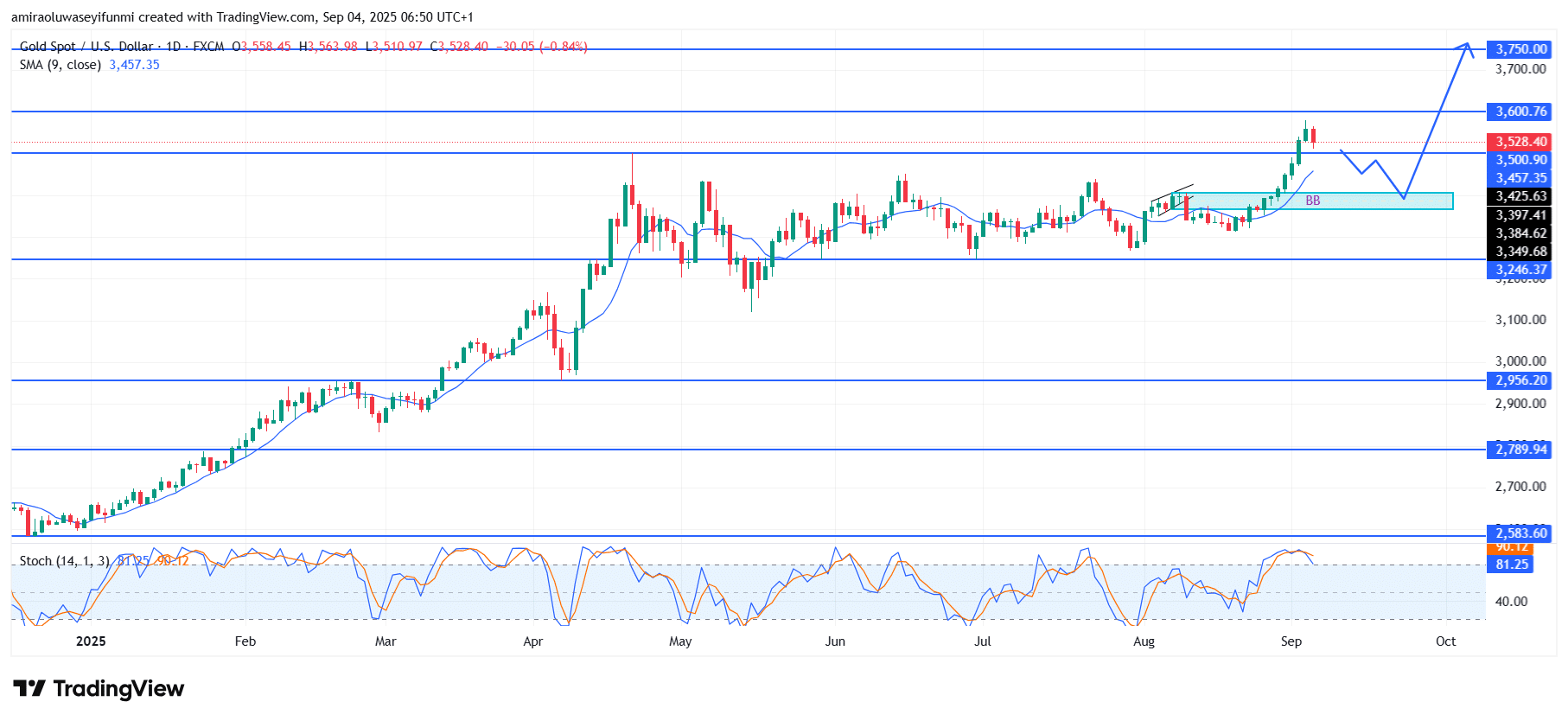

Gold (XAUUSD) bullish structure prepares for another upward continuation. The gold market continues to maintain a strong upward bias, with price action holding well above the short-term moving average at $3,460. The Stochastic Oscillator, although slightly elevated, still indicates that underlying bullish momentum has not been fully exhausted. The market’s ability to establish successive higher lows reflects investor confidence and aligns with the broader bullish structure that has been in place since early 2025.

Gold Key Levels

Resistance Levels: $3500, $3600, $3750

Support Levels: $3250, $2960, $2790

Gold Long-Term Trend: Bullish

Technically, price recently tested resistance around $3,600 before retreating slightly toward $3,530. This mild correction reflects natural market behavior following a strong bullish move, providing room for renewed buying interest. The critical support zone lies between $3,430 and $3,460, where past accumulation is expected to drive fresh demand. If this level holds, it will likely serve as a launchpad for further upside movement.

Looking forward, the outlook supports a continuation of bullish price action once the ongoing consolidation completes. Holding support within the $3,460–$3,500 range would strengthen the bullish continuation pattern, setting up an initial retest of $3,600. A decisive break above $3,600 could pave the way toward $3,750, signaling another strong upward leg in line with prevailing market momentum. Traders monitoring forex signals may also observe complementary trends between gold and related currency movements.

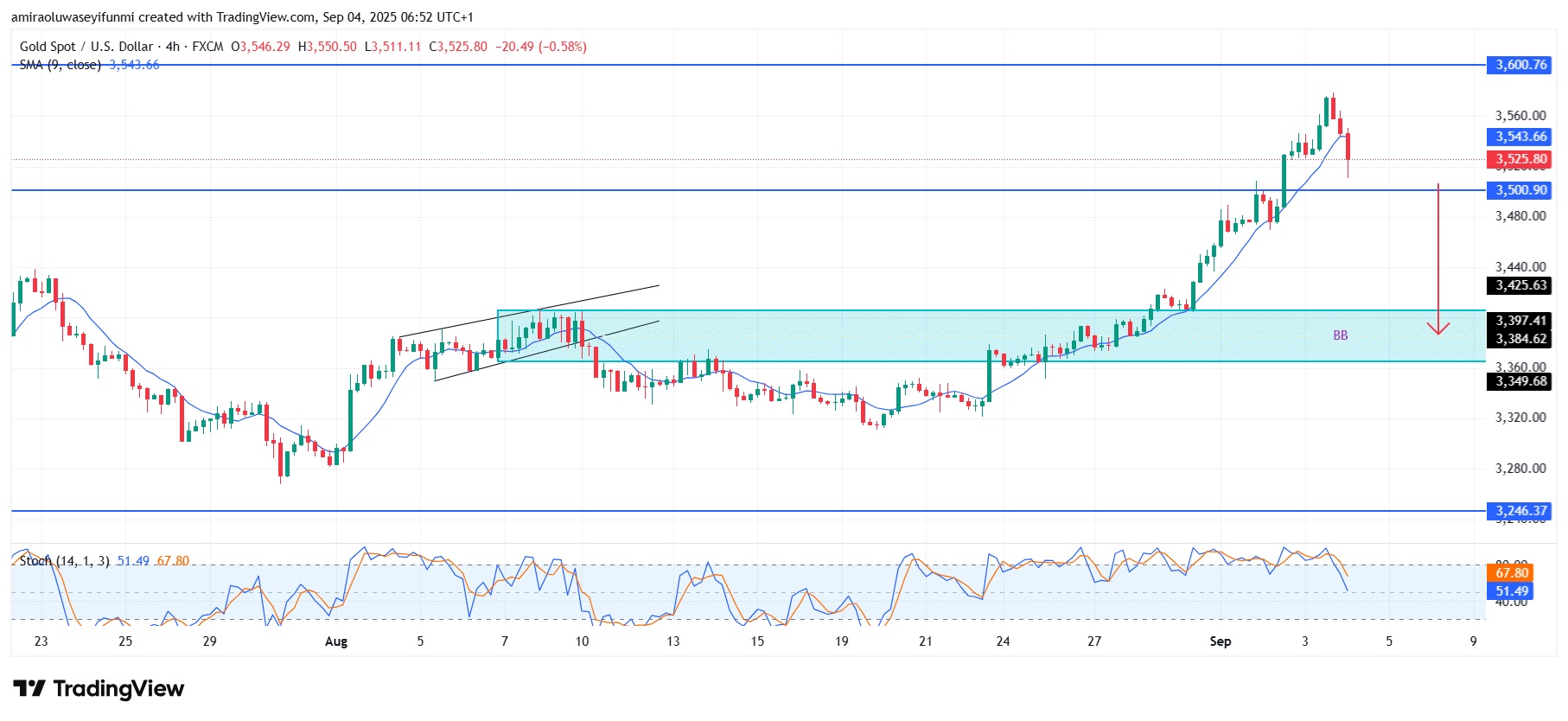

Gold Short-Term Trend: Bullish

On the four-hour chart, XAUUSD is experiencing short-term bearish pressure as price pulls back from the $3,600 resistance level. The rejection has driven the market below $3,540, with sellers eyeing the $3,500 support zone.

If the $3,500 level fails to hold, price could extend its decline toward the $3,430–$3,390 demand area for further testing. The stochastic indicator is trending downward, reinforcing short-term selling pressure.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.