The greenback fell across the board after a goodish pickup in the shared currency following the European Central Bank’s (ECB) expression of confidence in the economic outlook of the EU. Meanwhile, the ECB will be announcing its monetary policy decision later today. This report is expected to have some effects on the price action of the USD in the near-term and provide further directional clarity.

This together with a recent decline in the US equity futures lent further support to gold’s safe-haven appeal. The risk-off sentiment was further bolstered by a bearish tone around the US Treasury bond yields, which has been referred to as one of the key factors underpinning the non-yielding commodity.

Regardless of the numerous favorable conditions, gold remains under strong bearish pressure causing bulls to stay on the sidelines. That said, traders will be waiting to see a breakout in the short-term before taking any aggressive bet on gold, keeping in mind that some high-stake economic data are coming out of the US later today.

Gold (XAU) Value Forecast — September 10

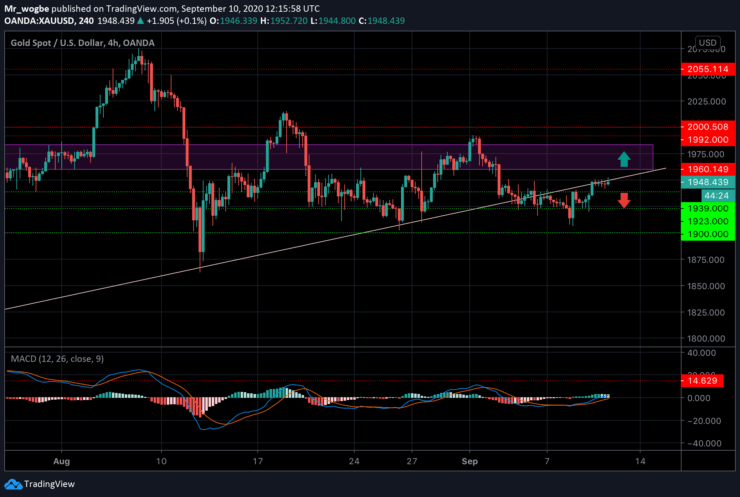

XAU/USD Major Bias: Sideways

Supply Levels: $1951, $1960, and $1983

Demand Levels: $1940, $1923, and $1906

XAU/USD has been in a narrow range between $1951 to $1943 for the past 24-hours. The yellow metal remains in a battle with the long-lasting ascending trendline. A. break above that line could propel the commodity to the $1960 pivot zone. However, failure to climb higher in the near-term could induce a sharp retrace.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.