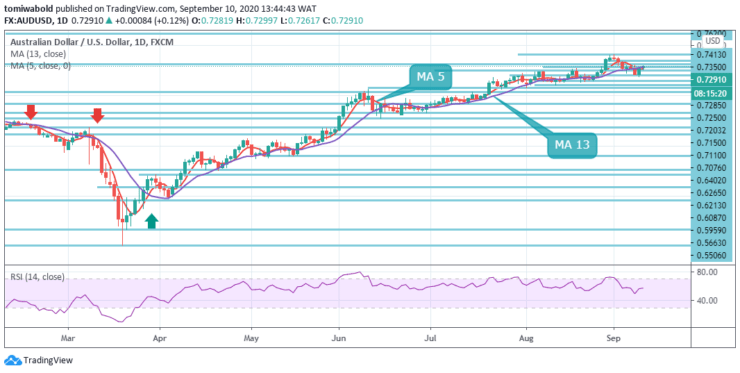

AUDUSD Price Analysis – September 10

The AUDUSD pair stays beneath the 0.7300 marks bound into the American session in a range during the European session and maintained the positive recovery from two-week lows. The recent Aussie data can be counted as fundamental precursors behind the quote’s pullback, as well as risk-reset.

Key Levels

Resistance Levels: 0.7413, 0.7350, 0.7285

Support Levels: 0.7250, 0.7150, 0.7076

Whereas the bears are expected to dissipate dominance near the 0.7250 marks, their further control will be aimed at the 0.7200 round level ahead of reinforcing the monthly low after reaching support of the channel close to the 0.7175 level.

In the meantime, an upside breakout of the 0.7285 level horizontal resistance may have to reach the 0.7311 main resistance level before enabling the bulls to establish controls. While doing so, before the top of the previous month, the 0.7350 level may gain investor interest, even the multi-month high, reaching 0.7413 level.

Intraday bias in AUDUSD appears to be neutral as consolidation from level 0.7413 is growing. With the 0.7150 support level intact, an increase from 0.5506 level is still in support of restarting from 0.7413 level sooner rather than later.

However, a decisive breach of 0.7150 level may validate short-term topping and transform the downside bias for steeper correction. The exchange rate will continue to edge higher concerning the near future. During the following trading session, the probable aim for the AUDUSD pair will be about the 0.7350 marks.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.