EURUSD Price Analysis – September 10

The Euro progresses higher in trading early Thursday, following positive gains around the 1.1830/40 levels hurting pessimistic sentiment in the near term. EURUSD has improved as investors expect the European Central Bank (ECB) to send out a message of confidence.

Key Levels

Resistance Levels: 1.2011, 1.1965, 1.1916

Support Levels: 1.1750, 1.1685, 1.1606

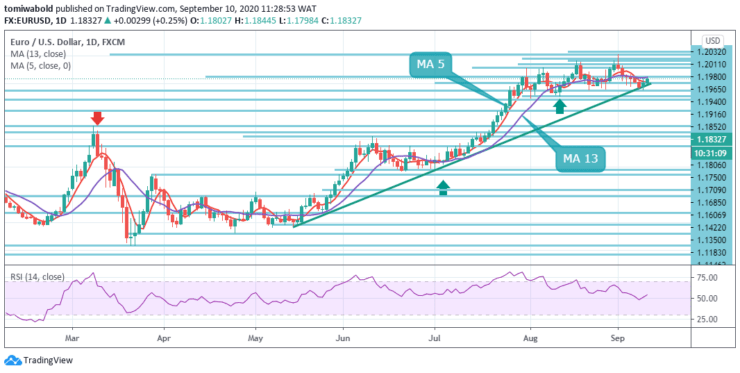

Technically, as observed in the daily chart, EURUSD Spot is holding steady at a level of 1.1835 and has undergone bearish divergence in prices giving higher highs while the RSI indicator gives lower highs, thus further potentially supporting bearishness.

Initial support is at 1.1750 level around which access to 1.1685-1.1422 levels may be open. If it stays under this mark then the next support is at level 1.1422. On the upside, an initial resistance is at level 1.1916, and then at levels 1.1980-1.2011.

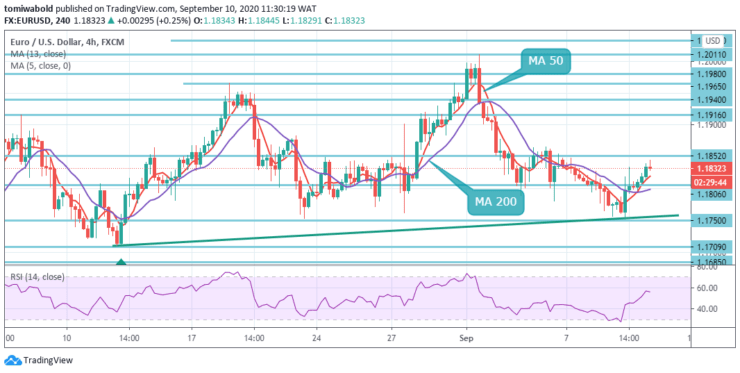

Intraday bias in EURUSD stays initially neutral. On the downside, a decisive breach of 1.1750 level may indicate short-term topping at 1.2011 level, in 4 hour RSI range condition. The intraday bias is shifted downside for the ascending trendline support (from level 1.1685).

There may be a prolonged break indicating that the fall may correct the entire increase from 1.0635 to 1.1495 levels and aim 1.0635 to 1.2011 levels. That being said, the rebound from the present level, accompanied by a resistance level of 1.2011, may also restart the increase from 1.0635 level.

Note: Learn2.Trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.