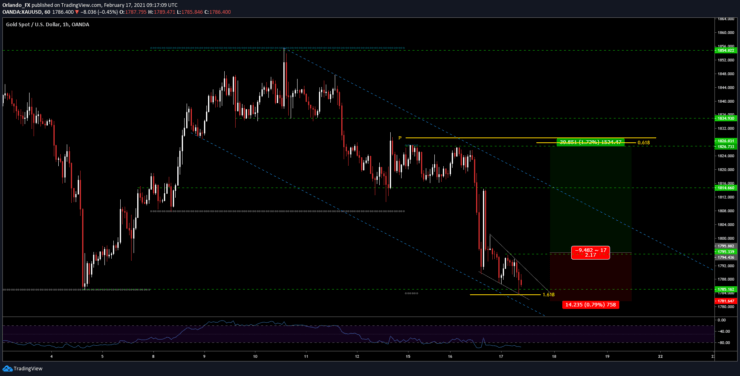

Key resistance: 1795-1814

Gold long-term bullish

Since the pandemic hit Gold has rallied 42.88% from low to high of the move and has retraced -15.40% from the highs to a massive key level.

Buys are still in play as Central Banks keep their asset purchasing programs at all time highs and investors seek shelter from a falling US Dollar to control the drawdown of their cash in hand. Gold is the answer.

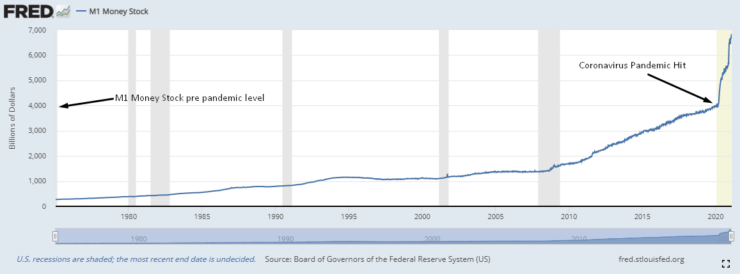

As a safe heaven this insane growth of the Fed´s balance sheet has inflated the price of precious metals. This is the opportunity with more than 40% of all US Dollars in circulation been printed in the last year. (see M1 money stock chart below)

1H Chart reading

Gold was capped to the upside by the weekly pivot around the 1825 level. This brought sellers in earlier this week for a -2.30% move. Price is now retesting the previous lows and the make-it-or-break-it bullish level inside of a reversal pattern right at the 161.8% of the first leg down. In order for longs to be in play today´s highs need to break which would also break the falling pennant. Should price break 1780 this idea is no longer valid

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.