GBPUSD Price Analysis – July 26

In the prior session, the GBPUSD pair spiked to level 1.2803, a recent six-week peak, following the weakness of the relentless dollar and optimistic UK numbers. Until it happens, Brexit-headlines controls the Sterling. There’s increased odds of a no-deal Brexit after the fifth round of talks collapsed last week.

Key Levels

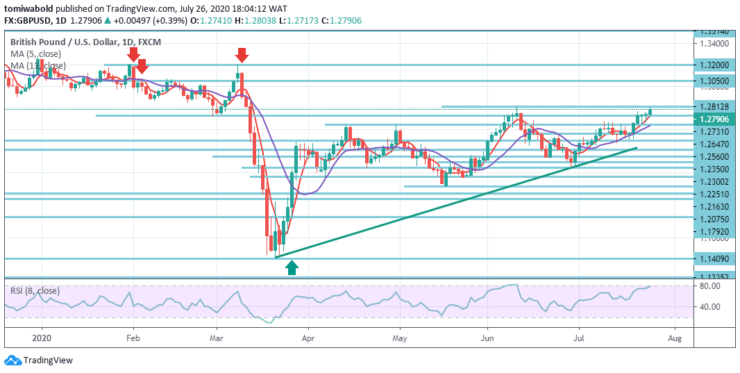

Resistance Levels: 1.3514, 1.3050, 1.2812

Support Levels: 1.2647, 1.2500, 1.2251

From 1.2251 level, GBPUSD recovery resumed last week and reached as high as 1.2803 level. Last week’s initial bias lingers on the upside. The decisive breach of level 1.2812 may restart the entire rally from level 1.1409.

A 100 percent forecast of 1.1409 to 1.2647 levels from 1.2075 to 1.3205 levels may be the next aim. On the negative, the intraday bias may then become neutral, beneath 1.2647 slight support level. Yet as long as 1.2500 support level holds, more growth may stay in order.

For now, chart patterns beneath positive ranges are neutral-to-bullish. A bullish moving average of 5 and 13 proceeds to provide intraday support in the 4-hour chart, presently at 1.2731 level, although technical indicators have lost bullish intensity there, stay within positive ranges, suggesting limited intention of selling.

The monthly high of June at 1.2812 level is the initial support, with potential for more increases on a breach beyond it. The GBPUSD pair also is bullish from a technical perspective while revealing that it stays beyond the moving average of 13 which split upwards, while the moving average of 13 progresses beneath.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.