Florida has surpassed New York in confirmed coronavirus cases, according to weekend news. The country reported 67,000 new infections on Saturday and the death toll topped 149K. Meanwhile, in Europe, the second wave hits Spain and Germany.

Preliminary estimates of business activity for July were mostly bullish outside the US, with Australia, the UK, and Europe returning to gains. The numbers, however, lagged behind support for stocks, which closed in the red globally.

The common currency rose amid hopes related to the EU recovery fund last week. The pound, on the other hand, has moved modestly forward amid the perennial Brexit unrest. It seems unlikely that the EU and the UK will strike a trade deal before the end of the year, according to the EU’s chief negotiator Michel Barnier.

The Japanese yen and Swiss franc strengthened sharply against the US dollar. On the other hand, commodity currencies were trapped between the weakness of the dollar and poor performance in stocks.

Gold skyrocketed to $ 1,900 per troy ounce, the highest level since September 2011. The bright metal is trading about $ 20 below its all-time high.

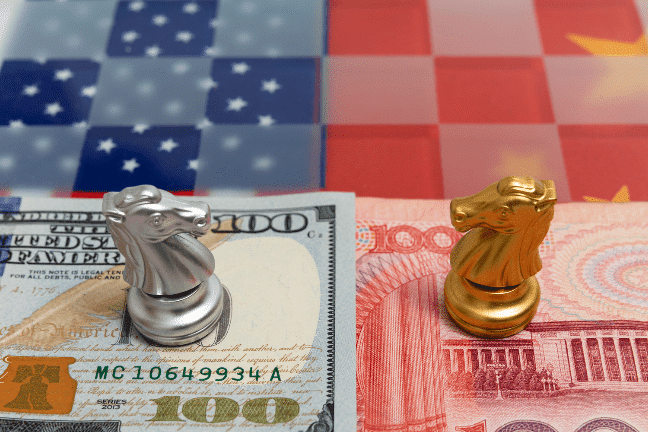

Tensions between China and the United States have yet to affect trade relations between the two economies. Panic selling could take over the financial world if the war of words turns into the trade.

Tensions between the US and China and coronavirus events in the world’s largest economy were the main reason for the dollar’s weakness.

The EU and the US are to publish their preliminary Q2 GDP estimates. Growth in the eyes of the storm in the context of a pandemic. The depth and duration of the economic downturn are still unclear.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.