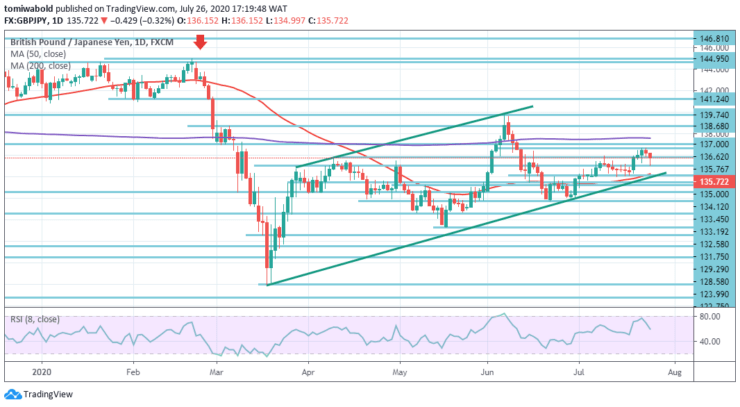

GBPJPY Price Analysis – July 26

Since the last session activity ended in red, the latest fresh acceleration lower generates an initial reversal signal. GBPJPY pullback beneath 136.00 level after extensive rallies on demand for safe-haven raise the sentiment for selling to close at 135.72 level. China’s revenge boosted Yen and ordered that the US shut down one consulate in China which increased tensions and spurred investors to safety.

Key Levels

Resistance Levels: 144.95, 139.74, 136.62

Support Levels: 134.12, 131.75, 129.29

On the daily chart, after the recent GBPJPY reversal from level 136.62, a compelling breach through the 1.3500 level may lend legitimacy to the gloomy view and intensify the drop back to the significant level of horizontal support near the 1.3412 area. Since reversing from overbought territory, its declining bullish momentum, and daily RSI head southwards.

As long as resistance level 144.95 holds, there remains a potential downside breakout in favor. A strong breach of 144.95 level, however, may increase the risk of bullish long-term reversal. Validation of the target would then be shifted to a resistance level of 156.59.

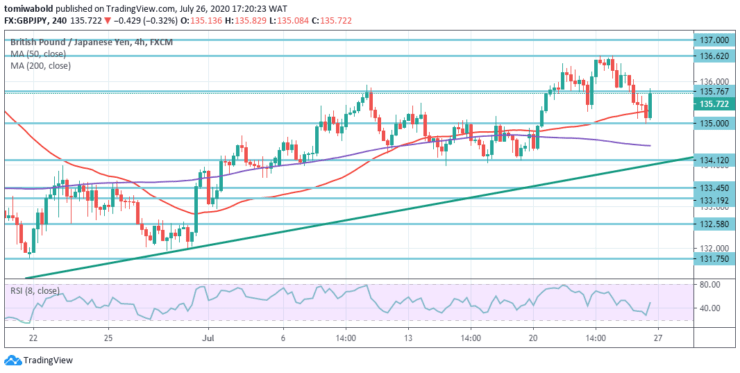

GBPJPY rose higher to level 136.62 but has since retreated. This week’s initial viewpoint is first optimistic. But as long as 134.12 support level stays, further rally may continue in support. On the positive, a breach of level 136.62 may restart the recovery from high levels 131.75 to 139.74.

Succeeding critical support at 134.12 level is in view and a breach would signal reversal and enable a broader decline at 134.00 zones on for next main support. Nonetheless, a solid breach of level 134.12 may indicate the conclusion of the recovery from level 131.75. With this support, the intraday bias becomes switched back to the downside.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.