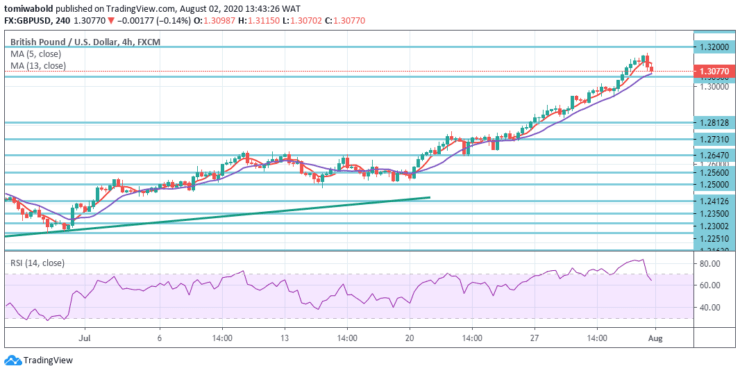

GBPUSD Price Analysis – August 2

GBPUSD ended the prior session at around 1.3170 level, which was the highest in four months. The weakness of the greenback is driving pounds higher while in England the currency is shrugging off restrictions on 4.3 million people. The GBP has been heavily overbought against the USD implying vigilance to avoid pursuing the pound higher shortly.

Key Levels

Resistance Levels: 1.3514, 1.3303, 1.3200

Support Levels: 1.3050, 1.2812 1.2647

Last week’s GBPUSD rally increased further to a level of 1.3170. As a new high is in effect, this week’s initial bias is first neutral. On the upside, the 1.3170 level breach may restart the increase from 1.1409 to 1.2647 levels at 1.3303 levels from 1.2075.

On the contrary, the bias to the downside for broader downshift may switch beneath the 1.3050 minor support level. But the downside may bring another rally which should be contained by 1.2812 resistance turned support level. That being said, a decisive split of 1.3514 level might at least indicate bottoming in the medium term and switch out a bullish viewpoint for 1.4376 resistance initially.

During the prior session, GBPUSD significantly advanced to a 4-month high of 1.3170 level, recording six green candles in a row in the 4-hour chart while dropping back around near-term support at 1.3050 level thus exiting at 1.3077 level.

The short-term moving averages 5 and 13 are beyond its 1.3050 level short-term support but the RSI is correcting from the overbought territory, suggesting a potential downside retracement. If it does not hold onto its support, the drop to 1.2812 level may extend beyond 38.2 percent of the rise.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.