GBPJPY Price Analysis – August 2

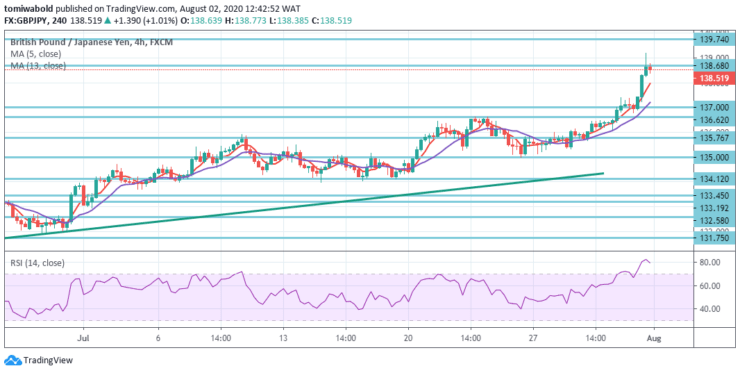

After 5 days of non-stop upside momentum, the GBPJPY cross returns past 138.00 marks in the prior session, with bulls now eyeing a step to taking back the June 5 mid-139.00 mark. The JPY may find buyers if COVID-19’s second wave continues to climb in speed. The spike was backed by the firm tone of the demand around the British pound and the dwindling demand for the Japanese yen safe-haven.

Key Levels

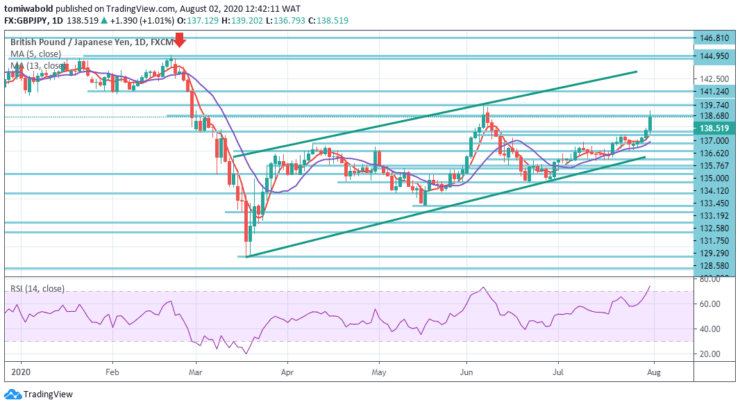

Resistance Levels: 144.95, 141.24, 139.74

Support Levels: 136.62, 131.75, 129.29

The GBPJPY cross has been trending higher, from a technical viewpoint, in a one-month ascending path. Since the GBP seems to have very little signs of bullish burnout, the trend may boost the cross toward the channel resistance, presently close to the region at 139.74 level.

In the wider view, an increase from level 123.99 is seen as an increase from level 122.75 (low) of the horizontal consolidation trend. As long as resistance level 144.95 holds, there remains an eventual downside breakout in favor. A strong breach of 144.95 level, therefore, may increase the risk of bullish long-term reversal.

GBPJPY grew to a level of 139.20 last week as an increase from a level of 131.75 continued. This week’s initial bias persists on the upside for the first resistance level of 139.74. A break may restore the entire increase from level 123.99 and reach a 100 percent forecast of 123.99 to level 135.76 from level 129.29 to level 141.24.

On the contrary, to suggest short term topping, breakage of 136.62 resistance turned support level is required. Then in the event of retreat, the forecast may stay moderately bullish. The emphasis would then be shifted to verifying upside resistance levels.

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.