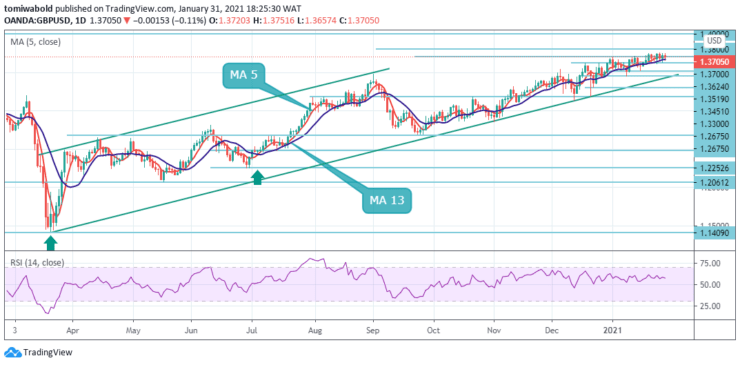

GBPUSD Price Analysis – January 31

The GBPUSD pair exited the prior week with modest gains after it eased from the mid 1.3700 level to close at 1.3705. The coronavirus spread reduction eased the pressure and offered some reprieve to the UK currency which was quite resilient to the dollar’s demand on risk-aversion.

Key Levels

Resistance Levels: 1.4345, 1.4000, 1.3800

Support Levels: 1.3624, 1.3515, 1.3300

GBPUSD eased from its bullish traction around 1.3758 level but is still far from bearish. On the daily chart, the pair continues to advance above the bullish moving average of 13, which provides weak support at 1.3650, while technical indicators such as the RSI are ranging within positive levels.

In a broader context, the target remains at the key round figure of 1.3800. A sustained breakout at this point should also be accompanied by continued trading beyond the upper horizontal line, which is currently at 1.4000. This should confirm the mid-term bottom at 1.1409. Nonetheless, a deviation at 1.3519 would maintain medium-term bearish sentiment for another decline.

In the 4-hour chart, the pair settled within its moving average of 5 and 13 where both are directionless. Technical indicators hover around their midlines, lacking directional strength. Meanwhile, major indicators have lost their directional strength but hold within positive levels.

However, GBPUSD’s rise from 1.3177 continued to 1.3758 in the previous week but retreated. The initial bias is neutral this week. On the other hand, after the 1.3519 resistance turned support level, the pair could target the 1.3300 near term low. A decisive breach of the 1.3800 upper marks would restart the general rally from 1.1409.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.