GBPUSD Price Analysis – January 3

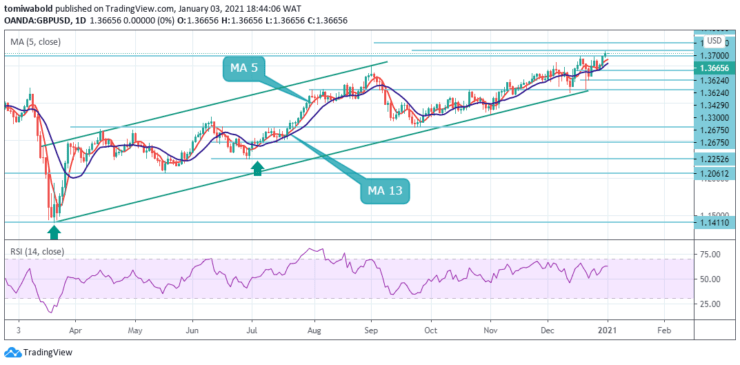

GBPUSD has sustained its positive tone into the new year while holding on to gains towards the 1.3665 level, a fresh multi-year high set. The Pounds stays supported by relief after the post-Brexit deal just one week before the end of the transition period.

Key Levels

Resistance Levels: 1.3900, 1.3800, 1.3700

Support Levels: 1.3429, 1.3300, 1.3177

GBPUSD is currently trying to breach resistance at the 1.3700 level. The rising moving average of 5 continues to support intact bullish price action. However, a convincing breach of the mentioned resistance can still accelerate the price to the high zone of 1.3800.

In the long term, the focus remains on the growth side. A sustained breach beyond may validate a long-term bottom at 1.1411. An increase from there can be either a correction or the start of a long-term uptrend. In any event, the next aim is a 38.2% rebound from 2.1161 to 1.1409 at 1.5134.

The GBPUSD pair rose from the 1.3177 level and broke the 1.3624 level. But since a temporary high has formed after the initial barrier at 1.3665, the initial bias is bullish initially this week. On the other hand, a break below 1.3624 may aim for a reversal trend from 1.3665 to 1.3429 from 1.2675 to 1.3177 levels.

In such a scenario, short-term sentiment may stay ranging as long as support level 1.3177 remains intact, in a steeper pullback scenario. Meanwhile, some subsequent sell-offs could leave the GBPUSD vulnerable to further slide beneath 1.3500 towards the 1.3429 congestion zone.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.