GBPUSD Price Analysis – November 10

The pound sterling is currently registering a continuing weakness against the USD as observed in the previous session that ends the last week of trading down on Friday at the level at 1.2775 after losing 39 pips. The sellers took control of the FX pair, as it confirmed their breakthrough in the previous low session after trading up to 25 pips below the intraday.

Key levels

Resistance levels: 1.3301, 1.3185, 1.3012

Support levels: 1.2582, 1.2195, 1.1958

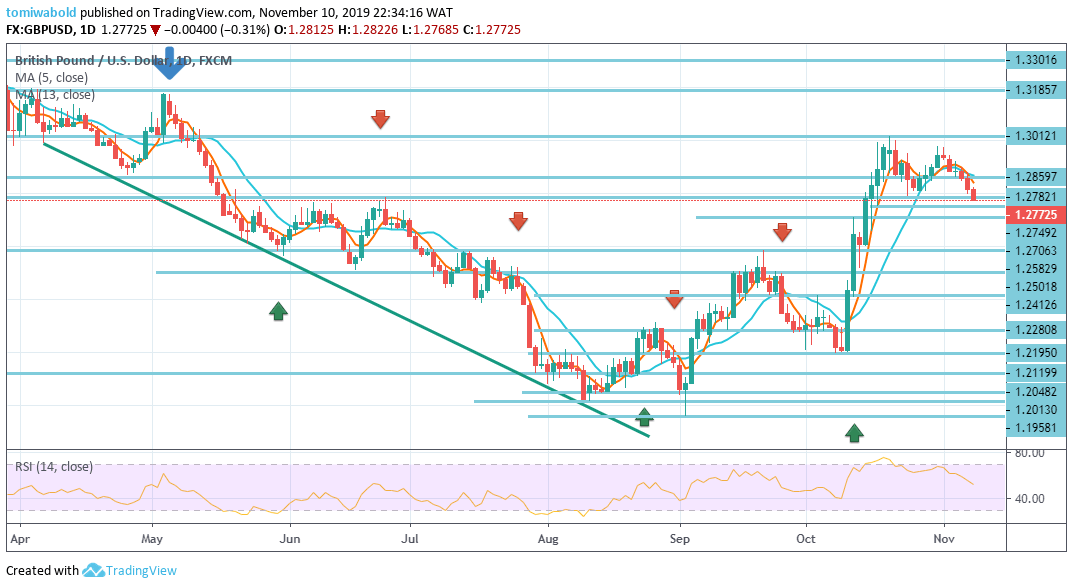

GBPUSD Long-term trend: Bullish

In the long-term picture, a medium-term base was structured at the 1.1958 level, before the base at the lowest low. Meanwhile, for this scenario, the advance from the level at 1.1958 is seen as a strong consolidation from the lowest low.

However, an additional advance towards the resistance level of 1.3185 can be recorded. However, this may remain the probable scenario while the level at 1.2582 resistance stays as intact support. Therefore, the firm break of the level at 1.2582 can again shift attention to the level at 1.1958 low.

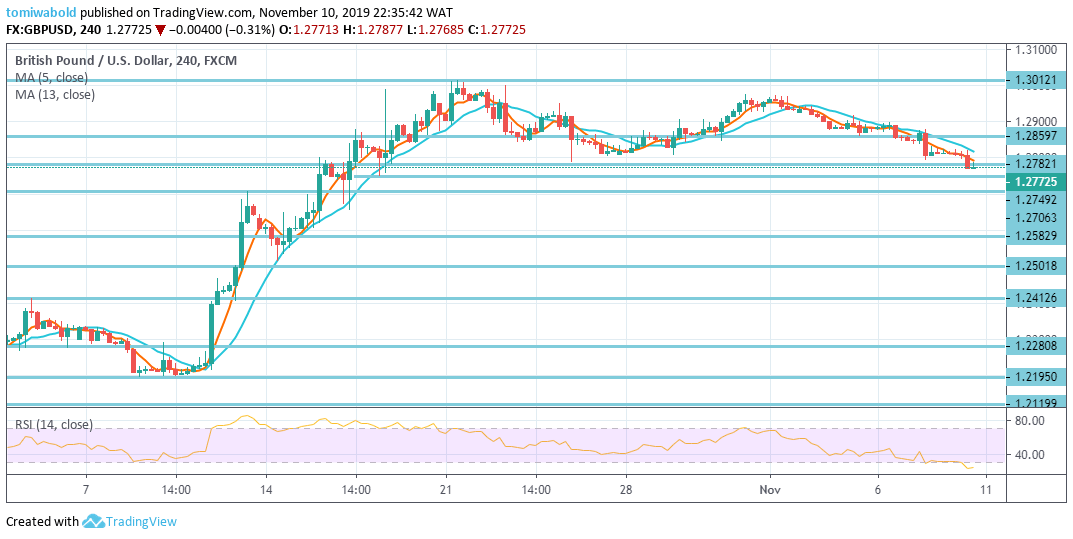

GBPUSD Short-term trend: Bearish

GBPUSD had collapsed slightly last week in the 4-hour timeframe, as consolidation from the 1.3012 level extended down. The initial bias remains neutral first and the possibility of a sustained plunge is likely.

Although the downward move may be restricted above the level at 1.2582 resistance turned support to resume its advance. At the top, a break of the level at 1.3012 may resume the advance of the level at 1.1958 to 1.2582 at 1.2195 beyond the level at 1.3012.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.