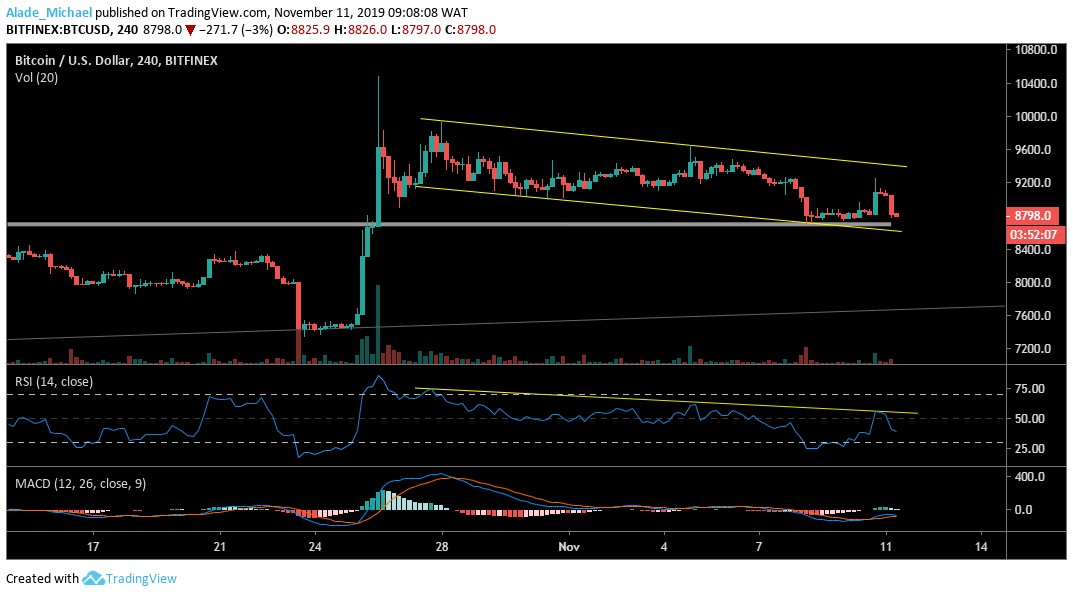

Bitcoin (BTC) Price Analysis: 4H Chart – Bearish

Key resistance levels: $9000, $9128, $9250

Key support levels: $8600, $8400, $8200

After spiking seeing a sharp rise from $8800, Bitcoin was unable to continue buying pressure to the channel’s resistance at $9400, although the price managed to touch $9250 before it was rejected. The price has dropped back beneath $9000 and BTC is now targeting a channel’s lower boundary at $8500 before we can see an upward correction. For now, key resistance holds at $9000 and potentially $9128 and $9250 resistance.

If the channel’s lower boundary fails to act as a support for Bitcoin on the 4-hour chart, a price break is likely to play out. Below the channel, immediate support lies at $8200 and $8000. However, BTC saw a sharp fall after testing the yellow diagonal resistance on the RSI 55. The MACD has continued to show that the bears are dominant at the moment.

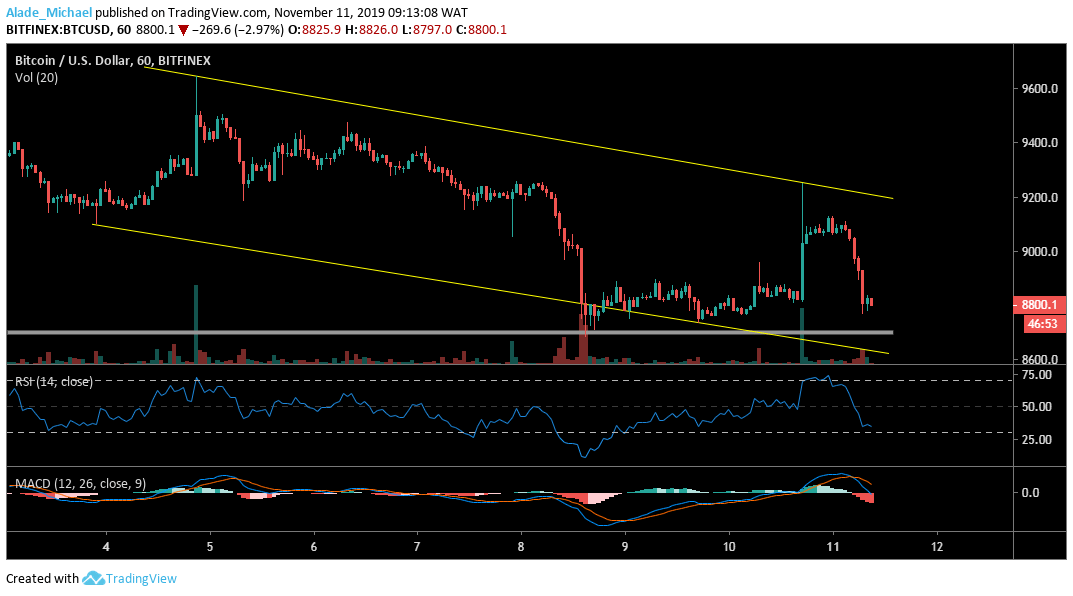

Bitcoin (BTC) Price Analysis: Hourly Chart – Bearish

Prior to the last 24-hours price action, Bitcoin is now shaping inside a descending channel which is slowly forming since November 4. BTC sharply reversed after locating resistance on the channel’s upper boundary. Currently, the price is waiting at $8800 but we can expect the next selling pressure to reach the $8700 and $8600 support to meet the channel’s lower boundary.

However, Bitcoin seemed to have found support on the lower band of the RSI following the rejection at the upper band. If the RSI 30 can bolster, we can expect a rebound to $900 and $9128 resistance. Looking at the bearish setup, the market is more likely to reach the $8600 support before rebounding. As we can see, the MACD is still suggesting that the bears are present.

BITCOIN SELL SIGNAL

Sell Entry: $8800

TP: $8612

SL: 9022

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.