Market Analysis – May 12

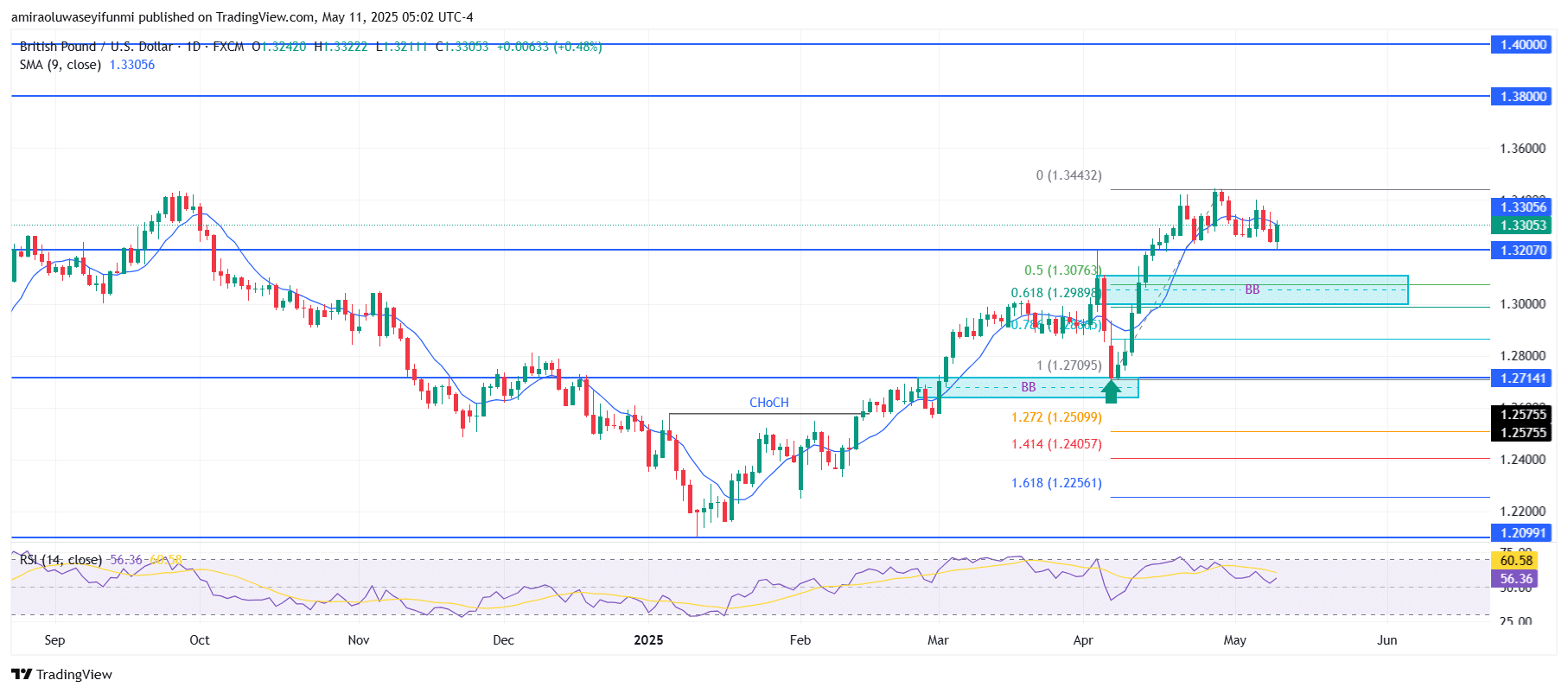

GBPUSD maintains its bullish bias while experiencing moderate consolidation above key levels. From a technical perspective, the pair remains positioned above its 9-day Simple Moving Average (SMA), currently at $1.33060, reinforcing the ongoing bullish trend. The Relative Strength Index (RSI) is hovering around 56.36, indicating a neutral-to-bullish momentum with no immediate signs of exhaustion. This suggests that while buying pressure has eased from recent highs, overall sentiment remains positive and supportive of continued upward movement.

GBPUSD Key Levels

Supply Levels: $1.34400, $1.38000, $1.40000

Demand Levels: $1.32100, $1.27100, $1.21000

GBPUSD Long-Term Trend: Bullish

Price action reveals a well-structured bullish formation, characterized by a clear change of character (CHoCH) and a strong rally that surpassed weak resistance at $1.32070. The recent high at $1.34430 now serves as a short-term ceiling, while the price undergoes a corrective pullback within a bullish order block zone near $1.29900–$1.30760. This zone aligns with the 61.8% Fibonacci retracement level of the previous upward swing, adding significance as a potential support area for renewed buying activity.

Looking ahead, a sustained hold above the breaker block could trigger a rebound toward $1.33060 and potentially lead to a retest of the $1.34430 high. Should bullish momentum intensify, a breakout beyond this level may open the path toward higher resistance levels at $1.38000 and $1.40000. On the other hand, failure to maintain above the order block could lead to a deeper retracement toward $1.27140. However, this would not invalidate the broader bullish trend unless that level is decisively breached. Traders monitoring forex signals may find opportunities in such price developments.

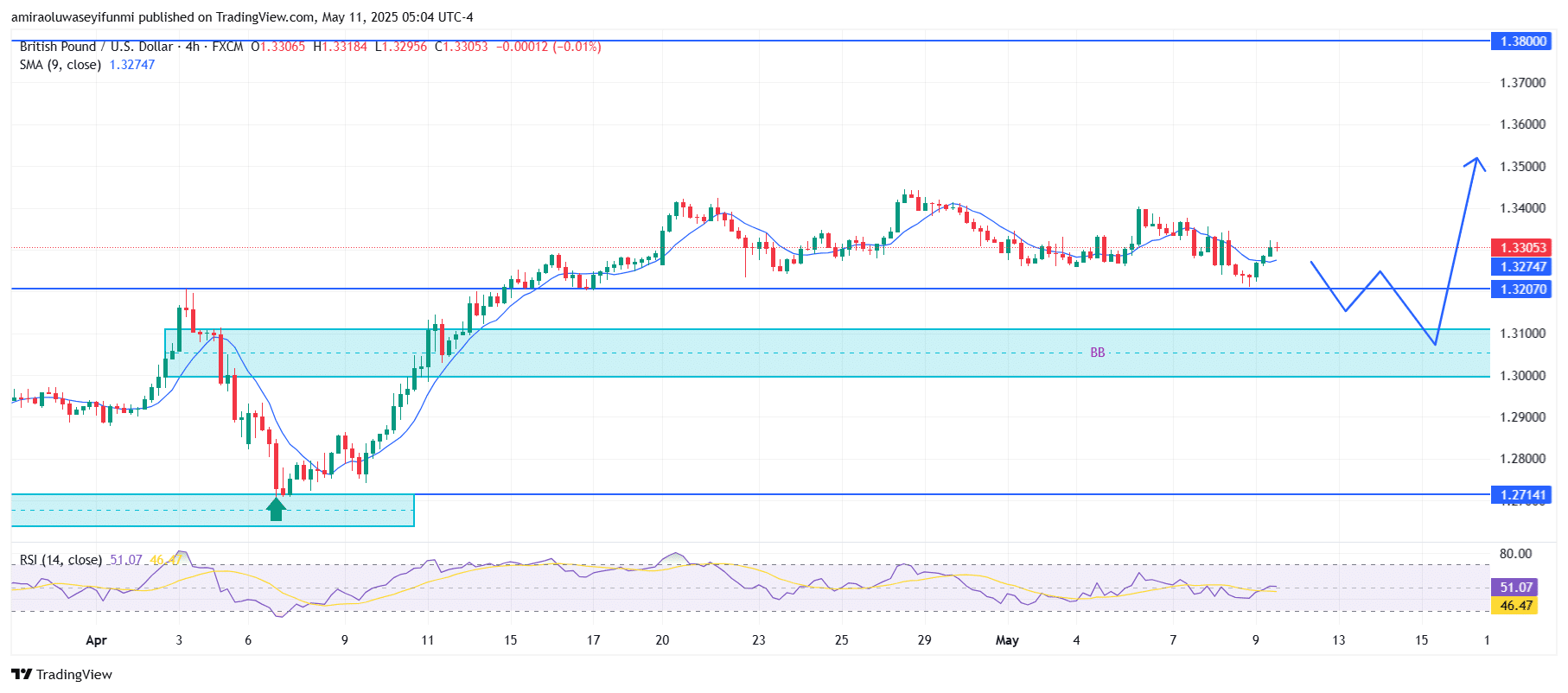

GBPUSD Short-Term Trend: Bullish

GBPUSD is currently consolidating above the key support zone at $1.32100, signaling buyer interest at lower price levels. The 9-period SMA is beginning to curl upward, suggesting the emergence of short- to medium-term bullish momentum.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.