NAS100 Analysis – May 11

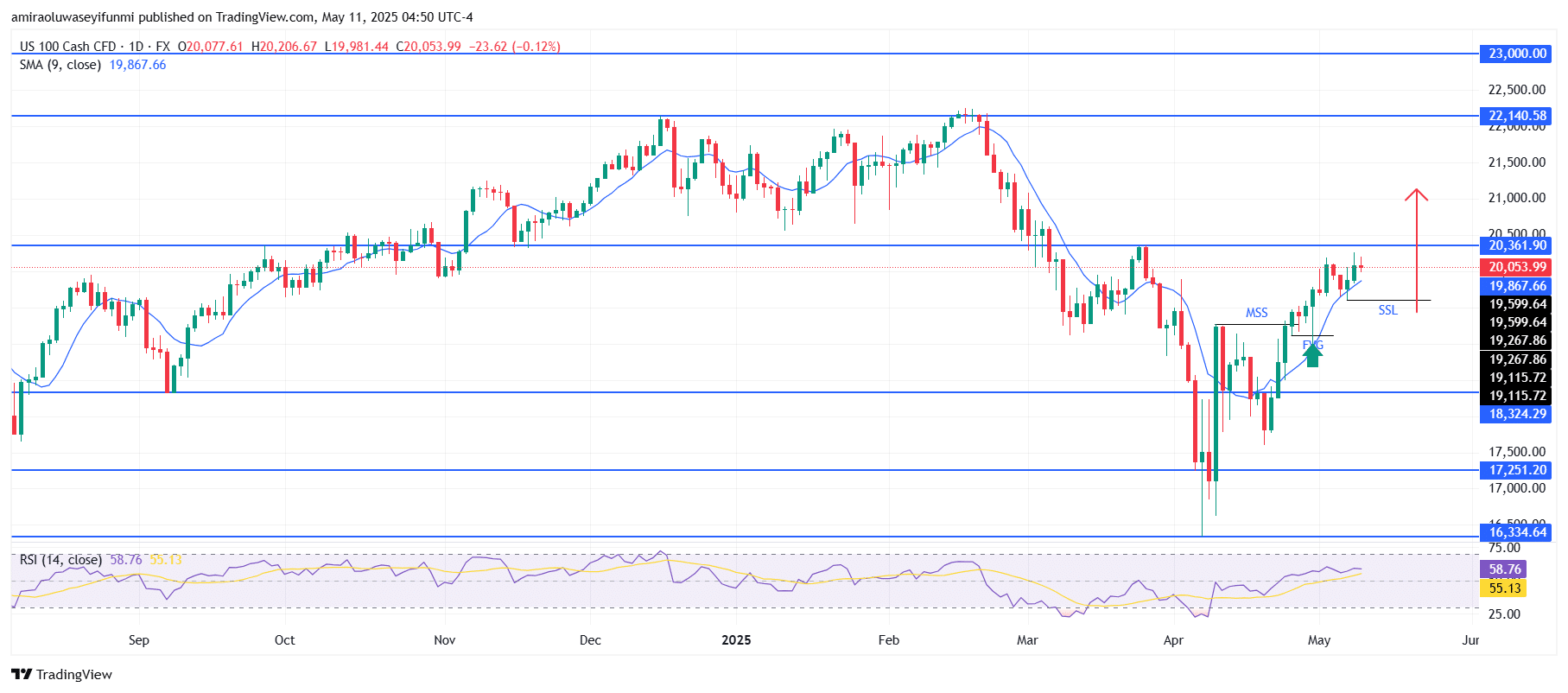

NAS100 has maintained its bullish momentum since April 2025. Since early April, it has continued to ascend with measured confidence, driven by favorable momentum indicators. The 9-day SMA, positioned around $19,870, continues to rise and provides a dynamic support level during price retracements. This moving average acts as a responsive floor, encouraging buying interest on dips. Meanwhile, the Relative Strength Index currently hovers near 58.76 — staying above the midpoint without entering overbought territory. This suggests a healthy directional bias while preserving room for additional upward movement.

NAS100 Key Levels

Resistance Levels: $20,360, $22,140, $23,000

Support Levels: $18,320, $17,250, $16,330

NAS100 Long-Term Trend: Bullish

The long-term outlook continues to reflect a solid bullish trend, established following a significant market structure shift and a deliberate sweep of sell-side liquidity. Price surged from the $18,320 bullish order block, surpassing former supply at $19,600. Currently, price is consolidating just beneath $20,360 — a historically significant level — forming higher highs and shallow pullbacks, which are typical patterns in a sustained uptrend. Although this area could represent short-term distribution, it does not yet signal exhaustion.

A decisive breakout above $20,360 may trigger a surge toward $22,140 and potentially extend to $23,000, as the market seeks new liquidity zones. On the other hand, if price pulls back from this resistance, the $19,600 region — which contains residual imbalances — could act as a strategic level for renewed buying interest. As long as the $18,320 base remains intact, the broader bullish outlook is likely to persist. The current pattern suggests accumulation rather than reversal, preserving the technical potential for continued gains supported by forex signals.

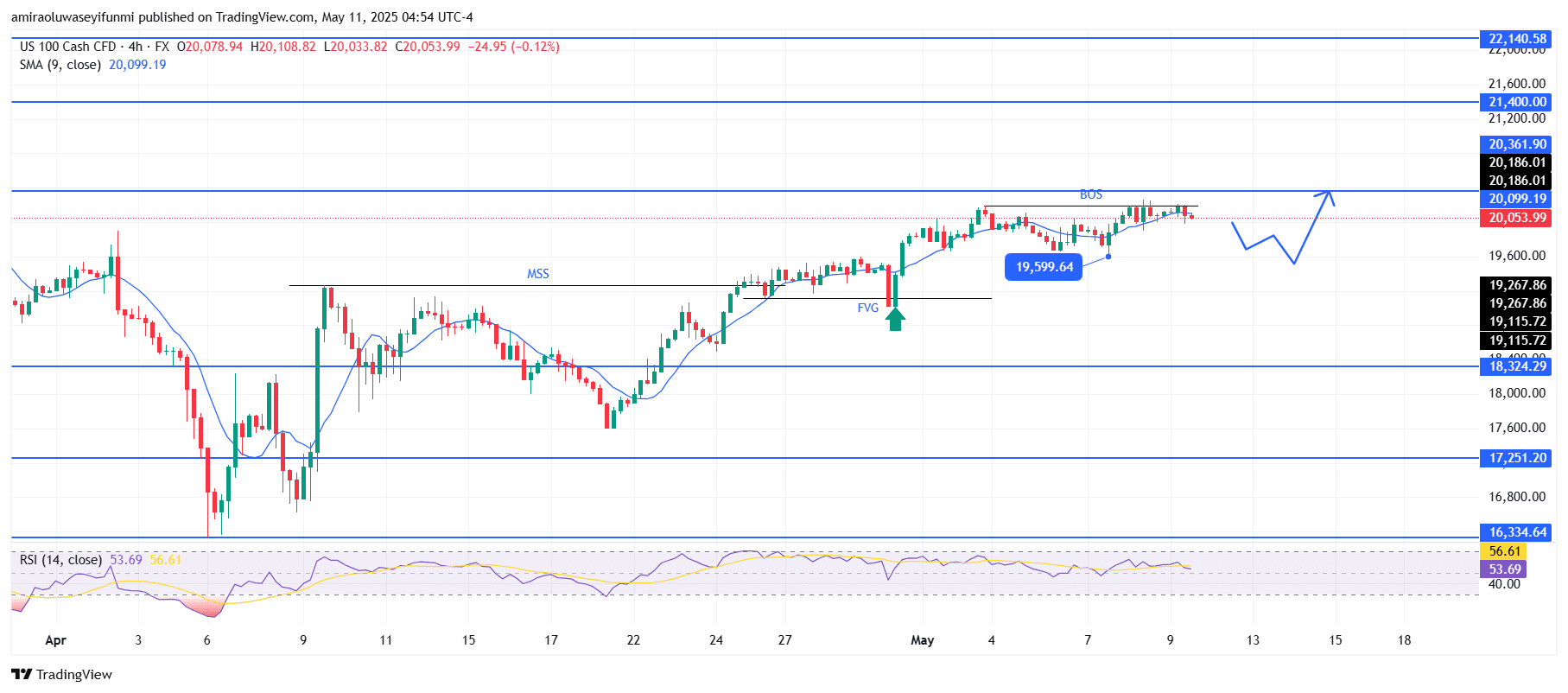

NAS100 Short-Term Trend: Bullish

NAS100 continues to exhibit a bullish structure following a clear break of structure (BOS) above $20,000, reinforced by the 9-period SMA currently resting at $20,100. Price action is consolidating just below the $20,360 resistance zone, indicating possible accumulation ahead of a breakout.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.