Market Analysis – September 29

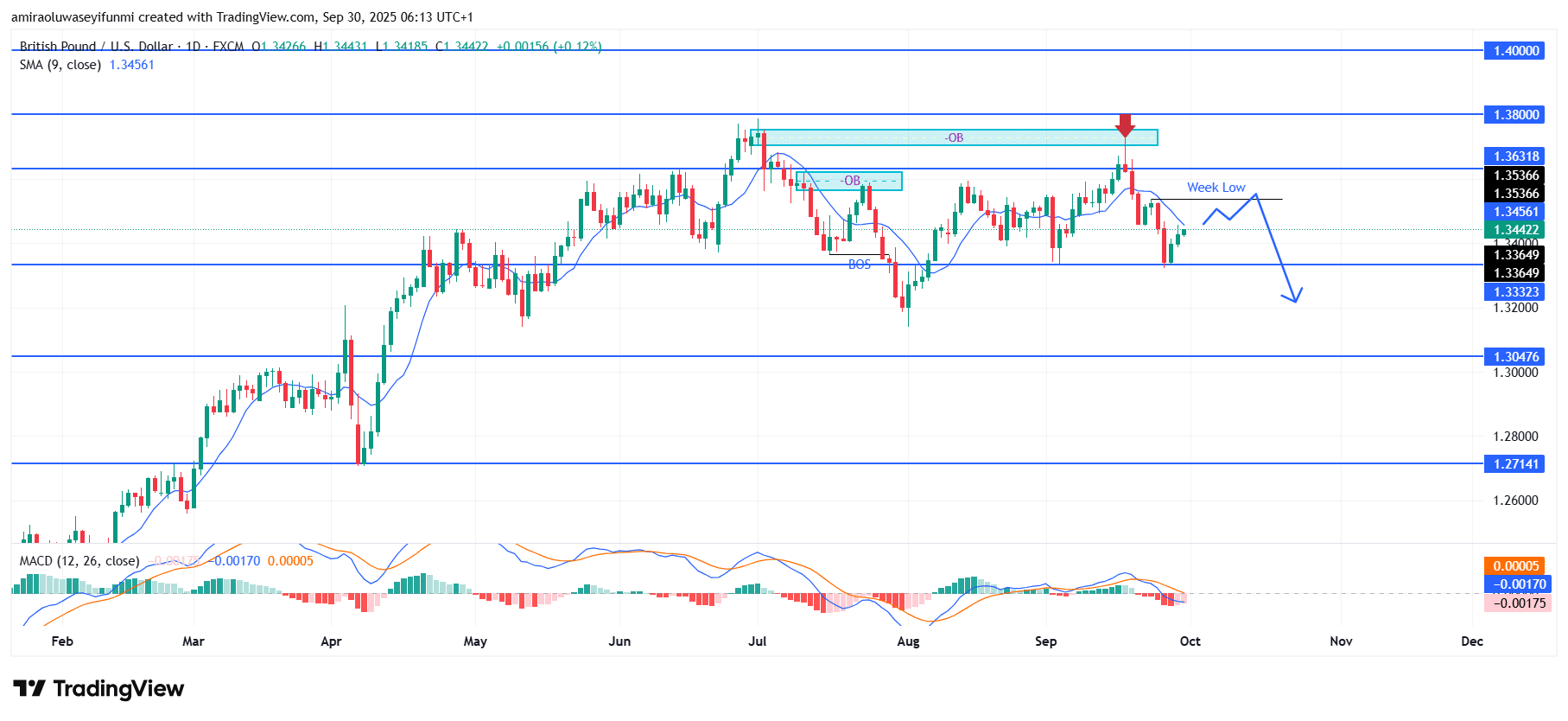

GBPUSD demonstrates an entrenched depreciation bias under persistent technical headwinds. The GBPUSD structure is showing reduced upward capacity, with recent movements reflecting a consistent contractionary tone across analytical indicators. The 9-day Simple Moving Average at $1.3460 now acts as a resistance ceiling, while the MACD oscillator maintains a negative gradient, confirming sustained weakening momentum. The combination of these technical factors reinforces the prevailing depreciation outlook.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

Structurally, the pronounced rejection from the $1.3800 supply block marked the pivotal turning point for the ongoing reversal. Subsequent declines have pushed price below key interim supports, with the $1.3540 level now functioning as an overhead barrier. The $1.3360 weekly low remains a fragile pivot, and a confirmed breach of this threshold would likely accelerate downward momentum toward deeper support zones.

Forward projections highlight an increased probability of extended retracement. A decisive move below $1.3360 would expose price to $1.3330, with $1.3050 forming the next key anchor zone. Should bearish momentum intensify, longer-term projections point toward $1.2710, signifying a full retracement of prior gains and confirming broader bearish control.

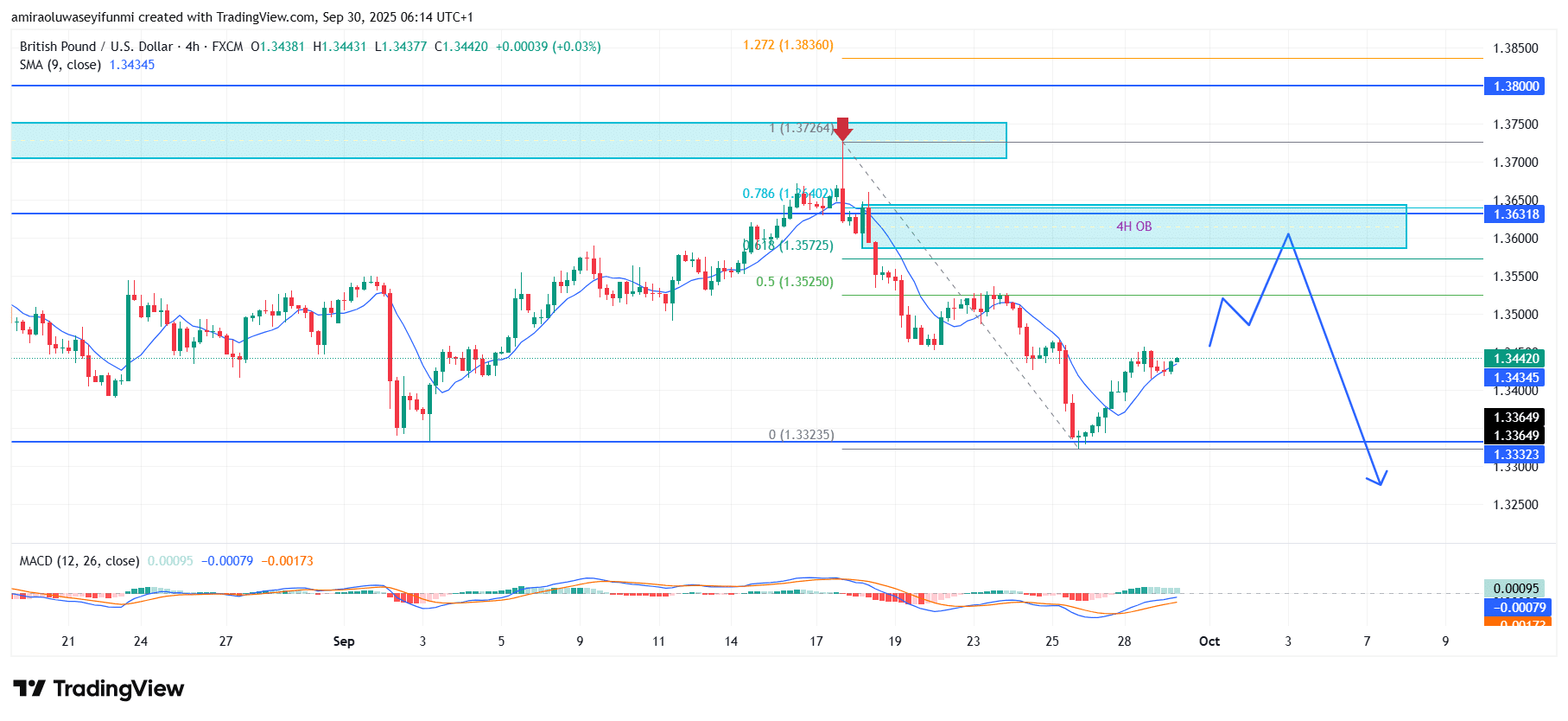

GBPUSD Short-Term Trend: Bearish

GBPUSD is currently staging a short-term retracement on the four-hour chart but remains capped beneath the $1.3630 supply zone. The moving average near $1.3440 continues to serve as interim support, while momentum indicators reflect underlying weakness. Price may retest the $1.3570–$1.3630 resistance band before sellers reassert dominance. Traders monitoring forex signals should watch for potential rejection from this zone, as renewed selling pressure could drive the pair back toward the $1.3360 and $1.3330 support levels.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.