Market Analysis – September 22

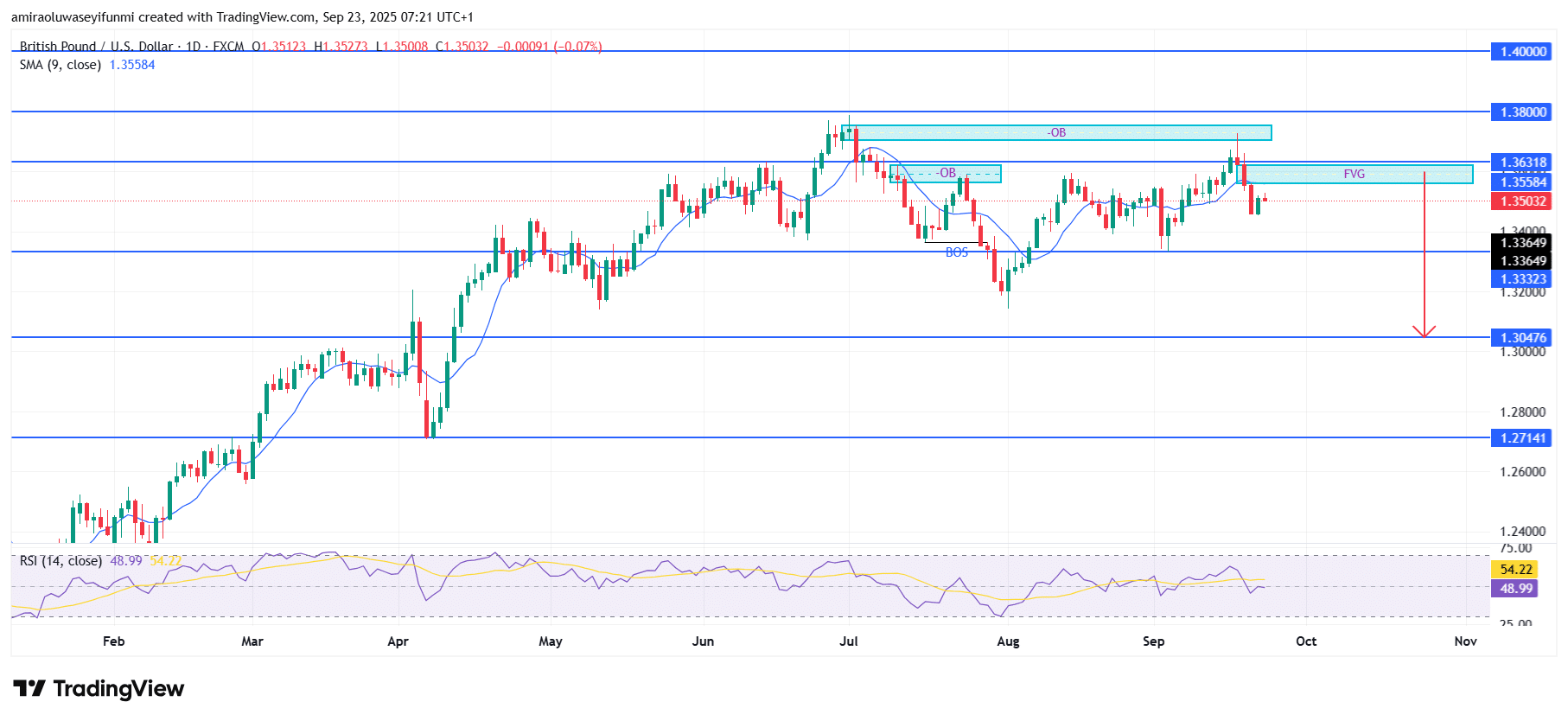

GBPUSD signals downside pressure amid weakening technical confirmations. The broader market structure currently reflects a loss of momentum as sellers take control. The pair is trading below the 9-day SMA at $1.3560, indicating reduced near-term bullish drive. RSI values at 48.96, now under the midline, reinforce the bearish sentiment, suggesting weakening buying strength and pointing toward further downward continuation. Market sentiment aligns with short-term bearish prospects, especially as bulls have repeatedly failed to sustain prices above $1.3630.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

GBPUSD recently rejected the fair value gap near $1.3630 and turned lower. Previous order block zones between $1.3630 and $1.3800 continue to act as resistance, restricting bullish momentum. A break of structure was observed earlier in the cycle, confirming sellers’ dominance and their grip on market direction. Price is currently pivoting around the $1.3360 support level, with bearish order flow maintaining control.

Looking ahead, if selling pressure persists, the immediate downside target is at $1.3330, which aligns with prior demand. A deeper decline could expose the $1.3050 support, serving as a medium-term bearish target. If this level breaks decisively, the market could open further downside potential toward $1.2710, strengthening the bearish outlook. Unless GBPUSD secures a sustained recovery above $1.3630, the technical bias remains in favor of continued depreciation. Traders monitoring forex signals may find opportunities to align positions with the prevailing downward momentum.

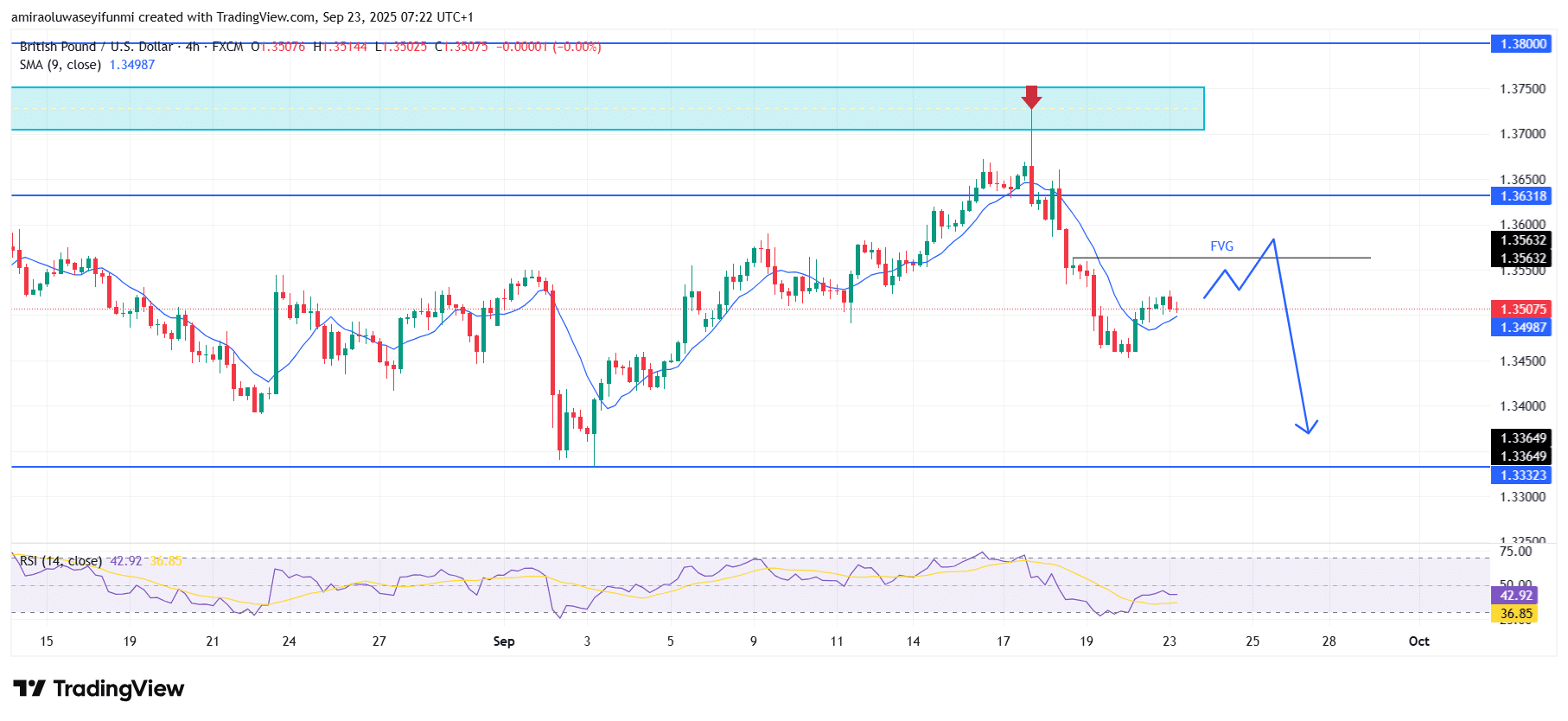

GBPUSD Short-Term Trend: Bearish

GBPUSD is currently trading below the 9-period SMA at $1.3500, confirming ongoing bearish pressure. Price recently rejected resistance at $1.3630 and is consolidating near $1.3510.

The RSI at 43.20 remains under the midline, reflecting weak buying strength. Continued selling pressure could drive prices toward $1.3370, with a potential extension to $1.3330 if bearish momentum remains intact.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.