Market Analysis – September 15

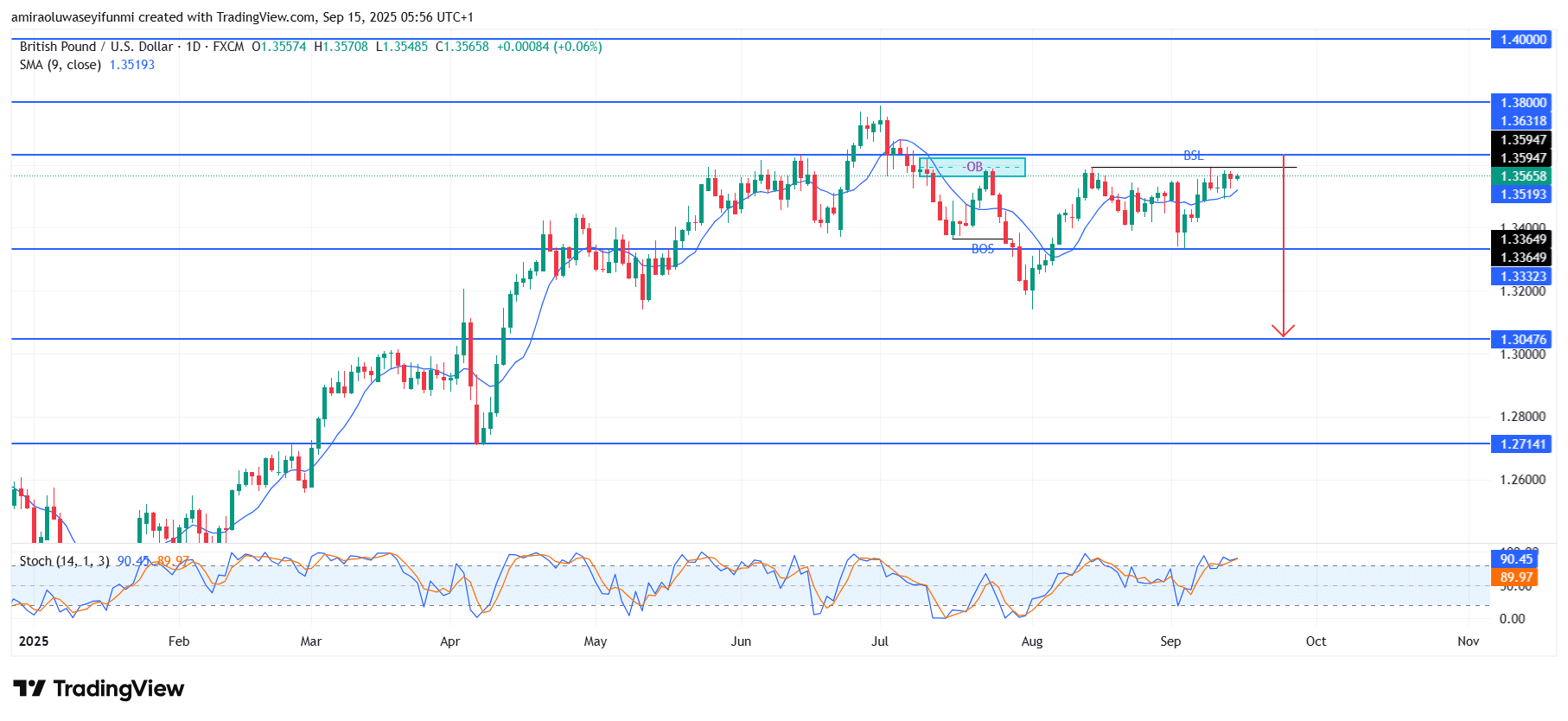

GBPUSD signals weakness after testing critical resistance levels. The pair has shown a slowdown in bullish momentum, with price action consolidating below the $1.35950 resistance level. The Stochastic Oscillator is signaling overbought conditions above the 90 mark, indicating that buying pressure may be exhausted. Similarly, the 9-day simple moving average at $1.35190 is flattening, a typical precursor to directional shifts. Together, these factors point to a weakening structure that may transition into bearish activity in the near term.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

From a technical perspective, the market recently tested the $1.35950 resistance level but failed to sustain a breakout, resulting in a liquidity grab above the buy-side liquidity (BSL). This rejection, along with the earlier order block (OB) near $1.35000 and a previous break of structure (BOS), strengthens the likelihood of continued bearish movement. The rejection at this key level forms a potential lower high, adding weight to the bearish bias. Market participants appear to be using this zone to close long positions, further shifting sentiment toward downside movement.

Looking ahead, the bearish outlook suggests that price may continue its correction toward the $1.33650 support, with a further decline potentially opening the path to $1.33320. If bearish pressure increases, a deeper retracement could retest the $1.30470 level as traders seek stronger demand zones. Overall, unless price reclaims $1.36310 with convincing bullish momentum, GBPUSD is expected to remain under downward pressure in the short to medium term.

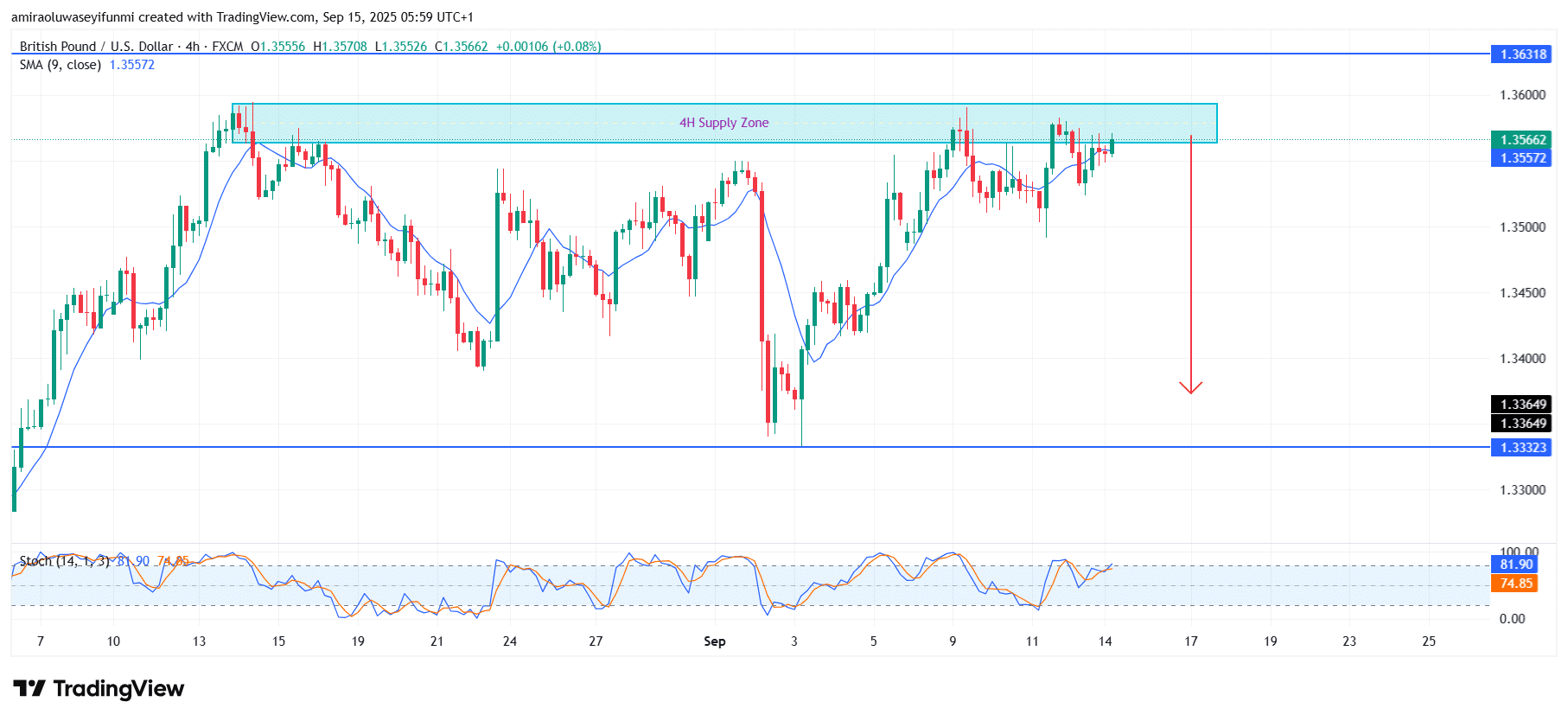

GBPUSD Short-Term Trend: Bearish

GBPUSD is currently rejecting the 4H supply zone between $1.35600–$1.36000, signaling persistent bearish pressure. The pair is trading just below the 9-period SMA, confirming weakening momentum.

The Stochastic Oscillator remains overbought, increasing the probability of a downside move. Traders using forex signals may target $1.33650 and $1.33300 as immediate support levels to watch for potential price reactions.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block – Guide, Tips & Insights | Learn 2 Trade

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.