Market Analysis – October 6

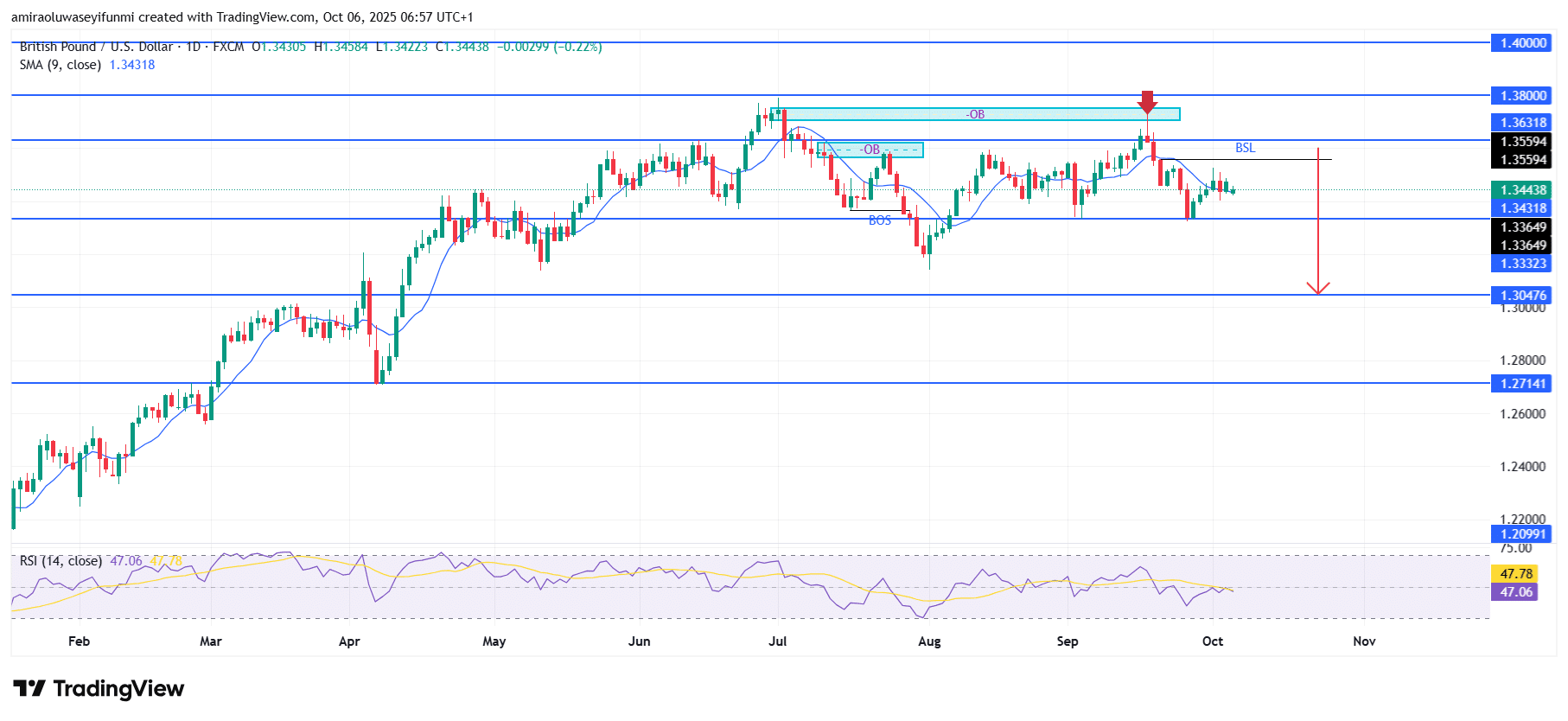

GBPUSD signals a continued downward movement as sellers reclaim short-term control. The pair is losing bullish momentum, with the 9-day SMA at $1.3430 currently exerting downward pressure on price action. Momentum indicators such as the RSI hover around 47, reflecting indecision but leaning toward bearish sentiment as the market struggles to sustain levels above the short-term moving average. This structure suggests that market participants are gradually transitioning from accumulation to distribution, consistent with broader bearish undertones.

GBPUSD Key Levels

Supply Levels: $1.3630, $1.3800, $1.4000

Demand Levels: $1.3330, $1.3050, $1.2710

GBPUSD Long-Term Trend: Bearish

From a technical perspective, price has continued to respect the rejection zone at $1.3630, which aligns with a previously established order block. Subsequent breaks of structure (BOS) around $1.3430–$1.3360 have strengthened the bearish bias, with buyers unable to regain control of these critical levels—indicating waning demand. Sellers have consistently defended the $1.3560 region, keeping price action compressed within a lower range and setting the stage for potential further downside movement.

Looking forward, a decisive move below $1.3360 would likely expose the path toward $1.3330 and eventually $1.3050 as the next downside targets. If bearish momentum intensifies, extended projections point to $1.2710, where stronger demand could reemerge. Conversely, only a sustained rally above $1.3560 would challenge the bearish outlook, though such a reversal appears less likely under the current market conditions.

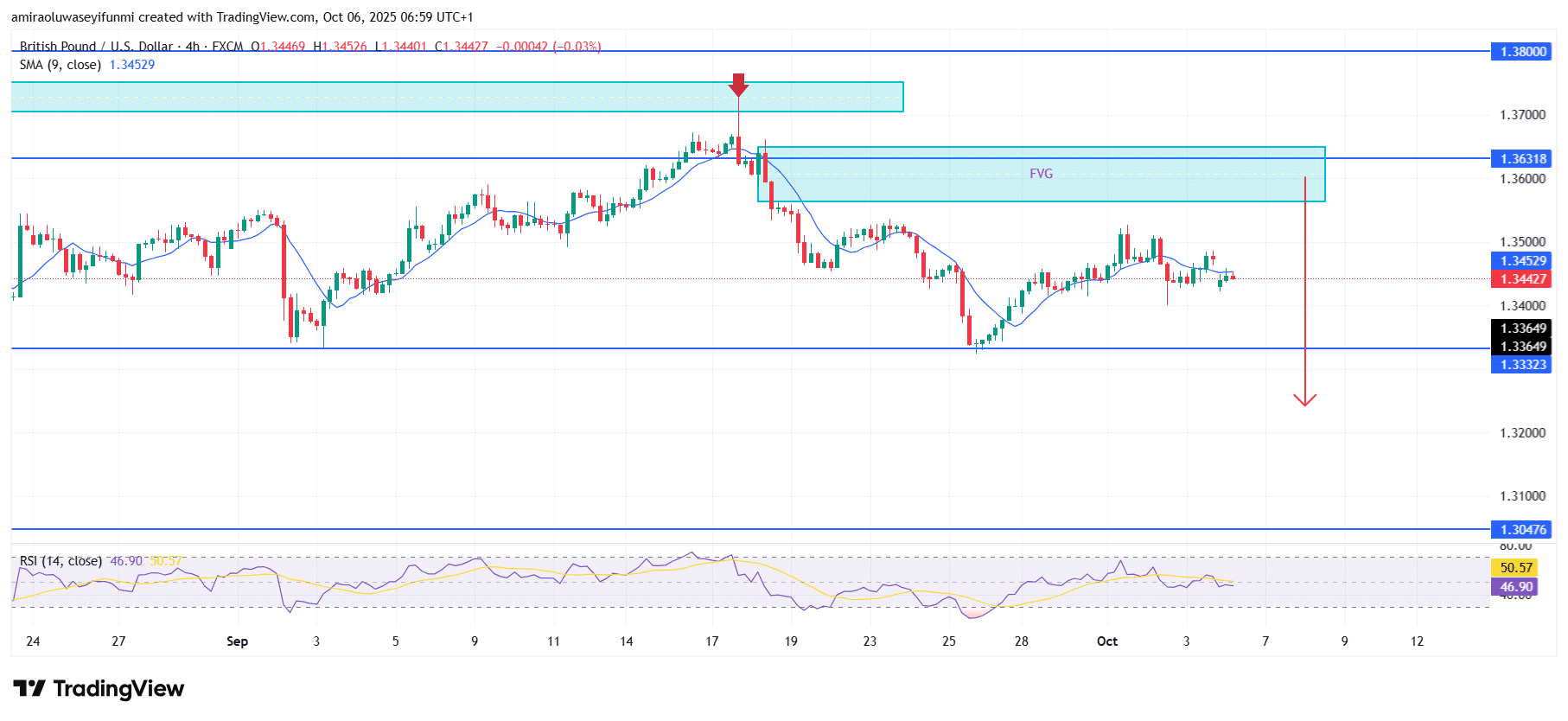

GBPUSD Short-Term Trend: Bearish

GBPUSD is presently ranging between the $1.3330 and $1.3630 price levels. The pair is gradually moving upward toward a Fair Value Gap (FVG), from which a reversal to the downside is anticipated as the market continues to trade sideways. Traders monitoring forex signals should pay close attention to potential rejection from the FVG zone, as it may trigger renewed selling pressure in alignment with the prevailing bearish sentiment.

Make money without lifting your fingers: Start using a world-class auto trading solution

How To Buy Lucky Block

Note: Learn2.trade is not a financial advisor. Do your research before investing your funds in any financial asset, product, or event. We are not responsible for your investment results.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.