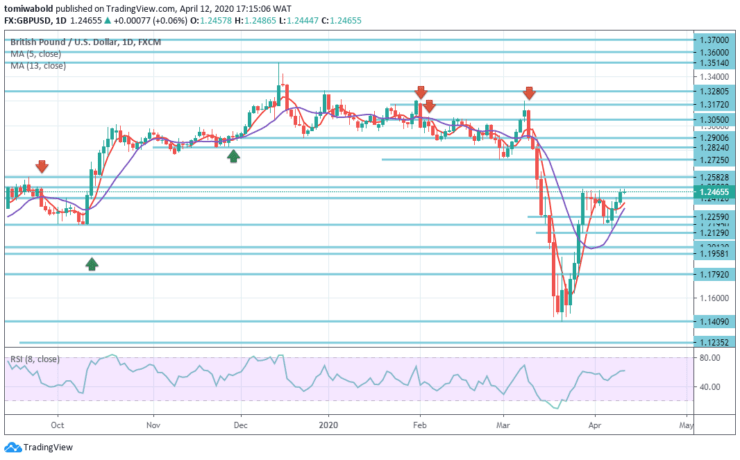

GBPUSD Price Analysis – April 12

The GBPUSD pair ended the prior week with gains around the 1.2465 level after peaks in the previous session at 1.2486 level. This represents the several times that this price zone was approached by the pair and was unable to push beyond it while anticipating acceleration above the level at 1.2500. The Sterling has gained from the weakening of the vast dollar and from reports that UK PM Johnson has left the hospital.

Key Levels

Resistance Levels: 1.3514, 1.3172, 1.2725

Support Levels: 1.2195, 1.1958, 1.1409

GBPUSD Long term Trend: Ranging

At the close of the previous session, the buying intensity around the sterling continues well enough steady, with GBPUSD flirting with multi-week highs around 1.2486 level while approaching strong resistance at 1.2500 level.

In the wider sense, the downtrend from 2.1161 (high) level is still unfolding. The next medium to the long-term goal would be a forecast of 61.8 percent from 1.1792 to 1.1958 at 1.2725 levels. The trend may stay bearish in either scenario as long as 1.3514 resistance level stays intact given a strong rebound.

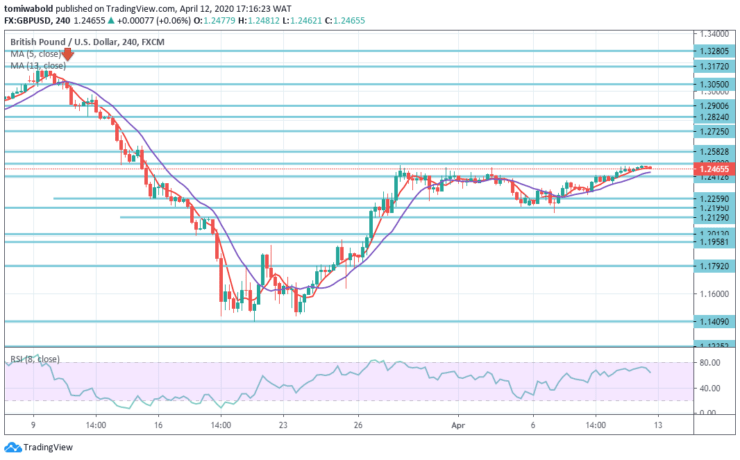

GBPUSD Short term Trend: Ranging

The bullish potential is restricted in the shorter term, and as per the 4-hour chart, whereas the RSI varies while the technical indicators have turned south, towards neutral levels. GBPUSD’s intraday bias remains neutral as it continues in range beneath the level at 1.2500.

On the downside, the break of 1.2195 minor support would imply ending the rally from 1.1409 level and shifting bias to the downside for the low level of 1.1409 additional testings. On the upside, continued retraction of 61.8 percent from 1.3172 to 1.1409 at 1.2500 levels may increase the likelihood of greater reversal and alter attention to 1.3172 level of resistance.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.