GBPJPY Price Analysis – April 12

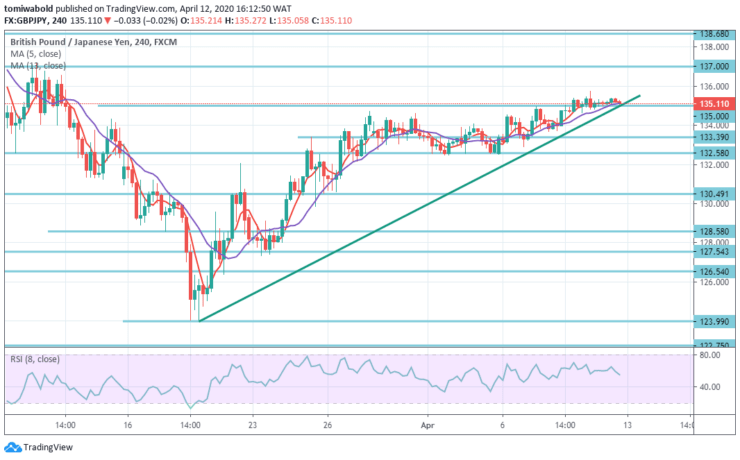

Even though there are fluctuations in the country caused by the coronavirus, GBPJPY continues at the forefront, while the price fluctuates beyond the level of 135.00, rising by around 0.40%. Motivated by the Bank of Japan head’s recent positive remarks, Haruhiko Kuroda, referring to market uncertainty and resolve to introduce easing which further boosted the pair to the north.

Key Levels

Resistance Levels: 147.95, 144.95, 138.68

Support Levels: 133.39, 127.54, 122.75

GBPJPY Long term Trend: Ranging

In a wider sense, current progress implies that 122.75 (low) level market activity is merely a side-consolidation pattern that ended at 147.95 level. The downtrend has since resumed from 195.86 (high) level and 251.09 (high) level.

A break of 122.75 from 147.95 to 102.76 levels in the following will hit a 61.8 percent of the projection from 195.86 (high) level to 122.75 level. The trend may stay bearish in any scenario because the resistance would stay at 147.95 level.

GBPJPY Short term Trend: Ranging

GBPJPY corrective bounce back from 123.99 level is rather a major advance and can be anticipated in the near term. However, recovery may be curbed by a turnaround of 61.8 percent from 144.95 to 123.99 at 137.00 levels, which will eventually restart the decline.

On the other hand, a failure of the short-term support level of 132.58 could shift the downward bias to repeated low-level testing of 123.99. Nonetheless, a continuous level break by 137.00 may increase the likelihood of a trend reversal and shift emphasis to the 144.95 resistance level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.