GBPJPY Price Analysis – May 3

As GBPJPY pulls back from the multi-day top, it reverses to level 133.47, down 0.75 percent in the previous session, amid recent risk-off. While doing so, the pair do seem to have dismissed pessimistic Japanese GDP projections and the Asian nation’s weak figures.

Key Levels

Resistance Levels: 147.95, 139.18, 135.76

Support Levels: 131.90, 126.54, 123.99

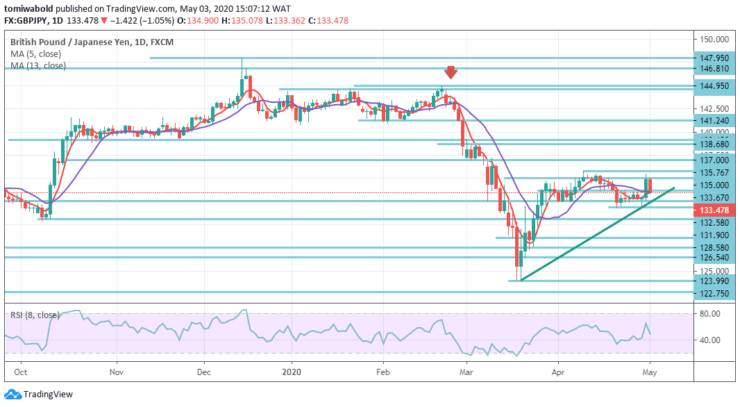

GBPJPY Long term Trend: Ranging

The daily chart illustrates the pair trying to ascertain the bullish initial response offered by two prior sessions hammer candle, springing over the top of the resistance level over the last six days, at 133.67 level. The GBPJPY has been constrained to 135.45 level so far and is attempting to test at 135.76 level more than the next horizontal level of resistance.

On setbacks to push beneath moving average of 5 and 13, presently near 133.67 level, may guide bulls to 135.00 thresholds on a daily close premise into an ongoing effort to re-test prior resistance levels. On the opposite, a downward break beneath may need to breach April month’s low registered around the level at horizontal support on 131.90 while targeting the upward trendline support.

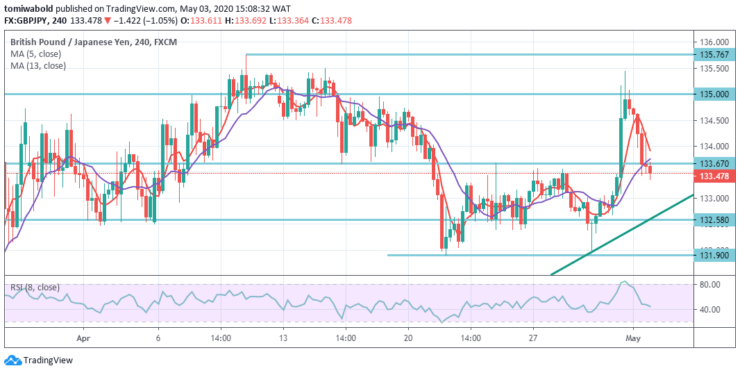

GBPJPY Short term Trend: Ranging

Last week’s swift recovery of GBPJPY indicates a turnaround from level 123.99 is not yet established. This week, the initial bias remains neutral initially as seen on the 4-hour chart. On the contrary, the 135.76 level break may aim at a retraction of 61.8 percent from 144.95 to 123.99 at 137.00 levels.

From there we will be expecting a high resistance to constraining upwards. But a continuous break of level 135.76 may set the stage to the next level of resistance at 144.95. On the downwards, a break of 131.90 level may shift bias back to the downside for a low level of 123.99 retests.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.