GBPUSD Price Analysis – May 3

After hovering with April’s monthly peak, the GBPUSD pair retracted rapidly at the later part of the week ending at 1.2487 level. The April UK Markit Manufacturing PMI has been adjusted down to 32.6, worse off than estimated, whereas in March, Consumer Credit plummeted to £-3.8 B. PM Johnson was positive as to the scenario of coronavirus, tweeting that the kingdom is “past the peak and on the downward slope.”

Key Levels

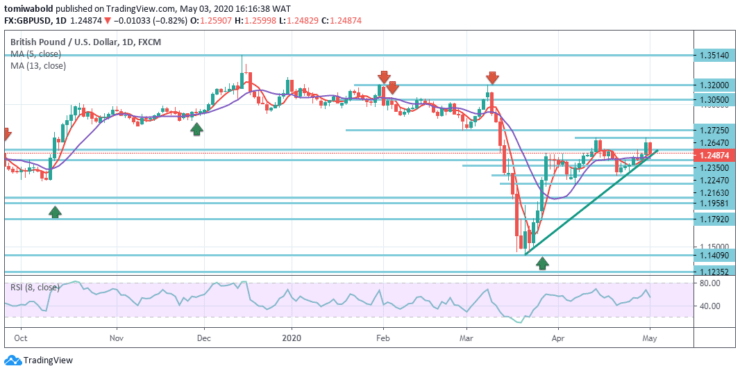

Resistance Levels: 1.3514, 1.3050, 1.2647

Support Levels: 1.2350, 1.1958, 1.1409

GBPUSD Long term Trend: Ranging

Last week GBPUSD recovered steadily but unable to crack the resistance level of 1.2647. At first, the early bias stays neutral this week. As long as 1.2247 support level stays intact, a consistent advance is in line with the majority.

The breach of level 1.2647 may restore the progress from level 1.1409 support towards level 1.3200 resistance. On the contrary, near-term support level breach of 1.2247 may imply a conclusion of recovery from level 1.1409. The intraday bias may be adjusted back to the downside to re-test low level 1.1409.

GBPUSD Short term Trend: Bullish

As shown in the 4-hour chart, the GBPUSD pair tends to lose traction upward, as technical indicators already softened to end the week with mild-bearish declines around their midlines. The same chart shows the price is well above the upward trendline which is below the level of direct horizontal resistance at 1.2520.

The upside horizontal resistance level holds steady at 1.2647, in which the pair peaked last week and the scene on the daily chart is much the same, as the moving average of 5 and 13 reaches the top at both ends of the horizontal line whereas the RSI goes south, presently at 41. The price challenges the upward trendline while the moving averages are above the present level.

Note: Learn2Trade.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.