Andresen became proclaimed by Satoshi Nakamoto as Bitcoin’s Lead Developer, and in 2012 launched the Bitcoin Foundation.

Publicly Traded Firms Undue Dominance

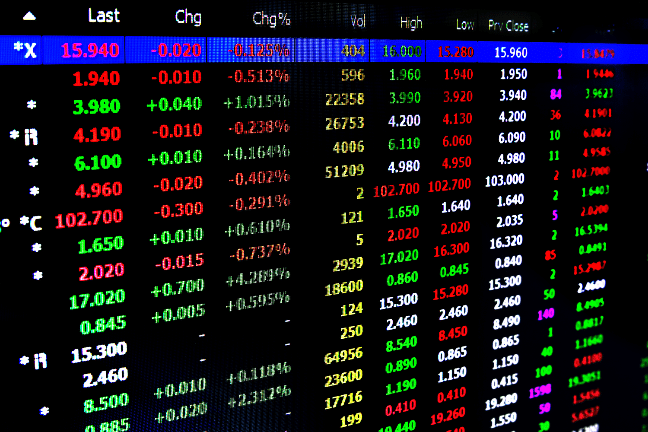

The COVID-19 global epidemic had severely impacted small firms, triggering the worst recession. Most of them, the markets would probably swallow. Mr. Andresen envisages major companies gaining from this global epidemic, through publicly traded stocks.

The market growth level would sink. As a direct consequence, some of its small-market rivals may be lost to the corporate giants. The stocks of companies may grow with the decreased competition, as the outcome of the current downturn may prove ‘positive’ for others.

Many analysts trailing his Twitter page noted this analogy is not right since small firms have had an upper hand over publicly traded companies to some extent.

High Growth Despite Market Carnage

This is remarkable as high-demand stocks were mostly recording vertical increases all through the Q1 2020 COVID-19 global epidemic. While the curfew was put on Wuhan exclusively, Tesla (TSLA) amazed investors by multiple twin-digit increases daily. Amazon (AMZN) also lately nearly reached its fresh all-time high (ATH) of $2,128, rising further over 30% after its sell-off in mid-March.

Few stocks, nevertheless, may not look good efficiently. Because of the carnage from the airline industry Berkshire Hathaway (BRK.A) lost $50B in Q1 2020.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.