GBP/JPY Market Analysis – February 13

The GBP/JPY underwent a massive repricing this week, tumbling from the 214.00 handle to test psychological support at 208.00. This bearish pivot was driven by a powerful ‘double-whammy’: the decisive election victory of Sanae Takaichi in Japan, which sent JGB yields to multi-decade highs, and a string of lackluster economic forecasts for the UK. As the Bank of England faces pressure to cut rates amidst cooling growth, the widening policy divergence with a newly emboldened Bank of Japan has left Sterling vulnerable, transforming what began as a technical correction into a full-scale fundamental retreat.

GBP/JPY Key Levels

Supply Levels: 210 , 211, 212

Demand Levels: 208, 207, 206

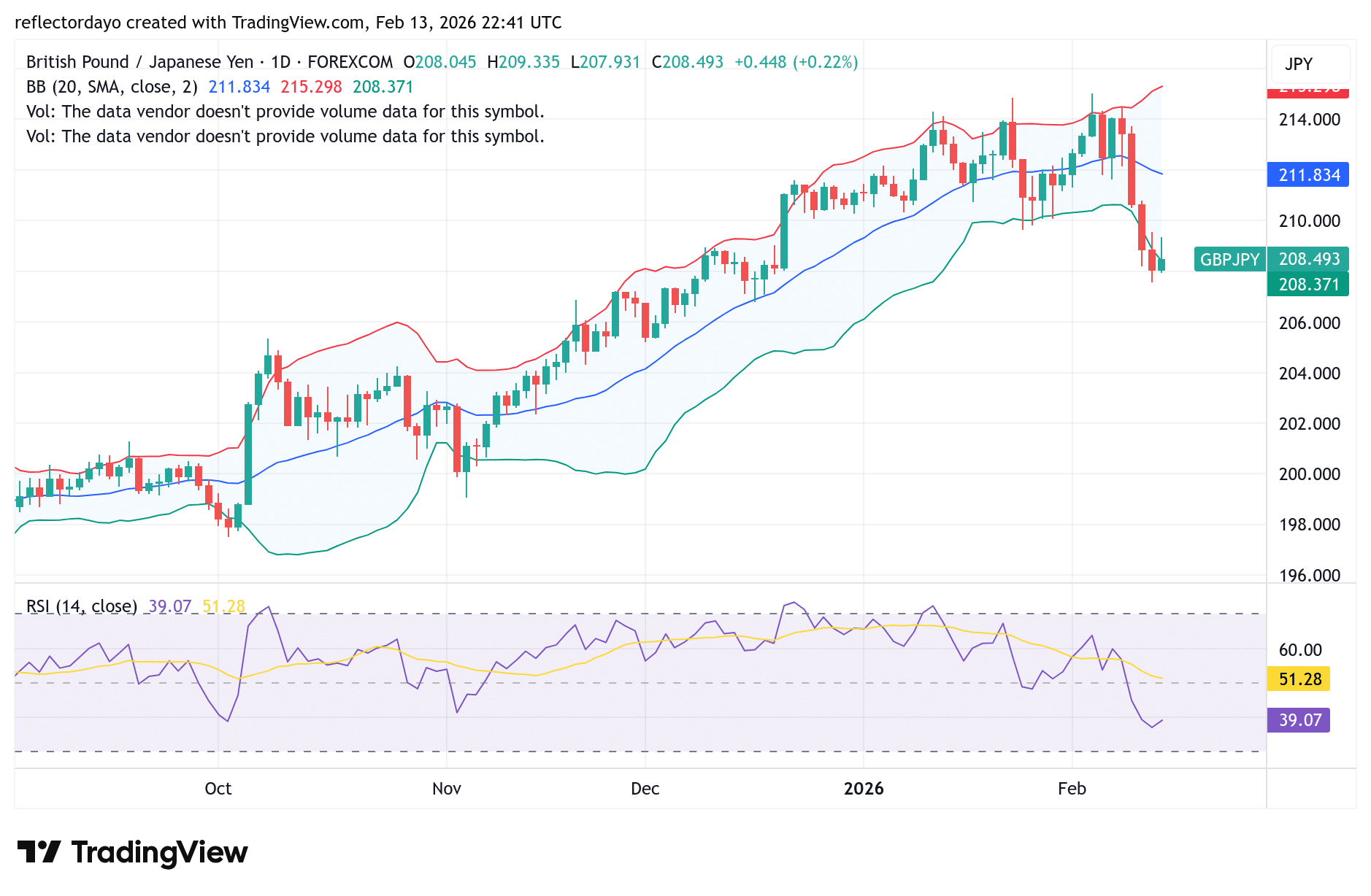

GBP/JPY From the Daily Chart ViewPoint

The GBP/JPY market has been notably volatile, marked by a sharp decline from the 214 level and a rapid “flush” toward the 208 support zone. This bearish momentum was driven by a combination of political developments in Japan and deteriorating economic sentiment in the United Kingdom.

A look at the daily chart shows that this week’s selling pressure triggered significant downward volatility. The sharp decline in price action led to a noticeable expansion in volatility, reflecting heightened market uncertainty. Such volatility spikes can sometimes signal exhaustion in a bearish move, potentially creating an opportunity for buyers to step in around the 208 support level—provided market conditions turn favorable.

The Bollinger Bands suggest that the market is approaching oversold territory, while the RSI is showing early signs of recovery, though it remains within bearish territory overall. The key question now is whether bulls will generate enough momentum to drive a meaningful rebound, or whether price will consolidate around the 208 level. The coming trading sessions should provide clearer direction.

Short-Term Trend:

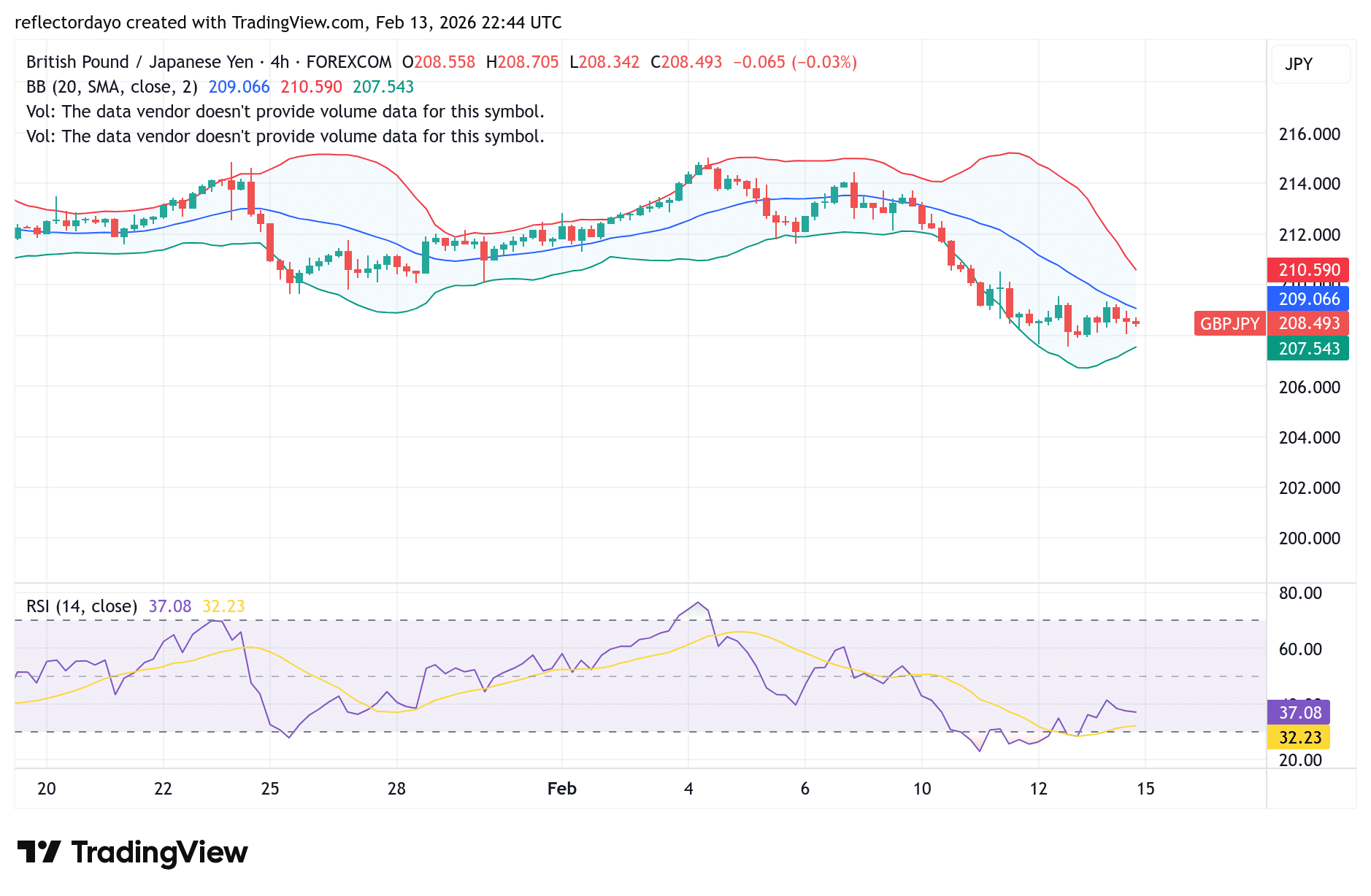

When we zoom into the lower timeframe, specifically the 4-hour chart, we observe a sharp contraction in market volatility. The Bollinger Bands are converging as price action stabilizes and consolidates around the 208 level. This compression in volatility often signals that the market may be preparing for a significant move.

The 208 level has previously acted as a strong support zone, helping to stabilize price during recent declines. If this level continues to hold, traders may maintain a cautiously optimistic stance, which could support the potential for a rebound toward the 214 resistance area. However, a decisive break below 208 would likely invalidate this recovery scenario.

Make money without lifting your fingers: Start using a world-class auto trading solution.

Related Resources

- Forex Signals — professional daily trading signals

- Crypto Signals — real-time BTC, ETH, SOL and XRP alerts

- Join VIP — get early signals before the free channel

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.