Market Analysis – January 23

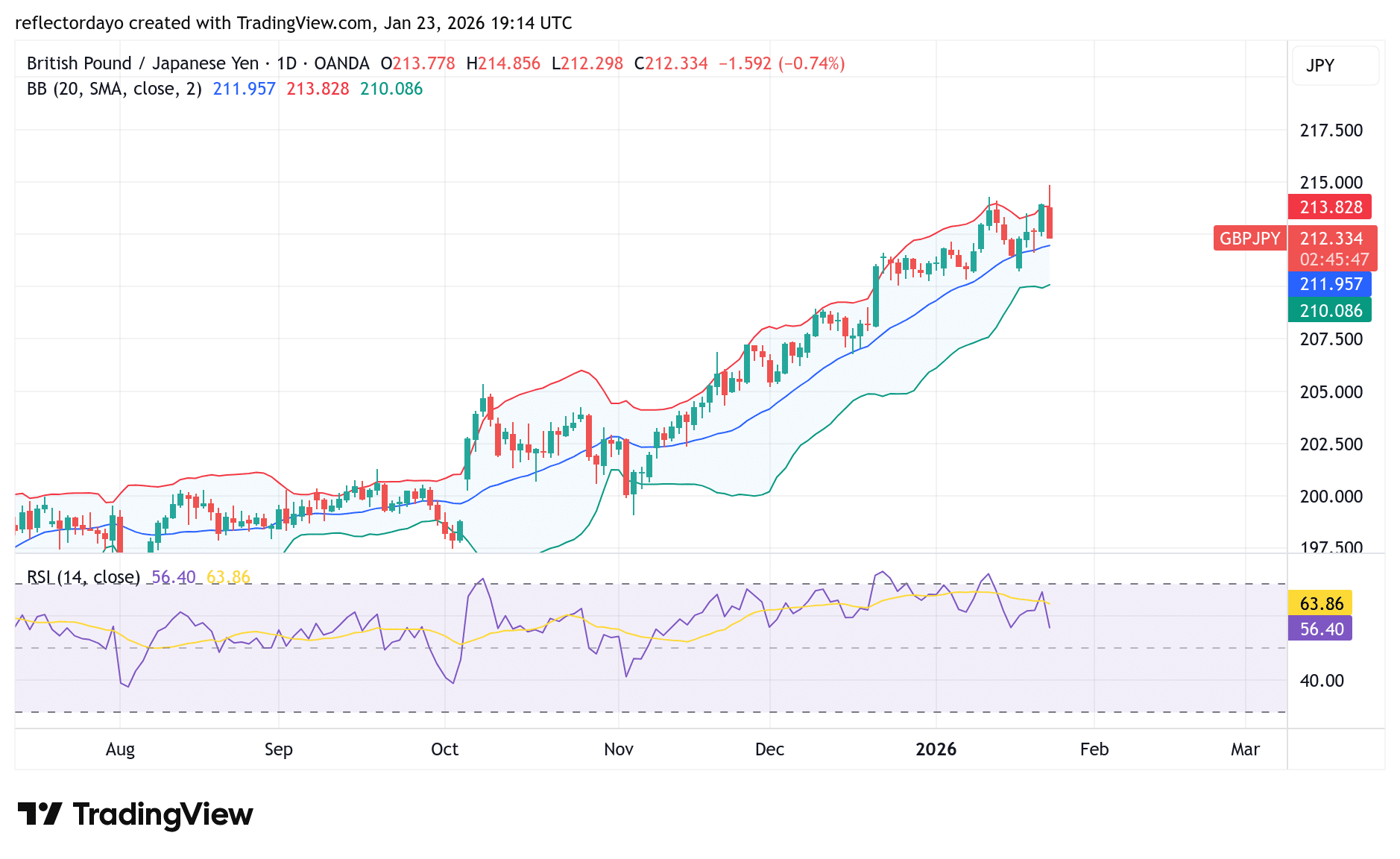

The GBPJPY pair, often referred to as “The Beast” for its high volatility, currently finds itself at a critical crossroads. While the overarching multi-month trend remains undeniably bullish—fueled by the significant interest rate differential between the Bank of England and the Bank of Japan—today’s price action has delivered a stark, bearish divergence. This shift marks a notable “sell the fact” reaction that has momentarily halted the Pound’s upward momentum.

The catalyst for this bearish close is a confluence of shifting fundamentals in the East. Despite the Bank of Japan (BoJ) maintaining its benchmark rate at 0.75%, the accompanying hawkish sentiment caught markets off guard. With an upgraded inflation outlook for FY 2026 and a surprise dissenting vote for an immediate hike by board member Hajime Takata, the Yen found renewed vigor. This internal pressure was compounded by mounting intervention anxiety as the pair flirted with psychological resistance levels near 215.00, prompting a defensive retreat from GBP bulls.

GBP/JPY Key Levels

Supply Levels: 214 , 215, 216

Demand Levels: 208, 207, 206

GBP/JPY Bullish Interest Regroups at 212

A few weeks ago, we observed that the 212 price level acted as a key resistance, standing in the way of GBP/JPY, which had been trending upward for quite some time. Selling pressure around this level temporarily capped the market until bulls eventually forced a breakout above it. This breakout strengthened bullish sentiment and encouraged further upside movement.

However, in today’s session, the market closed on a bearish note after peaking around the 215 price level. Although the bearish price action was notable during the session, buying interest around the 212 level has begun to re-emerge. This suggests that the market may find support there and potentially rebound.

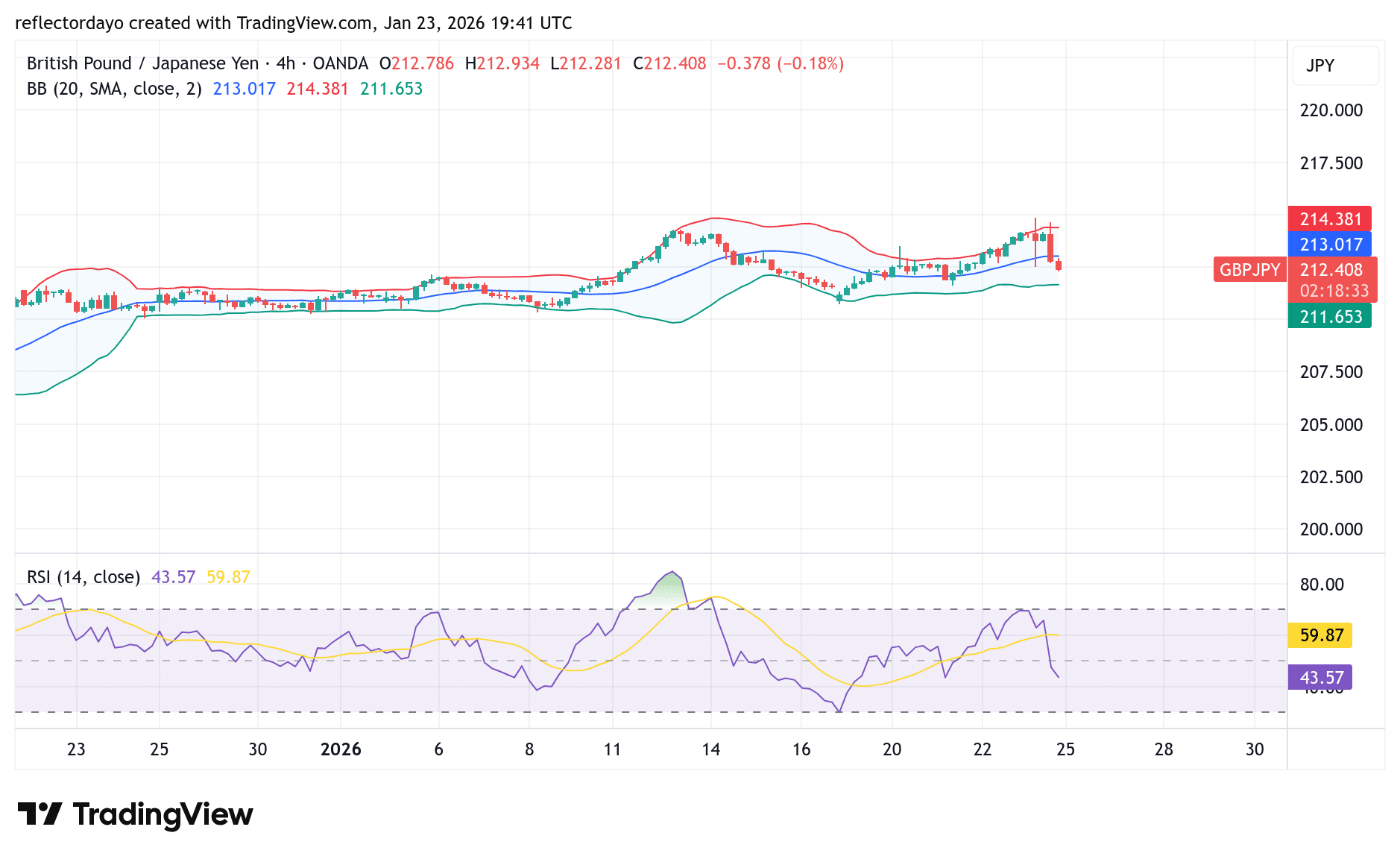

GBP/JPY Short-Term Trend:

Zooming into the 4-hour chart, we can better observe the current market dynamics as trading draws to a close for the week. Initially, bullish momentum pushed price toward the 215 level, which in turn triggered a wave of sell orders. This selling pressure weighed heavily on the market, causing the price to struggle and hold ground around the 215 level.

Traders and analysts are now watching this price area closely, awaiting clearer signals on the market’s next direction.

Make money without lifting your fingers: Start using a world-class auto trading solution.

- Broker

- Min Deposit

- Score

- Visit Broker

- Award-winning Cryptocurrency trading platform

- $100 minimum deposit,

- FCA & Cysec regulated

- 20% welcome bonus of upto $10,000

- Minimum deposit $100

- Verify your account before the bonus is credited

- Fund Moneta Markets account with a minimum of $250

- Opt in using the form to claim your 50% deposit bonus

Learn to Trade

Never Miss A Trade Again

Signal Notification

Real-time signal notifications whenever a signal is opened, closes or Updated

Get Alerts

Immediate alerts to your email and mobile phone.

Entry Price Levels

Entry price level for every signal Just choose one of our Top Brokers in the list above to get all this free.